Gstr 10

Gstr 10 - May 15 2024 nbsp 0183 32 Learn all about GSTR 1 understand its due date and who should file it Check out the complete process for GSTR 1 form filing and the penalty for late filing Understanding the difference between GSTR 1 GSTR 2A and GSTR 3B is essential not just for timely and accurate filing but also for maximizing your Input Tax Credit ITC and avoiding costly errors

Gstr 10

Gstr 10

GSTR-2 is a monthly inward supply report, which can also include reverse charge transactions. It is used to do buyer-seller reconciliation, also known as invoice matching, by the government. Jul 18, 2025 · GSTR 1 is a monthly GST return that contains details of all outward supplies. This is a step-by-step guide on how to file GSTR 1 on the GST Portal.

Difference Between GSTR 1 GSTR 2A amp GSTR 3B GST Return

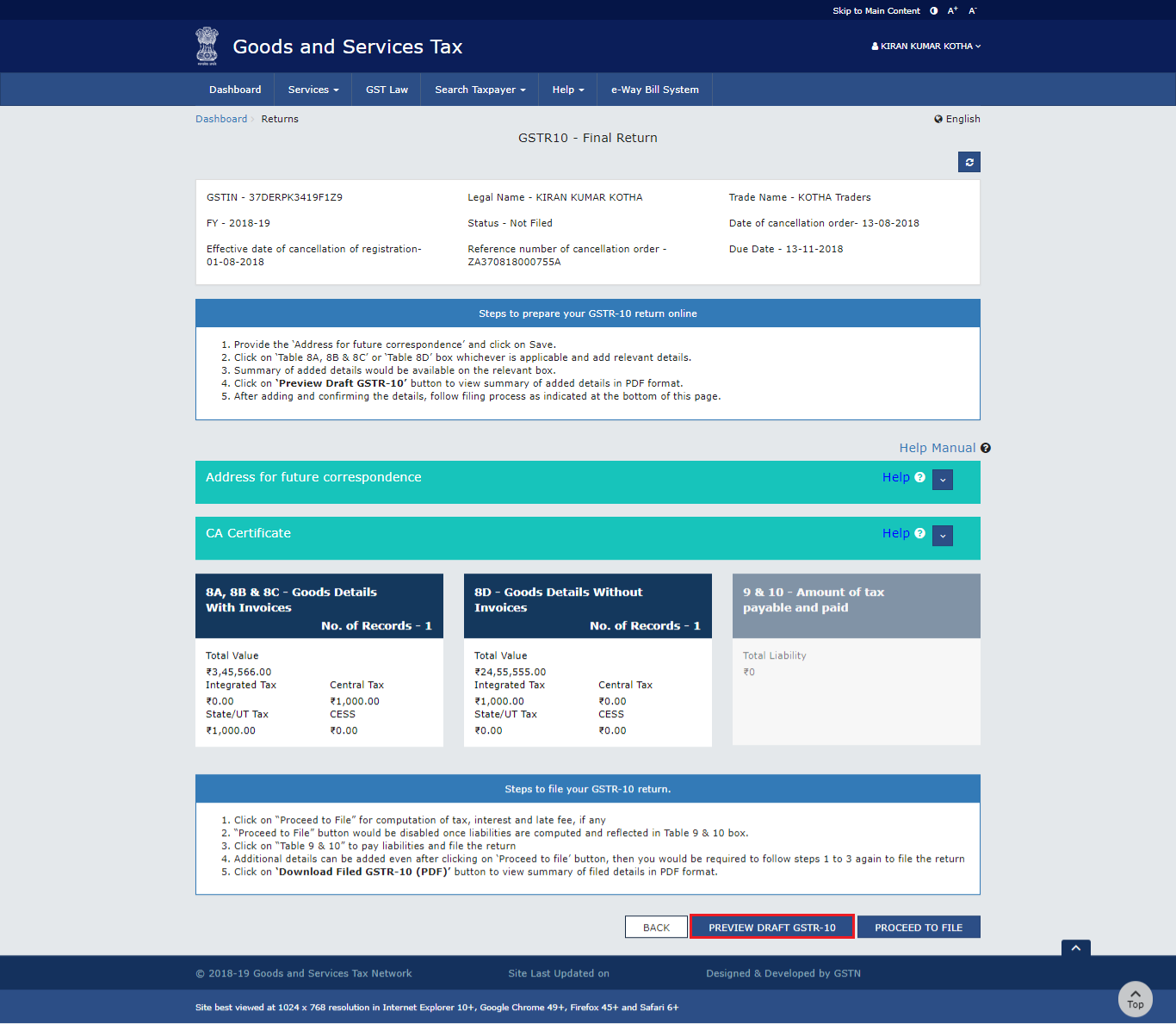

GSTR 10 Everything You Need To Know

Gstr 10Sep 7, 2024 · What is GSTR? A GSTR (i.e. Goods & Service Tax Return) is a document that every GST-registered business has to submit to the government. It includes all details of the business’s purchases, sales, and taxes paid and collected. Learn about GSTR 1 Filing due dates format late fees eligibility rules and quarterly return details for GST compliance Every GST registered business shall submit sales details GSTR 1 Monthly GSTR 1 is to be filed by the 11th of the subsequent month

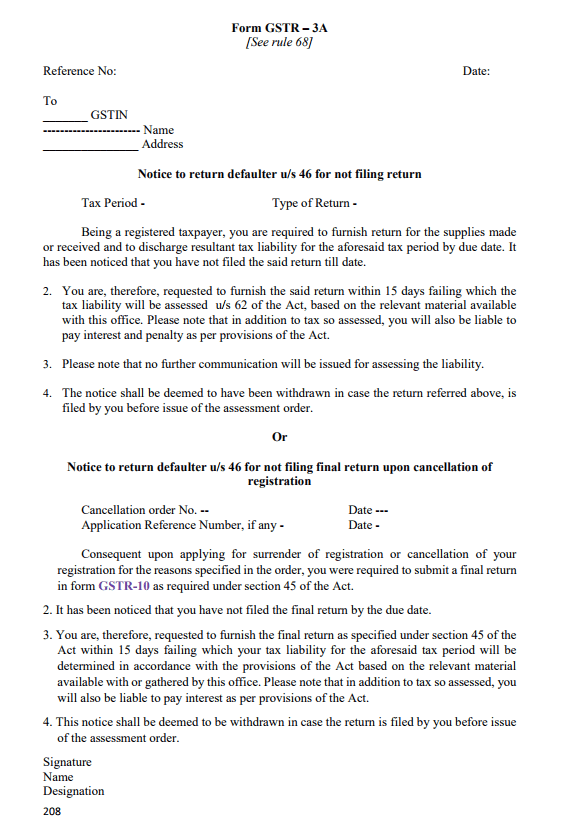

Feb 28, 2025 · Understand the key differences between GSTR-1, GSTR-3B, and GSTR-9 to ensure GST compliance. Learn their purposes, filing requirements, and more with our detailed guide. GSTR 10 Late Fees Eligibility Rules Filing Returns Pice GSTR 10 Return Filing Due Date For Taxpayer

How To File GSTR 1 On GST Portal ClearTax

GSTR 10 What Is GSTR 10 And How To File It MyBillBook

Form GSTR 1A is an amendment return of Form GSTR 1 filed for a tax period by a taxpayer. Any record filed in a particular GSTR 1 can be amended in the same period GSTR -1A or any mistake committed can be rectified. GSTR 10 Return Filing Late Fees Due Date Format Rules Pice

Form GSTR 1A is an amendment return of Form GSTR 1 filed for a tax period by a taxpayer. Any record filed in a particular GSTR 1 can be amended in the same period GSTR -1A or any mistake committed can be rectified. GSTR 10 Filing Eligibility Due Dates Process TaxHelpdesk GSTR 10 Online Tax Filing Services India

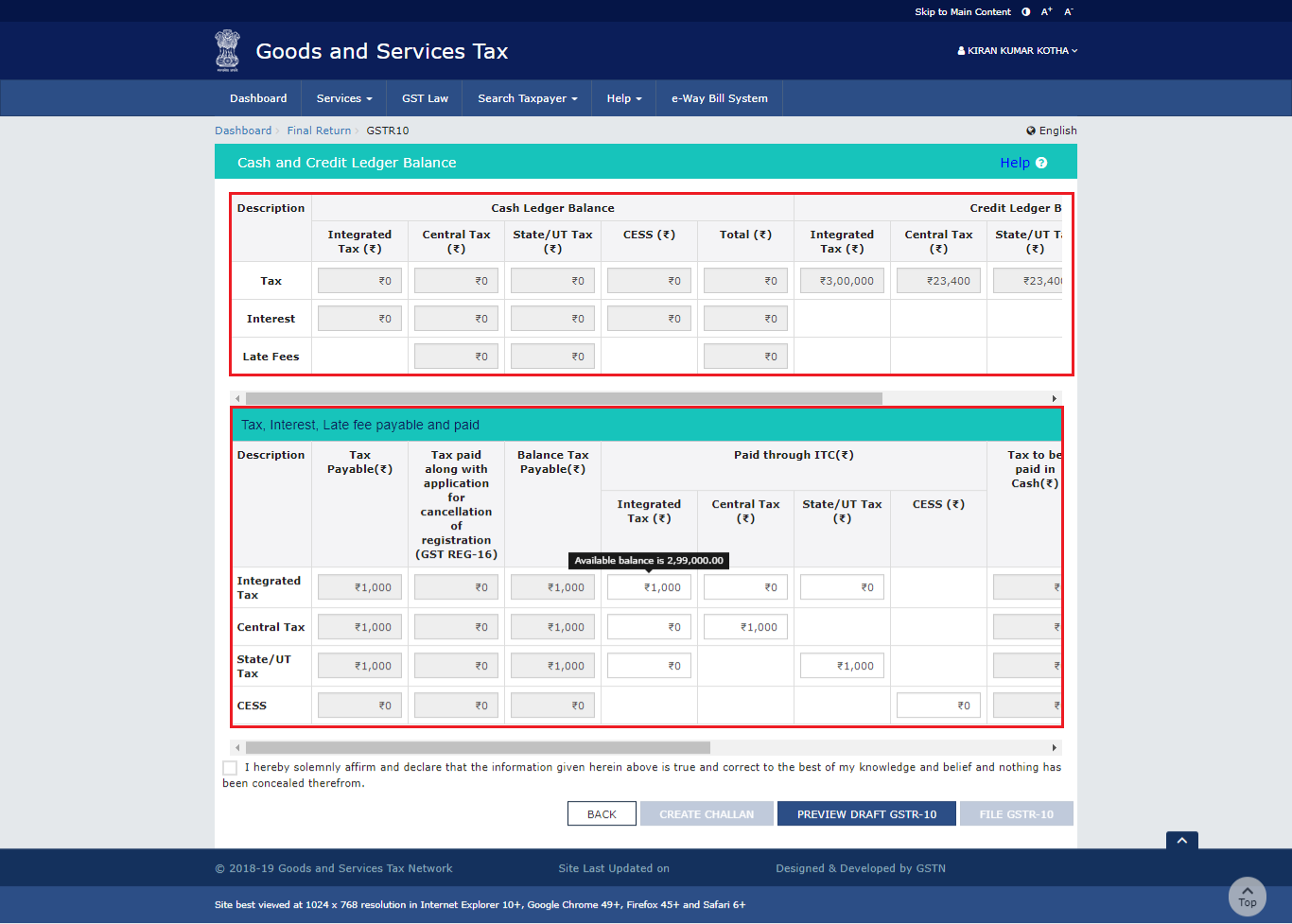

GSTR 10 Details Return Filing Format

GSTR 10 Details Return Filing Format

GSTR 10 Details Return Filing Format

GSTR 10 Details Return Filing Format

Easy GSTR 10 Return Filing Applicability Late Fees And Due Date Taxgyany

Understanding GSTR 10 A Comprehensive Guide To Filing Final Return

GSTR 10 Return Filing Late Fees Due Date Format Rules Pice

GSTR 10 Return Filing Late Fees Due Date Format Rules Pice

GSTR 10 Filing Eligibility Due Dates Process

Know All About GSTR 10 Webinar By GSTN Team Today At 4 PM SAG Infotech