Gstr 1 Due Date For Dec 2024

Gstr 1 Due Date For Dec 2024 - May 15 2024 nbsp 0183 32 Learn all about GSTR 1 understand its due date and who should file it Check out the complete process for GSTR 1 form filing and the penalty for late filing Understanding the difference between GSTR 1 GSTR 2A and GSTR 3B is essential not just for timely and accurate filing but also for maximizing your Input Tax Credit ITC and avoiding

Gstr 1 Due Date For Dec 2024

Gstr 1 Due Date For Dec 2024

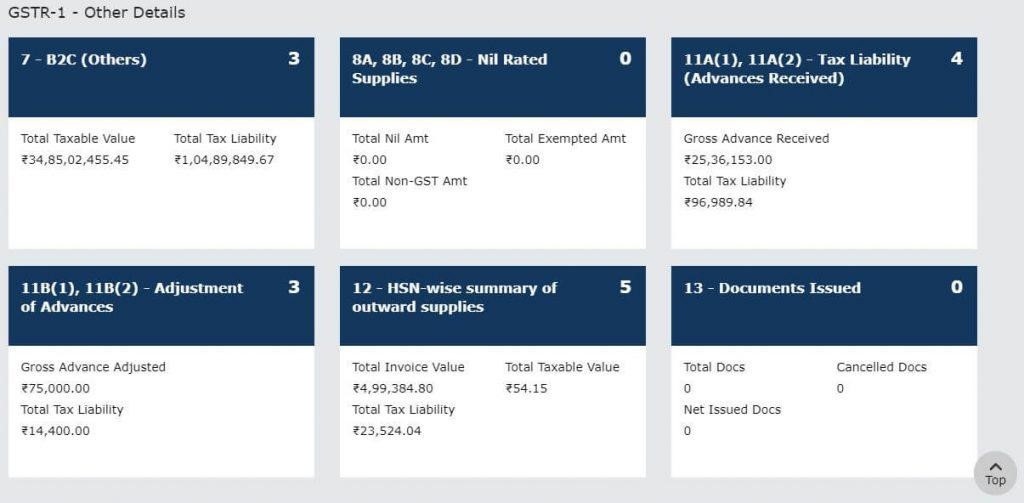

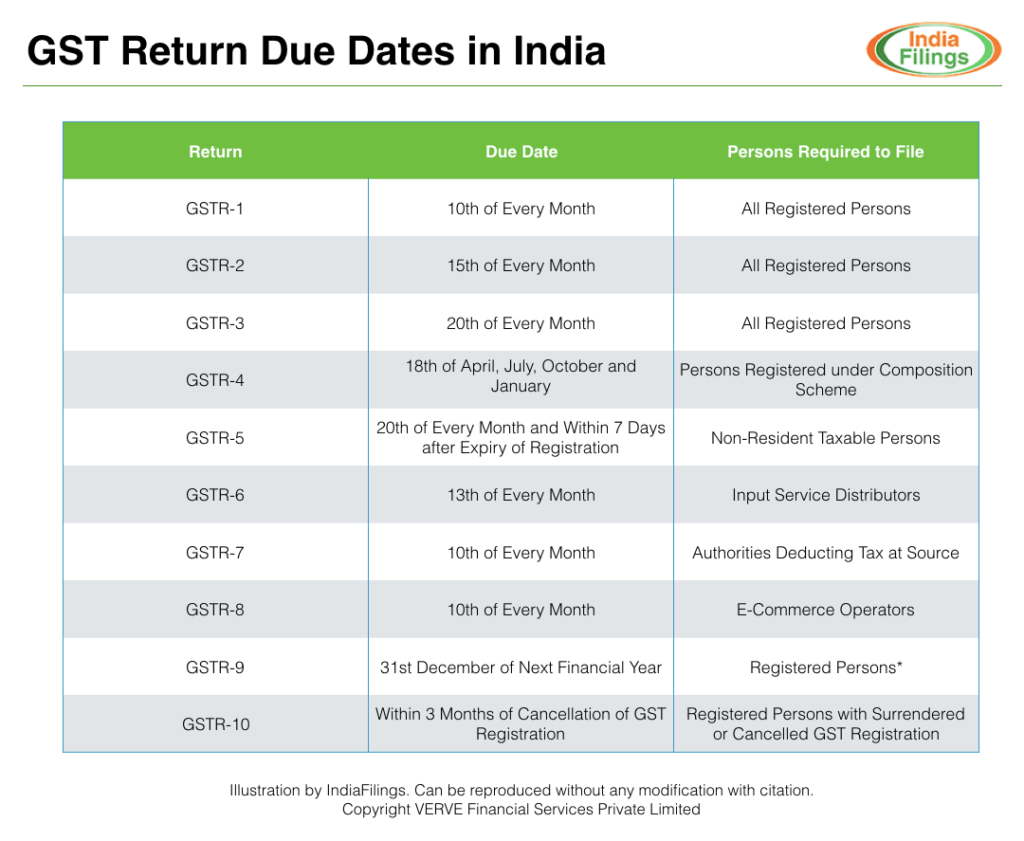

GSTR-2 is a monthly inward supply report, which can also include reverse charge transactions. It is used to do buyer-seller reconciliation, also known as invoice matching, by the government. Jul 18, 2025 · GSTR 1 is a monthly GST return that contains details of all outward supplies. This is a step-by-step guide on how to file GSTR 1 on the GST Portal.

Difference Between GSTR 1 GSTR 2A amp GSTR 3B GST Return

Important Due Date Jan 2023 GST TDS TCS PF ESIC Due Date Tax

Gstr 1 Due Date For Dec 2024Sep 7, 2024 · What is GSTR? A GSTR (i.e. Goods & Service Tax Return) is a document that every GST-registered business has to submit to the government. It includes all details of the … Learn about GSTR 1 Filing due dates format late fees eligibility rules and quarterly return details for GST compliance Every GST registered business shall submit sales details GSTR 1

Feb 28, 2025 · Understand the key differences between GSTR-1, GSTR-3B, and GSTR-9 to ensure GST compliance. Learn their purposes, filing requirements, and more with our detailed … GSTR 1 Filings And Voluntary Compliance Corpbiz GSTR 1 Meaning Eligibility Due Date How To File

How To File GSTR 1 On GST Portal ClearTax

GSTR 1 Due Date Extension Possible For Aug 2021 Month GSTR1 Filing

Form GSTR 1A is an amendment return of Form GSTR 1 filed for a tax period by a taxpayer. Any record filed in a particular GSTR 1 can be amended in the same period GSTR -1A or any … GSTR 4 Filing Quarterly Return For Composition Scheme

Form GSTR 1A is an amendment return of Form GSTR 1 filed for a tax period by a taxpayer. Any record filed in a particular GSTR 1 can be amended in the same period GSTR -1A or any … New GST REG 31 Form For Suspension Intimation Registration Big Alert For Taxpayers GSTR 1 Filing Within 10 Days For Two Months

GST Returns New Due Dates For GSTR 1 And GSTR 3B GST Advisory On

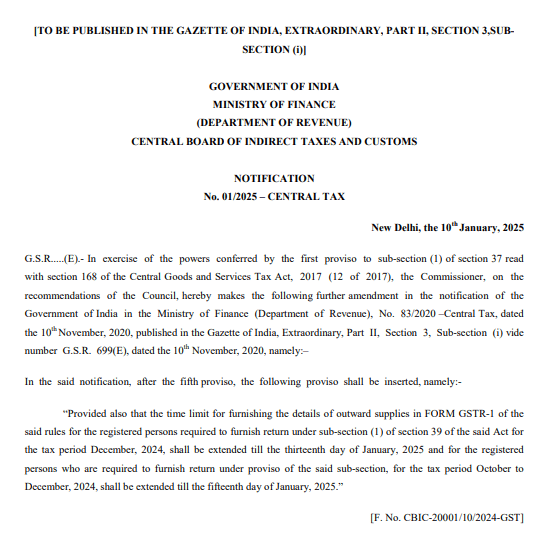

Extension Of Due Date GSTR 1 And GSTR 3B For The Month Of Dec2024

Stagewes Blog

General Knowledge Questions And Answers

GSTR 1 Due Date Extended For December 2024 Return Tax Guide

GSTR 1 Due Date Extended For December 2024 Return Tax Guide

GSTR 1 GSTR 2 And GSTR 3 Due Dates Extended ExcelDataPro

GSTR 4 Filing Quarterly Return For Composition Scheme

GSTR 1 GSTR 3B Return Filing Due Dates Extended For Odisha

GSTR Due Dates List March 2024