How To Calculate Working Capital Requirement

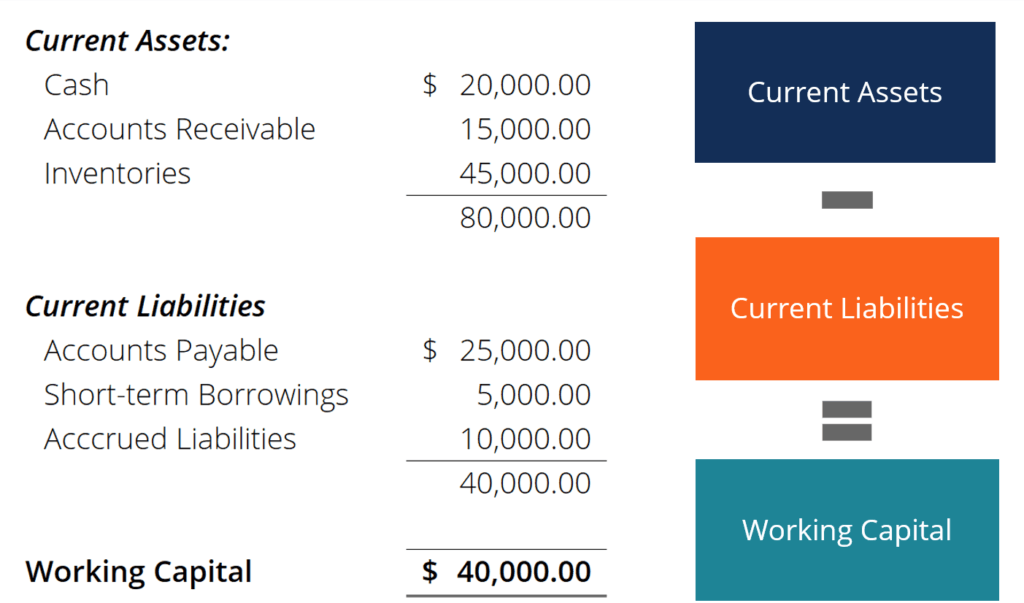

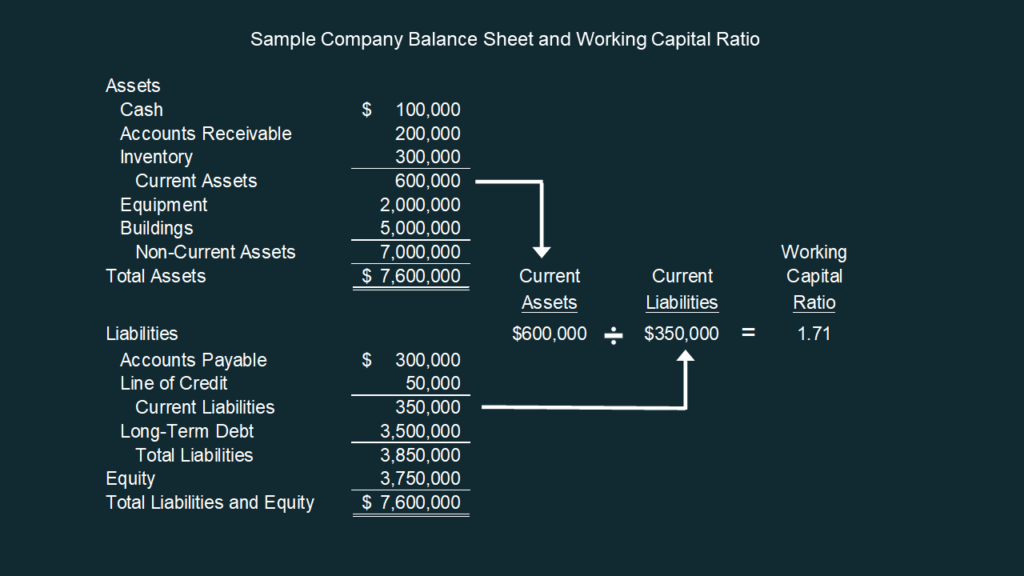

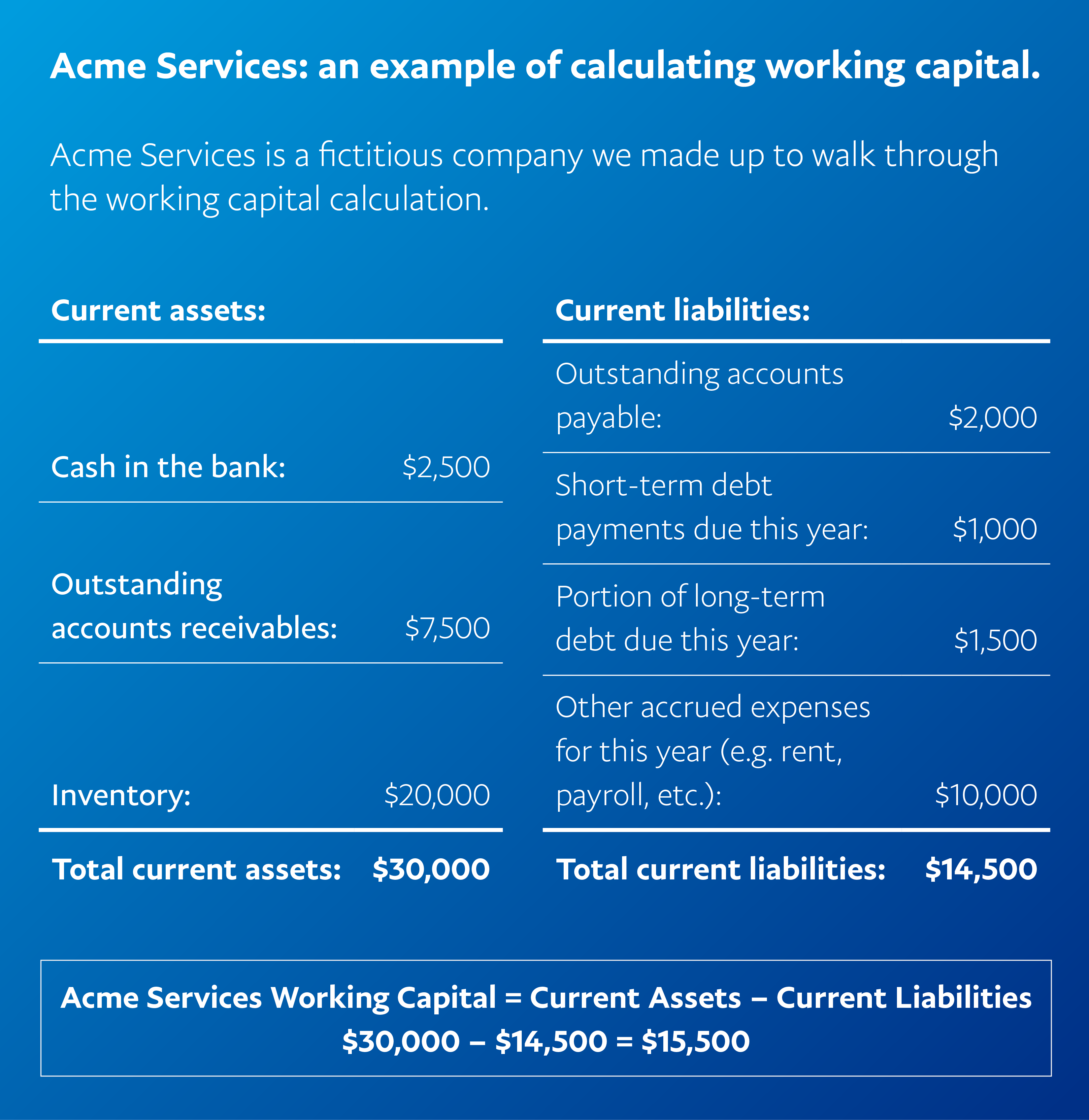

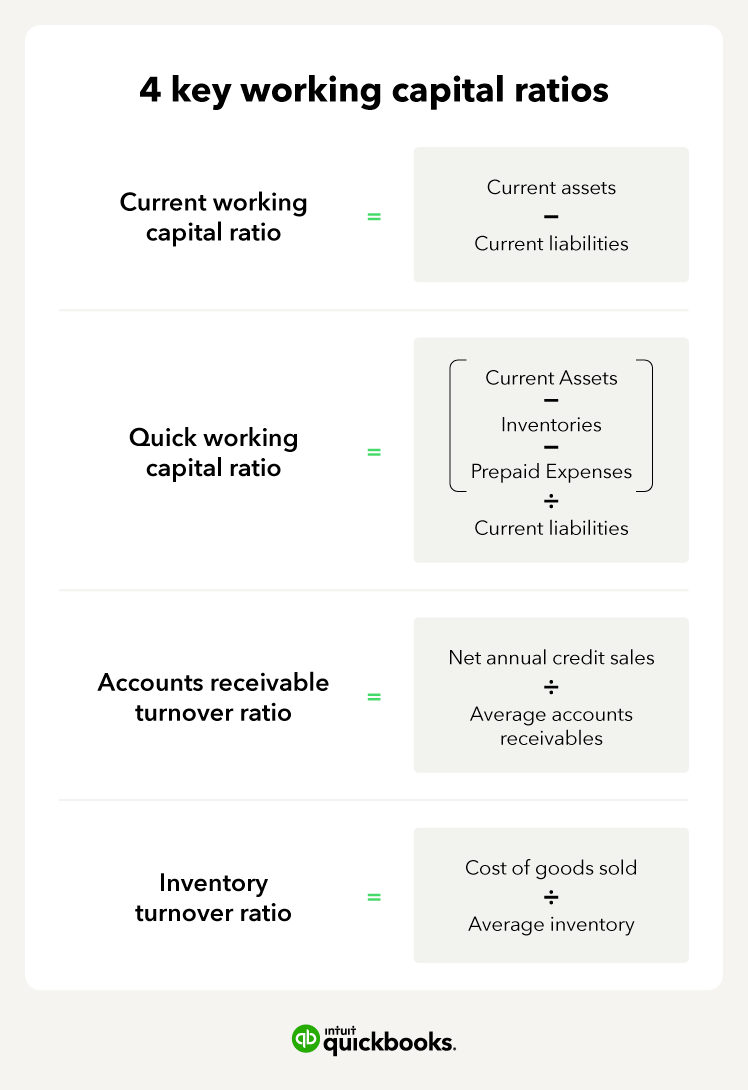

How To Calculate Working Capital Requirement - The working capital formula is Working Capital Current Assets Current Liabilities The working capital formula tells us the short term liquid assets available after short term liabilities have been paid off It is a measure of a company s short term liquidity and is important for performing financial analysis financial modeling and Logically the working capital requirement calculation can be done via the following formula WCR Inventory Accounts Receivable Accounts Payable Understanding a change in working capital requirement If you re wondering how to assess your working capital requirement look at its components first

How To Calculate Working Capital Requirement

How To Calculate Working Capital Requirement

Working Capital = current assets – current liabilities. The number will always be a positive amount because it represents how much money the company has in hand to meet its short term financial obligations. If current assets are greater than current liabilities, you have a positive Working Capital position or what is called a funding surplus. The formula to calculate WCR is straightforward: WCR = Current Assets – Current Liabilities. The components of the formula are defined as follows: Current assets: These are the assets that are expected to be converted into cash or used up within a year. Examples include cash, accounts receivable, inventory, and prepaid expenses.

How To Assess Your Working Capital Requirement WCR

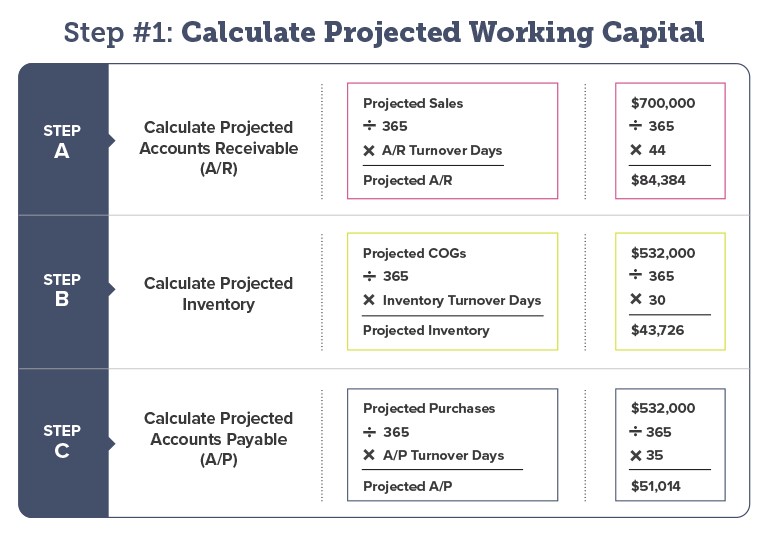

Methods For Estimating Working Capital Requirement

How To Calculate Working Capital RequirementTable of Contents. What is Working Capital? How to Calculate Working Capital. Working Capital Formula. What are the Components of Working Capital? How to Calculate Working Capital Ratio. Working Capital Example. How to Analyze Working Capital. How to Understand Change in Working Capital (NWC) How to Reconcile. Net working capital requirement Inventory Accounts receivable Accounts payable This requirement to find the finance to fund inventory and accounts receivable is an issue for any business but can be a major cause of concern for a high growth start up business

Working capital = current assets – current liabilities. Current assets are items such as: Property. Cash in the bank. Inventory. Accounts receivables. While liabilities usually refer to: Salary obligations. Accounts payable. Leases. Taxes. Working Capital Requirement WCR Complete Guide Agicap Gross Working Capital Meaning Formula How To Calculate

Working Capital Requirement WCR Formula And Calculations

Working Capital Requirement BBA mantra

Working capital is calculated simply by subtracting current liabilities from current assets. Calculating the metric known as the current ratio can also be useful. The current ratio, also. Working Capital Turnover Ratio Ideal Walton Durham

Working capital is calculated simply by subtracting current liabilities from current assets. Calculating the metric known as the current ratio can also be useful. The current ratio, also. Types Of Working Capital Check Factors Meaning QuickBooks How To Calculate Current Ratio With Working Capital Haiper

Working Capital Formula How To Calculate Working Capital

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

Net Working Capital Formulas Examples And How To Improve It

How To Calculate Working Capital Requirement For Adequate Cash Flow In

Working Capital Equation Example Tessshebaylo

How Much Working Capital Is Needed To Grow Your Business Pursuit

How To Calculate Working Capital Guide Formula Examples

Working Capital Turnover Ratio Ideal Walton Durham

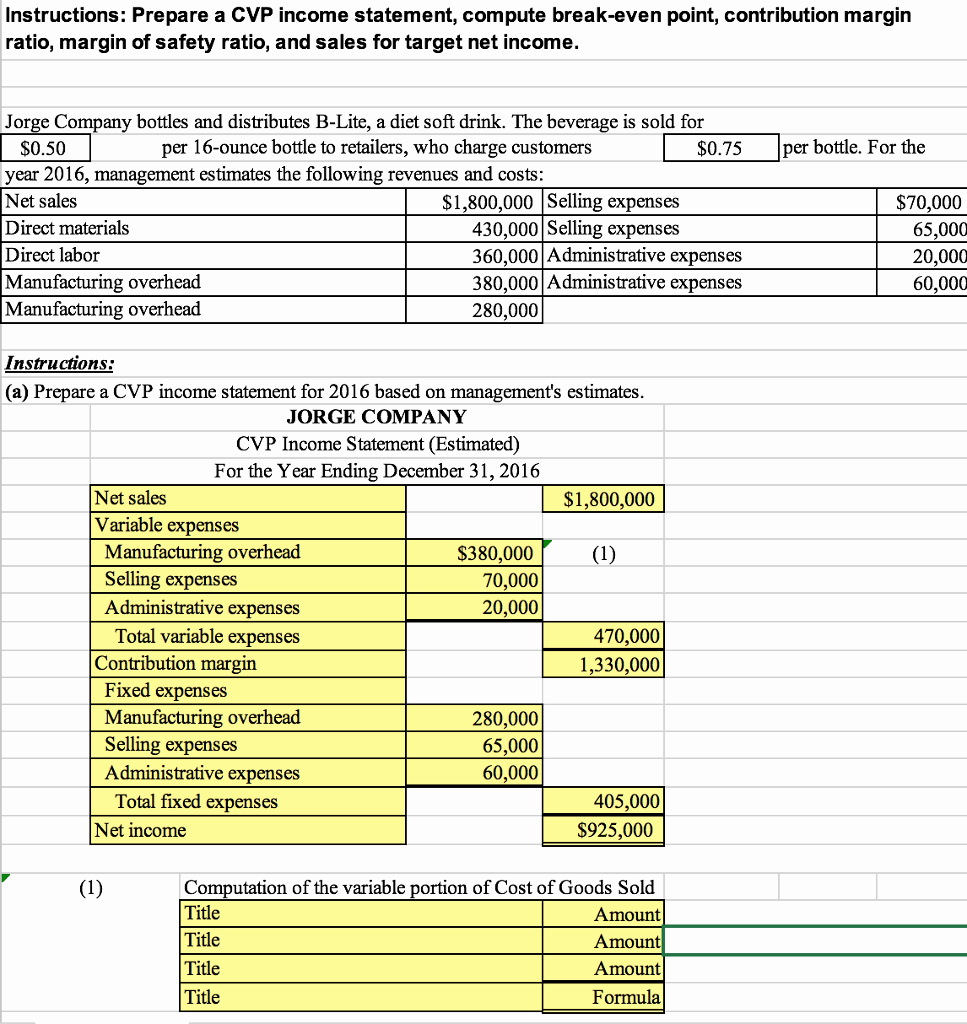

50 Working Capital Requirement Calculation Excel

Working Capital Requirement Formula Plan Projections