Gstr 1 Json File

Gstr 1 Json File - May 15 2024 nbsp 0183 32 Learn all about GSTR 1 understand its due date and who should file it Check out the complete process for GSTR 1 form filing and the penalty for late filing Understanding the difference between GSTR 1 GSTR 2A and GSTR 3B is essential not just for timely and accurate filing but also for maximizing your Input Tax Credit ITC and avoiding costly errors

Gstr 1 Json File

Gstr 1 Json File

GSTR-2 is a monthly inward supply report, which can also include reverse charge transactions. It is used to do buyer-seller reconciliation, also known as invoice matching, by the government. Jul 18, 2025 · GSTR 1 is a monthly GST return that contains details of all outward supplies. This is a step-by-step guide on how to file GSTR 1 on the GST Portal.

Difference Between GSTR 1 GSTR 2A amp GSTR 3B GST Return

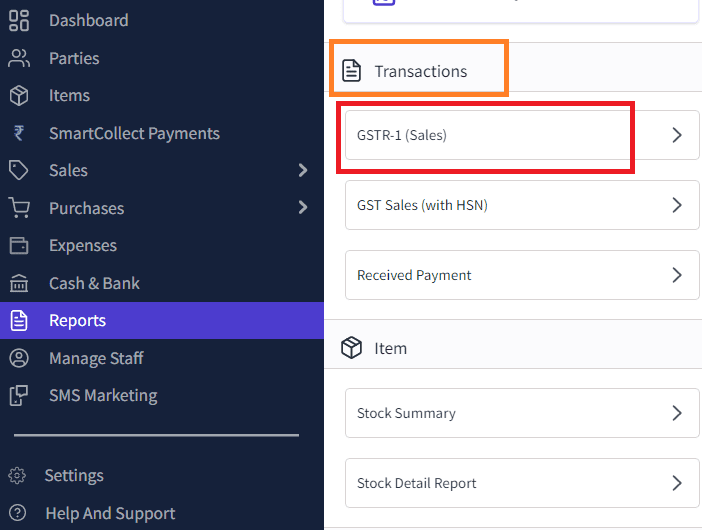

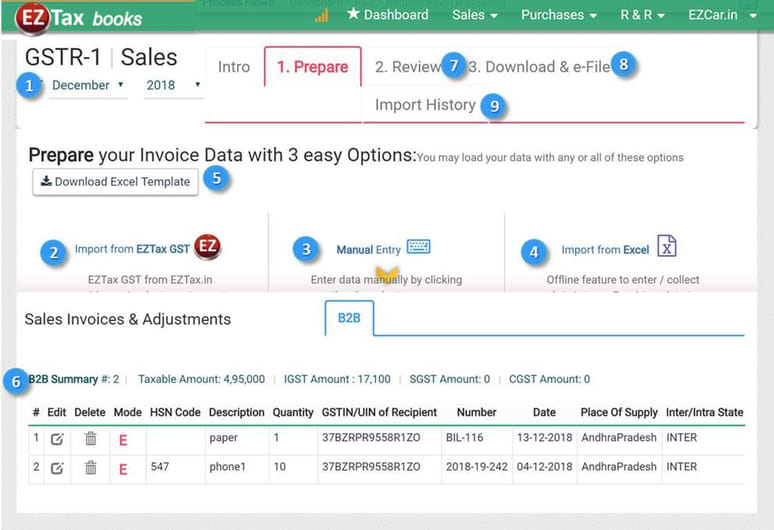

How To Prepare GSTR 1 JSON File For GSTN EZTax in GST Help Center

Gstr 1 Json FileSep 7, 2024 · What is GSTR? A GSTR (i.e. Goods & Service Tax Return) is a document that every GST-registered business has to submit to the government. It includes all details of the business’s purchases, sales, and taxes paid and collected. Learn about GSTR 1 Filing due dates format late fees eligibility rules and quarterly return details for GST compliance Every GST registered business shall submit sales details GSTR 1 Monthly GSTR 1 is to be filed by the 11th of the subsequent month

Feb 28, 2025 · Understand the key differences between GSTR-1, GSTR-3B, and GSTR-9 to ensure GST compliance. Learn their purposes, filing requirements, and more with our detailed guide. HOW TO EXPORT GSTR 1 JSON FILE FOR EACH SECTIONS IN TALLY PRIME YouTube Gstr1 Export In Tally Prime 4 1 gstr 1 Return Filing Tally Json File

How To File GSTR 1 On GST Portal ClearTax

How To Convert GSTR 1 JSON File To Excel YouTube

Form GSTR 1A is an amendment return of Form GSTR 1 filed for a tax period by a taxpayer. Any record filed in a particular GSTR 1 can be amended in the same period GSTR -1A or any mistake committed can be rectified. GSTR 1 JSON Upload And Filing In Saral Pro YouTube

Form GSTR 1A is an amendment return of Form GSTR 1 filed for a tax period by a taxpayer. Any record filed in a particular GSTR 1 can be amended in the same period GSTR -1A or any mistake committed can be rectified. Importing GSTR 1 JSON File In Excel Without Using Any Software website How To File Gstr 1 From Tally Prime How To Export Gstr 1 Json File

GSTR 1 JSON Import Winman GST YouTube

Tally 3 0 GSTR 1 JSON File YouTube

How To You Export GSTR 1 JSON File From Tally Prime With New Update

How To Export Gstr 1 Json File From Tally Prime Tutorial YouTube

How To Export Gstr 1 Json File From Tally Prime GST R 3B PDF Export In

How To Export GSTR 1 From Tally Prime Export GSTR 1 JSON CSV EXCEL

How To Create GSTR 1 Json File In Busy How To Create GSTR 1 Json

GSTR 1 JSON Upload And Filing In Saral Pro YouTube

HOW TO EXPORT GSTR 1 JSON FILE FROM TALLY PRIME 4 0 TALLY PRIME 4 0

How To Download Gstr1 From Gst Portal Download Gstr1 Return Offline