Form 1125 A Instructions

Form 1125 A Instructions - What is Form 1125 A Form 1125 A is an IRS tax form used by businesses to report their cost of goods sold otherwise known as COGS This information is used in conjunction with the parent filing to calculate the business s gross profit for the year Do I Need to File Form 1125 A Sole proprietors and single owner LLCs calculate and report their business taxes on Schedule C The cost of goods sold calculation is in Part III This calculation is added to other expenses and income to get a net income taxable income for the business This amount is included with other business income on Line 12 of Schedule 1 of your 1040

Form 1125 A Instructions

Form 1125 A Instructions

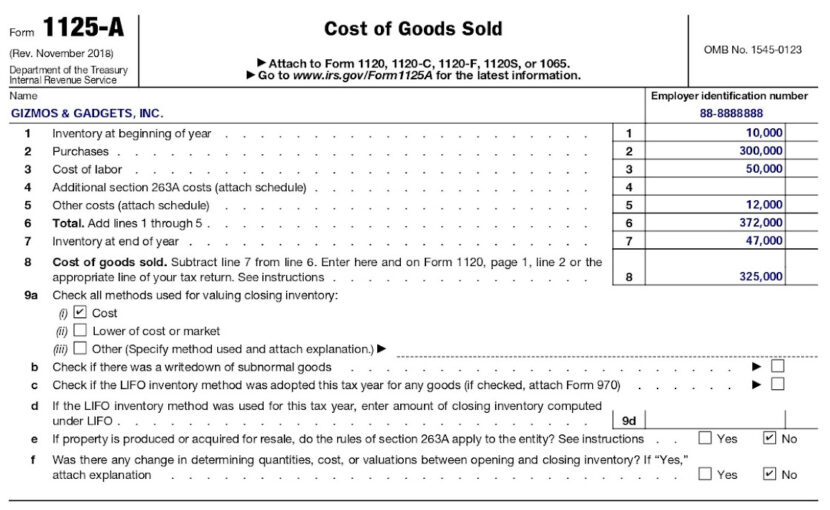

Form 1125-A - Cost of Goods Sold Form 1125-A is used by business return filers (Form 1065, 1120 and 1120-S) to calculate and then deduct the cost of goods sold by a corporation or partnership. This calculation must be separately reported on the return as set forth below. For businesses that sell inventory to customers, the cost of goods sold (COGS) deduction is likely going to be the largest expense for the expense. The COGS ...

How to Include Cost of Goods Sold on Your Business Tax Return The Balance

What Is Form 1125 A Example

Form 1125 A InstructionsPage 1 of 2 Instructions for Form 1125-A 17:53 - 12-OCT-2011 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Department of the Treasury Internal Revenue Service 2011 Instructions for Form 1125-A Cost of Goods Sold A small business taxpayer defined below may use a method of accounting for inventories that either 1 treats inventories as nonincidental materials and supplies or 2 conforms to the taxpayer s financial accounting treatment of inventories A small business taxpayer is not required to capitalize costs under section 263A General Instructions

1125-A - Cost of Goods Sold Thomas McGourty Updated 5 months ago What is the form used for? Filers of Form 1120, 1120-C, 1120-F, 1120S, 1065, or 1065-B complete and attach this form if they report a deduction for the cost of goods sold. Is the form Supported in our program? Yes IRS Form 1125 E Printable IRS Form 1125 E Sign Online PDFliner Form 1125 a Calculates Cost Goods Sold Stock Vector Royalty Free

IRS Form 1125 A Cost of Goods Sold YouTube

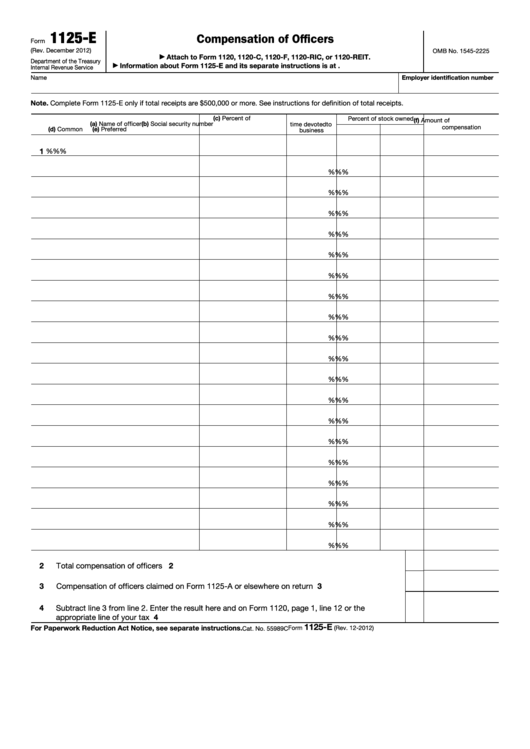

What Is Form 1125 E Example

A small business taxpayer claiming • The production of real property and Use Form 1125-A to calculate and deduct exemption from the requirement to keep tangible personal property for use in its cost of goods sold for certain entities. inventories is changing its method of trade or business or in an activity engaged accounting for purposes of sec... Fillable Form 1125 E Compensation Of Officers Printable Pdf Download

A small business taxpayer claiming • The production of real property and Use Form 1125-A to calculate and deduct exemption from the requirement to keep tangible personal property for use in its cost of goods sold for certain entities. inventories is changing its method of trade or business or in an activity engaged accounting for purposes of sec... Form 1125 E Compensation Of Officers 2013 Free Download Form 1125 A Fill Out Printable PDF Forms Online

Form 1125 E Compensation Of Officers 2013 Free Download

IRS Form 1125 A Cost Of Goods Sold PDF

Form 1125 A Cost Of Goods Sold 2012 Free Download

Form 1125 A Cost Of Goods Sold Support

How To Find Form 1125 E Compensation Of Officers Online YouTube

Form 1125 E Instructions 2024 2025

Schedule K 1 Form 1120s Instructions 2025 Cynthia C Bushey

Fillable Form 1125 E Compensation Of Officers Printable Pdf Download

Form 1125 Instructions 2012 Fill Out Sign Online DocHub

How To Fill Out Form 1125 A Cost Of Goods Sold For 2022 YouTube