Depreciation 5 Year Property

Depreciation 5 Year Property - Find out what is depreciation in business accounting types of depreciation its formula and how depreciation is calculated in small business Mar 6 2023 nbsp 0183 32 Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life Capital assets such as buildings machinery and equipment are

Depreciation 5 Year Property

Depreciation 5 Year Property

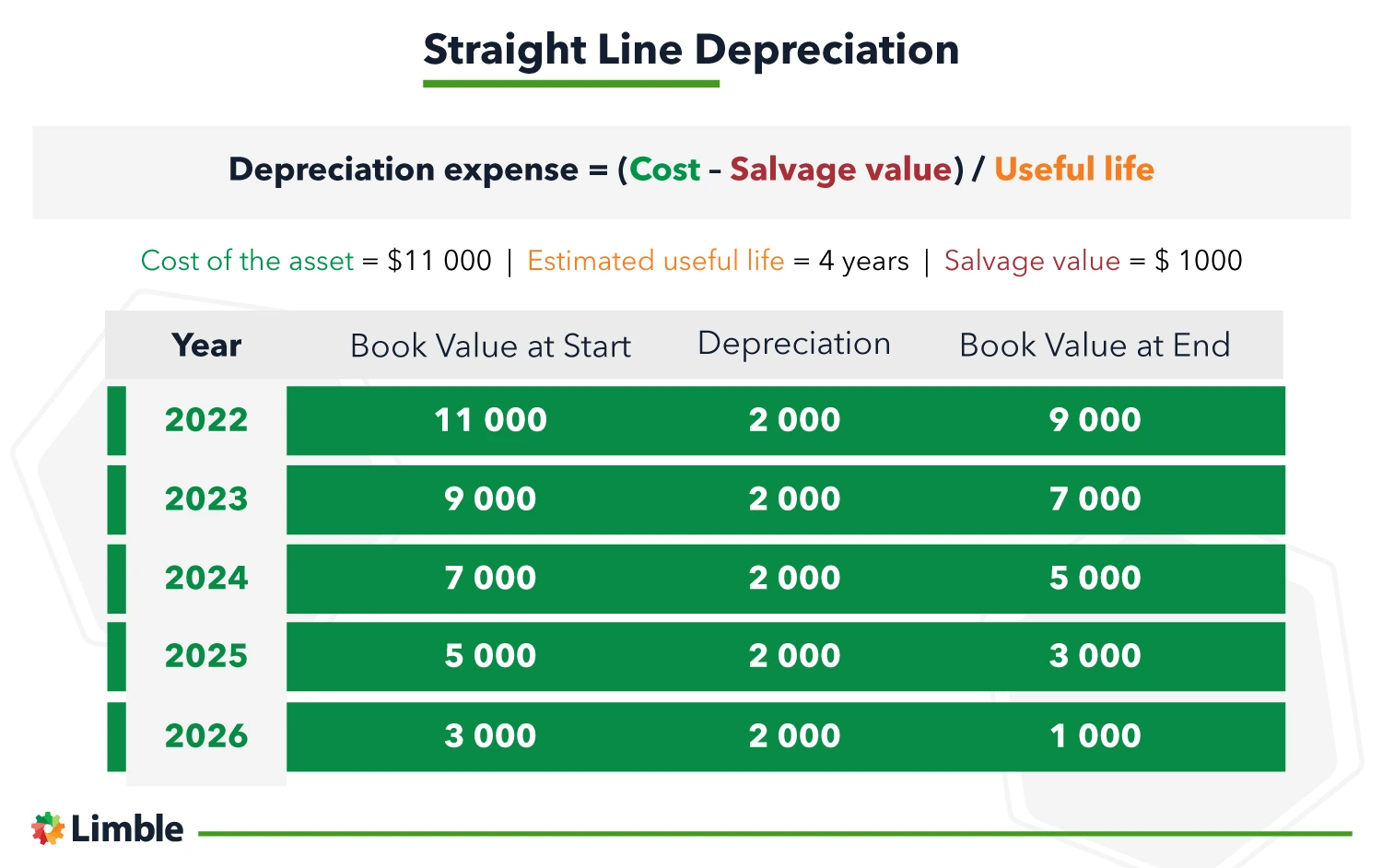

Depreciation is any method of allocating such net cost to those periods in which the organization is expected to benefit from the use of the asset. Depreciation is the process of deducting the … Mar 22, 2014 · Depreciation is a reduction in the value of a tangible fixed asset due to normal usage, wear and tear, new technology, or unfavourable market conditions. Unlike amortization, …

Depreciation Causes Methods Of Calculating And Examples

How To Prepare Depreciation Schedule In Excel YouTube

Depreciation 5 Year PropertyDepreciation is an accounting method used to calculate the decrease in value of a fixed asset while it’s used in a company’s revenue-generating operations. After an asset is purchased, a … Jun 16 2023 nbsp 0183 32 Depreciation is an accounting method that spreads the cost of an asset over its expected useful life

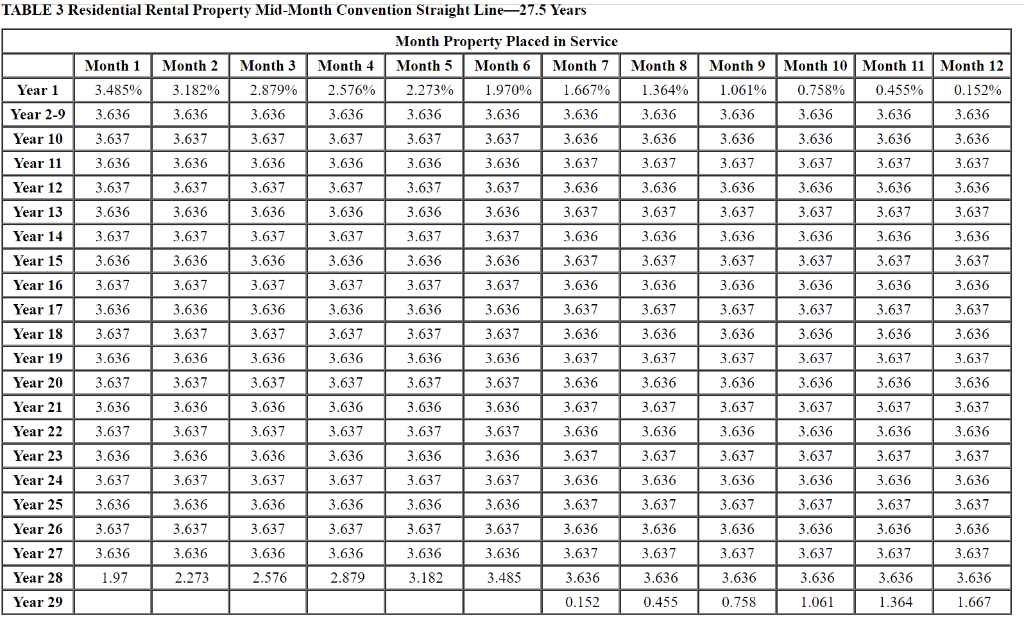

Jan 11, 2024 · Depreciation can affect the value of your assets and your taxes – often for several years. Learn how depreciation works and how to track it. Depreciation For Rental Property How Does It Work Eligibility Depreciation Residential Vs All Other Archer Investors

What Is Depreciation Types Examples Quiz Accounting Capital

How To Calculate The Declining Balance Method For Depreciation

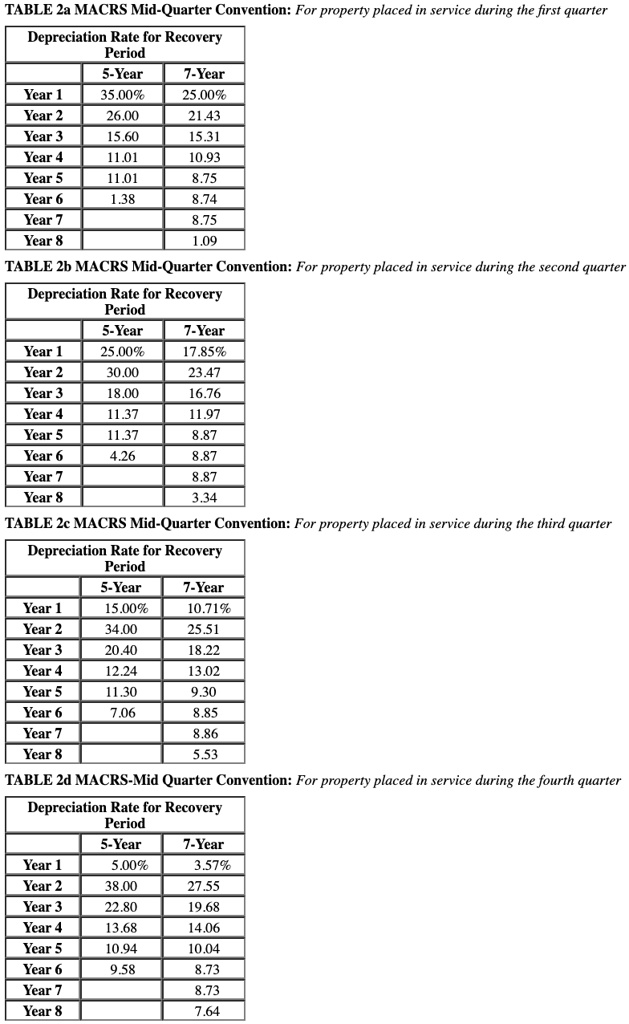

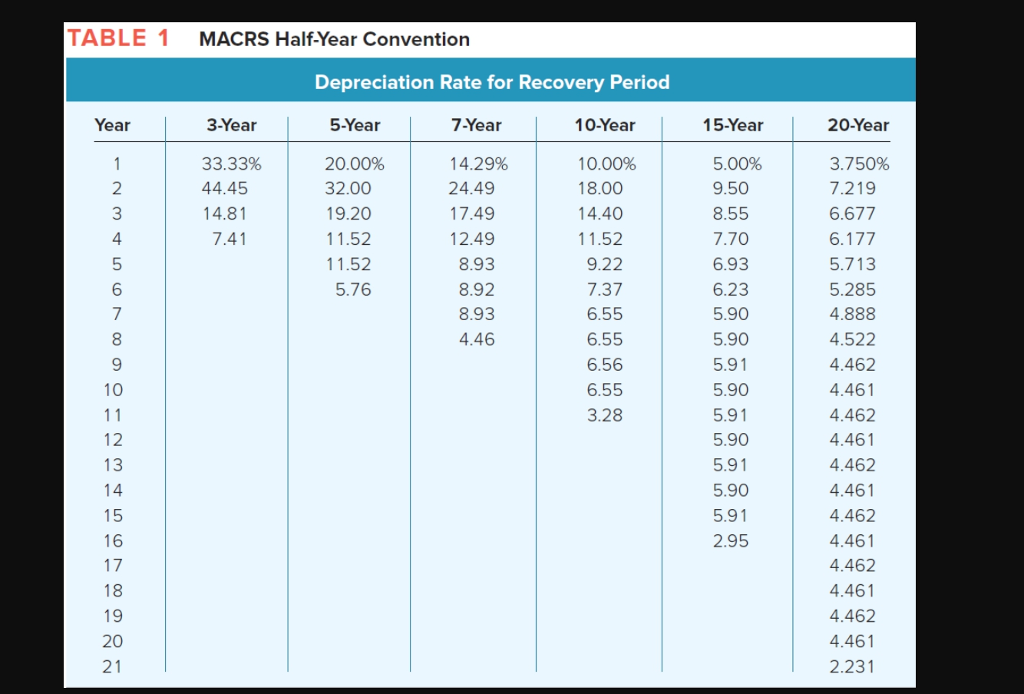

Meaning of Depreciation Depreciation can be defined as a continuing, permanent and gradual decrease in the book value of fixed assets. This type of shrinkage is based on the cost of … Irs Depreciation Tables For Computers Cabinets Matttroy

Meaning of Depreciation Depreciation can be defined as a continuing, permanent and gradual decrease in the book value of fixed assets. This type of shrinkage is based on the cost of … MACRS Depreciation Tables How To Calculate 2017 MACRS Property Depreciation

Macrs Depreciation Table Cabinets Matttroy

Method Table

Macrs Depreciation Table 2016 Cabinets Matttroy

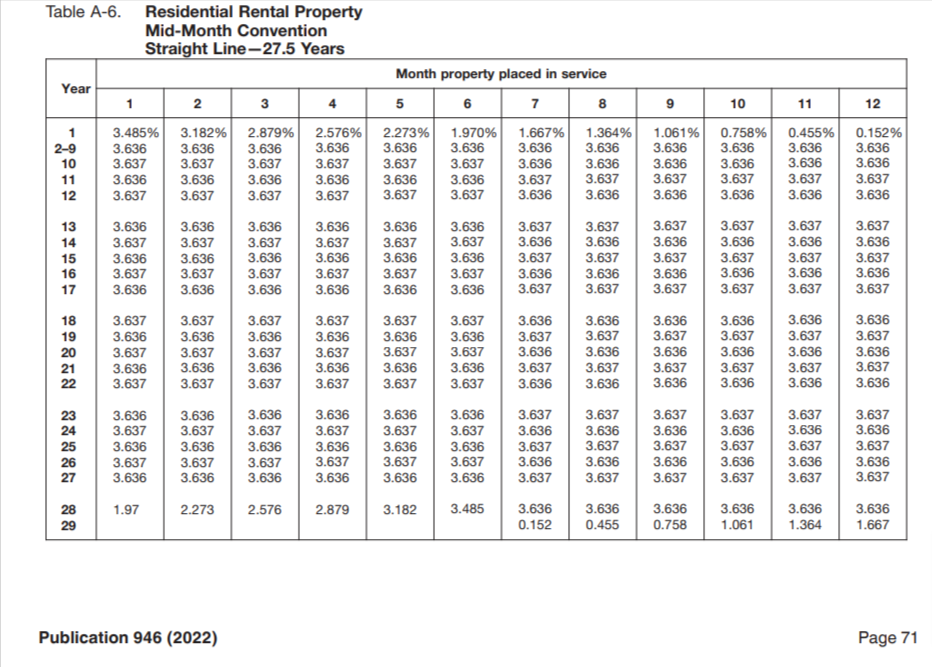

Depreciation Tables ITeachAccounting

Macrs Depreciation Table Cabinets Matttroy

New Depreciation Rules For 2024 Dion Myrtie

Macrs Depreciation Table 2018 Frameimage

Irs Depreciation Tables For Computers Cabinets Matttroy

Macrs Depreciation Tables 39 Year Property Cycle Calculations

Bonus Depreciation 2025 Rental Property Tiffany E Brock