How To Calculate Interest Coverage Ratio

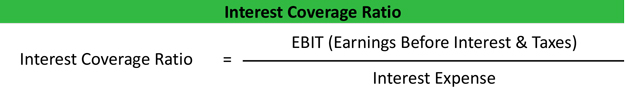

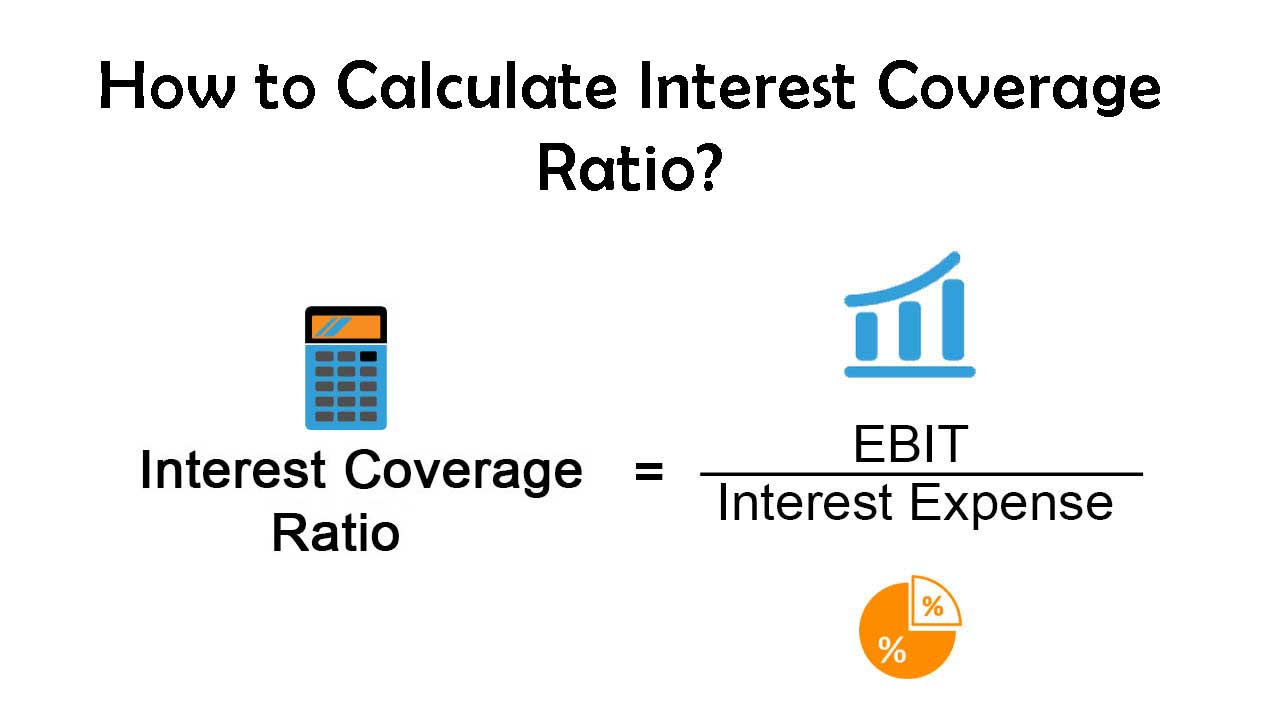

How To Calculate Interest Coverage Ratio - The ratio is calculated by dividing EBIT by the company s interest expense A higher interest coverage ratio means that a company is more poised to pay its debts while the opposite is true The formula is Interest Coverage Ratio EBIT Interest Expense While this metric is often used in the context of companies you can better grasp the concept by applying it to yourself Add up the interest expenses from your mortgage credit card debt car loans student loans and other obligations

How To Calculate Interest Coverage Ratio

How To Calculate Interest Coverage Ratio

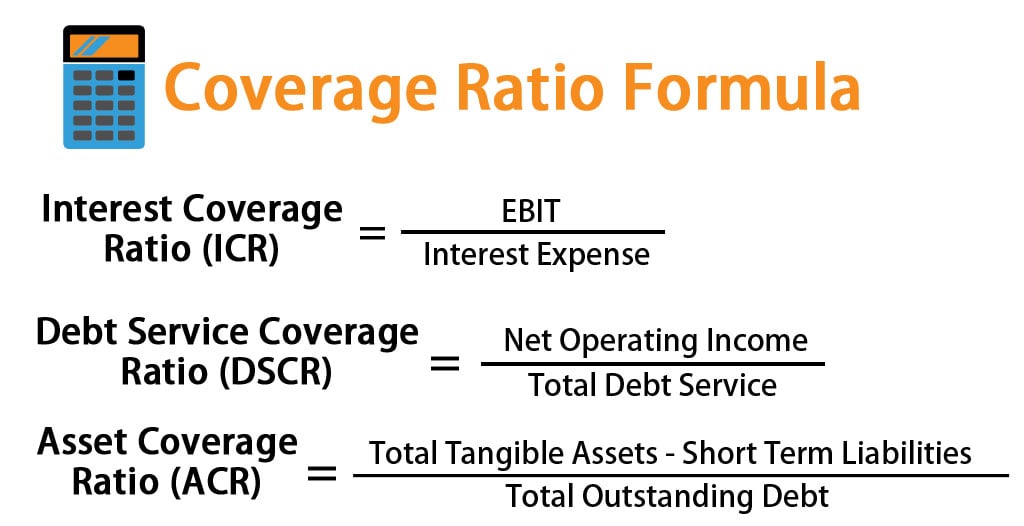

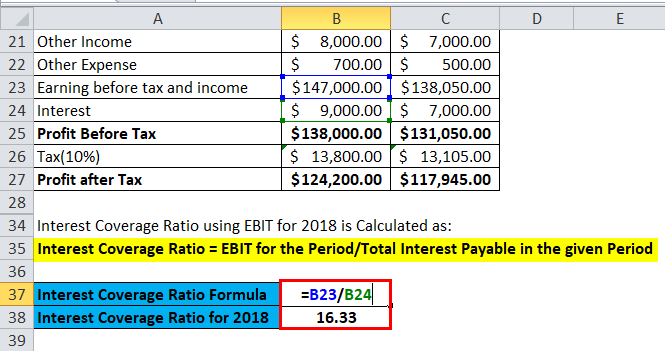

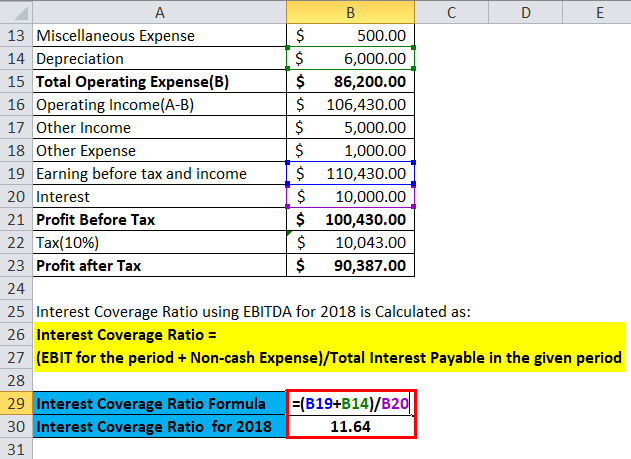

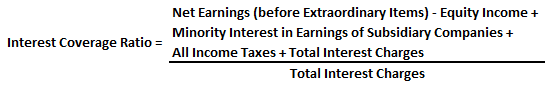

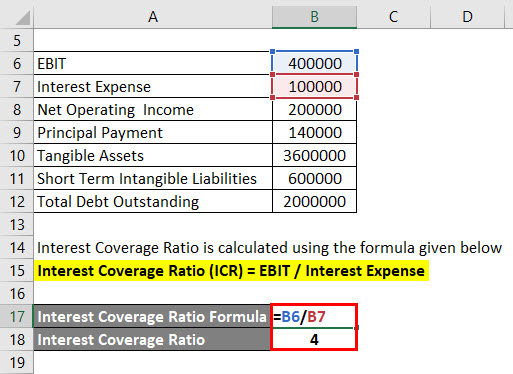

The formula to calculate the interest coverage ratio involves dividing a company’s operating cash flow metric – as mentioned earlier – by the interest expense burden. Interest Coverage Ratio (ICR) = EBIT ÷ Interest Expense The interest coverage ratio calculator (also named as times interest earned ratio) is a tool that, based on the interest coverage ratio formula, shows the investor how many times company earnings cover.

How To Calculate And Use The Interest Coverage Ratio

Interest Coverage Ratio Guide How To Calculate And Interpret ICR

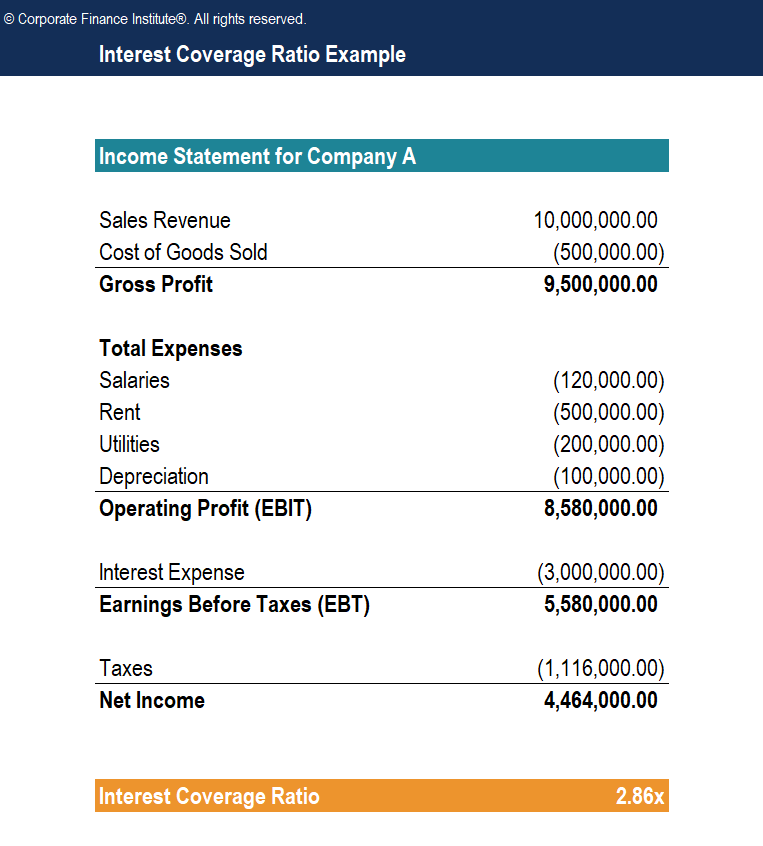

How To Calculate Interest Coverage RatioThe Interest Coverage Ratio is calculated by dividing a company's earnings before interest and taxes (EBIT) by its interest expenses. The formula for Interest Coverage Ratio can be expressed as follows: To determine the interest coverage ratio EBIT Revenue COGS Operating Expenses EBIT 10 000 000 500 000 120 000 500 000 200 000 100 000 8 580 000 Therefore Interest Coverage Ratio 8 580 000 3 000 000 2 86x Company A can pay its interest payments 2 86 times with its operating profit

The calculation for the interest coverage ratio is Some rough guidelines for ranges of this ratio and how to interpret them: A ratio of less than 1 will require immediate attention. It implies that a company can't service current interest payments, and is in very poor financial health Fixed Charge Coverage Ratio Here s Everything You Need To Know Interest Coverage Ratio Guide How To Calculate And Interpret ICR

Interest Coverage Ratio Calculator

How To Calculate Interest Coverage Ratio From Balance Sheet YouTube

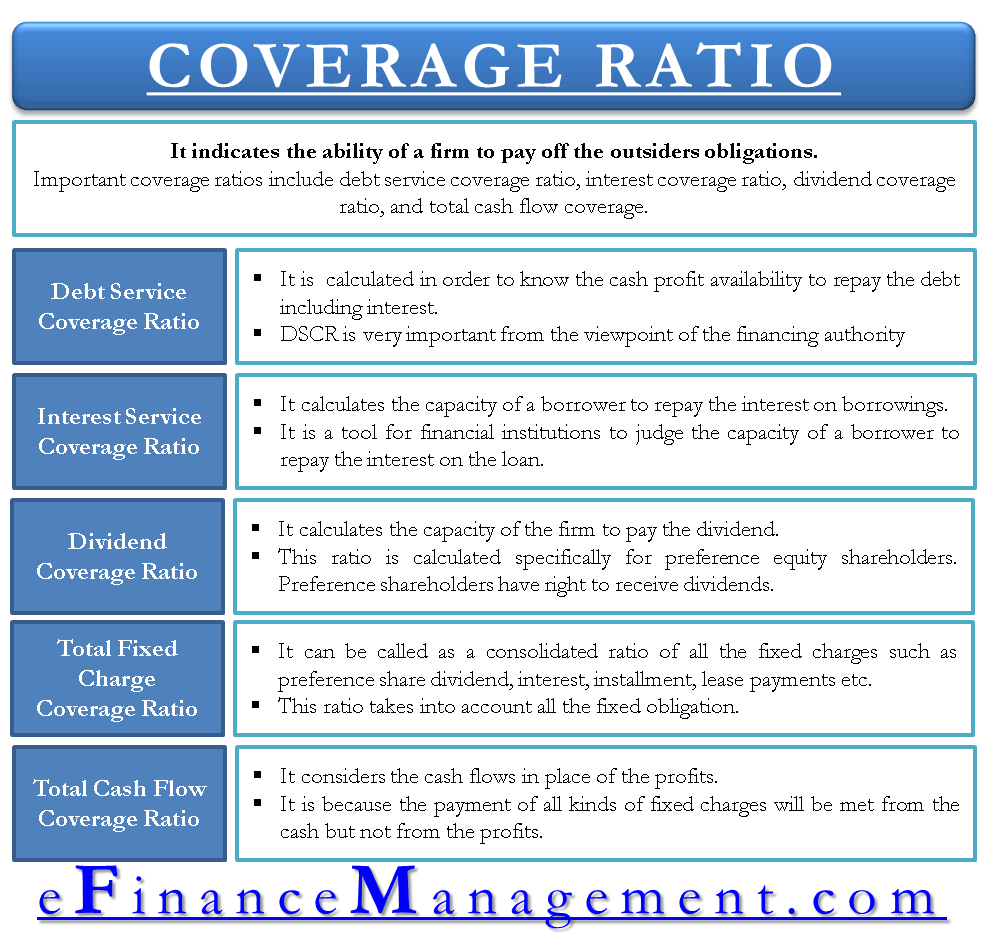

Key Takeaways A coverage ratio, broadly, is a measure of a company's ability to service its debt and meet its financial obligations. The higher the coverage ratio, the easier it should be to. How To Calculate Ebit Interest Coverage Haiper

Key Takeaways A coverage ratio, broadly, is a measure of a company's ability to service its debt and meet its financial obligations. The higher the coverage ratio, the easier it should be to. Interest Coverage Ratio Formula Example Analysis Interest Coverage Ratio Formula Meaning Example And Interpretation

Interest Coverage Ratio Formula Meaning Example And Interpretation

Coverage Ratio Formula How To Calculate Coverage Ratio

Interest Coverage Ratio Formula Calculator Excel Template

Coverage Ratio

Interest Coverage Ratio Formula Calculator Excel Template

Interest Coverage Ratio Formula Example Analysis

Interest Coverage Ratio Investopedia

How To Calculate Ebit Interest Coverage Haiper

How To Calculate Interest Coverage Ratio Sharda Associates

How To Calculate Interest Coverage 3 Steps with Pictures