Depreciation Table 5 Year Macrs Table Half Year Convention Example

Depreciation Table 5 Year Macrs Table Half Year Convention Example - Jun 16 2023 nbsp 0183 32 Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business s profitability Mar 6 2023 nbsp 0183 32 Depreciation is the reduction in the value of a fixed asset due to usage wear and tear the passage of time or obsolescence The loss on an asset that arises from depreciation

Depreciation Table 5 Year Macrs Table Half Year Convention Example

Depreciation Table 5 Year Macrs Table Half Year Convention Example

[1] Depreciation is thus the decrease in the value of assets and the method used to reallocate, or "write down" the cost of a tangible asset (such as equipment) over its useful life span. … The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits.

Depreciation Causes Methods Of Calculating And Examples

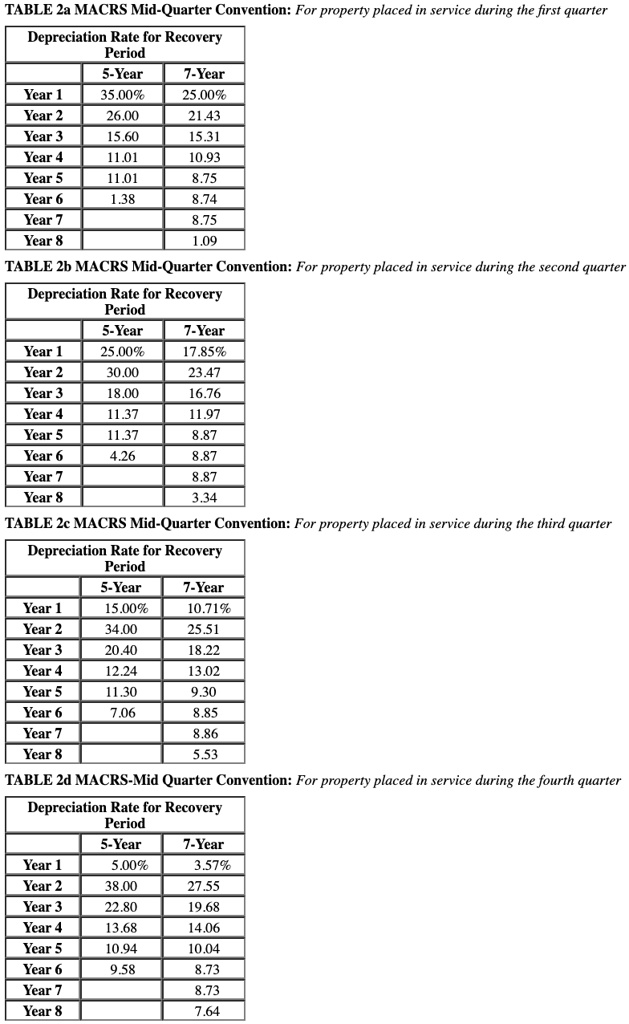

Macrs Depreciation Table Cabinets Matttroy

Depreciation Table 5 Year Macrs Table Half Year Convention ExampleDepreciation is an accounting method used to calculate the decrease in value of a fixed asset while it’s used in a company’s revenue-generating operations. After an asset is purchased, a … In this article we ll break down what depreciation is how to calculate it and why it matters for our business What is Depreciation In accounting terms depreciation is defined as the systematic

Oct 16, 2024 · Depreciation is the method of allocating the cost of a tangible asset over its useful life. In simpler terms, it’s a way to spread out the cost of an expensive item over the time it’s … MACRS Depreciation Tables How To Calculate 8 Pics Macrs Depreciation Table 2017 39 Year And View Alqu Blog

Depreciation Methods 4 Types Of Depreciation You Must Know

Macrs Depreciation Table Cabinets Matttroy

Depreciation is a non-cash business expense incurred by a company for employing a tangible asset like machinery, tools, and equipment for business use. It is accounted for throughout the … Macrs Depreciation Table 2018 Frameimage

Depreciation is a non-cash business expense incurred by a company for employing a tangible asset like machinery, tools, and equipment for business use. It is accounted for throughout the … Macrs Depreciation Table Excel 2017 Cabinets Matttroy MACRS Depreciation Calculator Table Calculator Table Guide Fixed Asset

Macrs Depreciation Table Cabinets Matttroy

Method Table

Macrs Depreciation Table 2016 Cabinets Matttroy

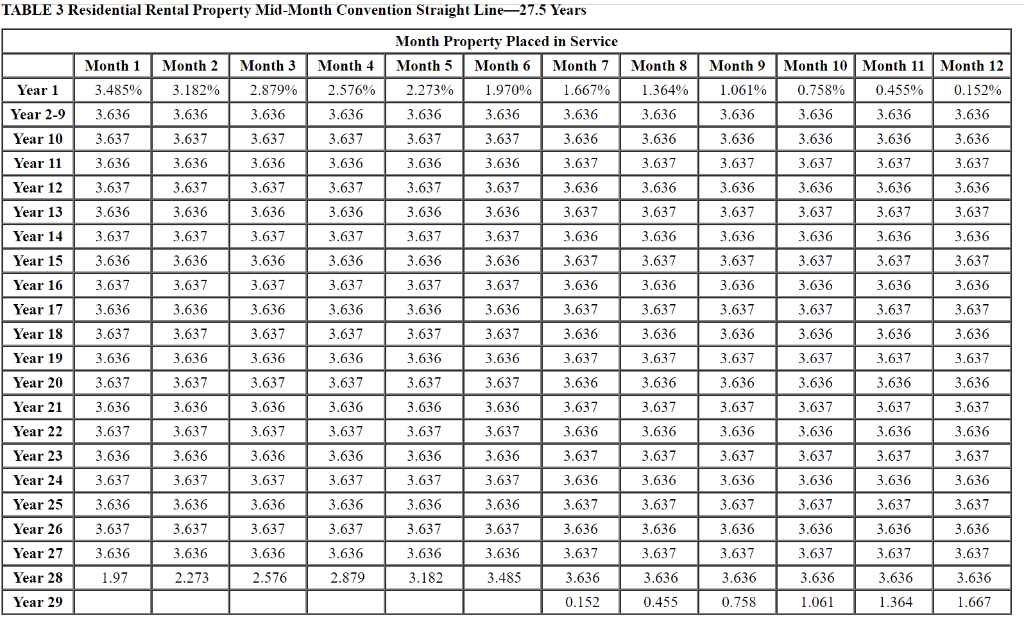

Depreciation Tables ITeachAccounting

Macrs Depreciation Table Cabinets Matttroy

Macrs Depreciation Table Cabinets Matttroy

Macrs Depreciation Table Cabinets Matttroy

Macrs Depreciation Table 2018 Frameimage

OUTLINE Questions News Depreciation Taxes Ppt Download

Macrs Depreciation Table 2017 Excel Review Home Decor