Internal Rate Of Return

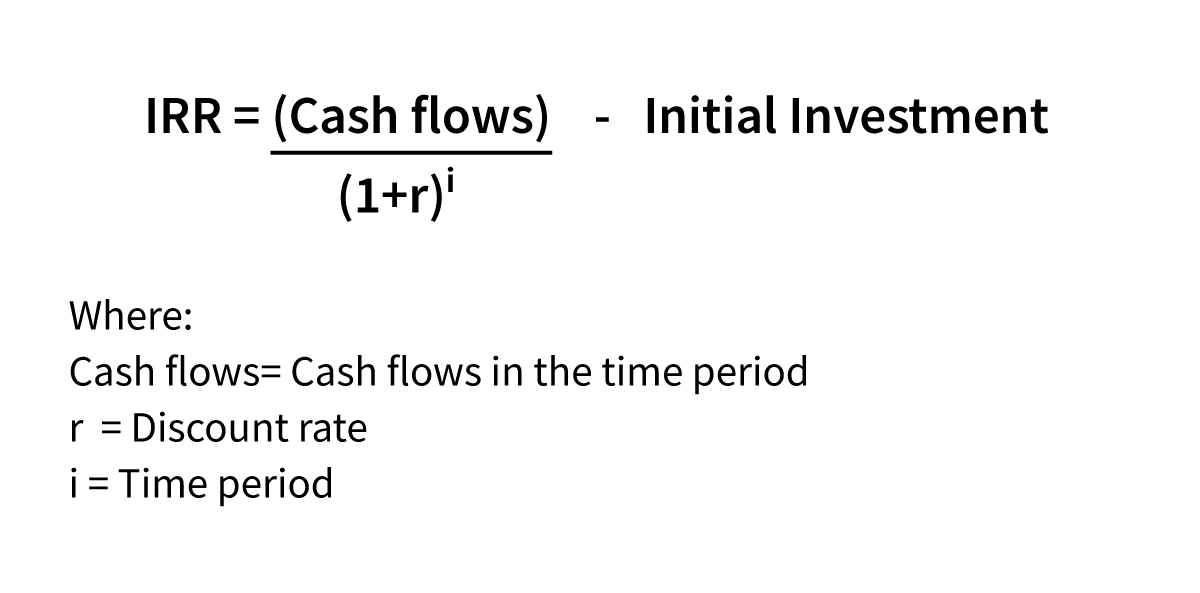

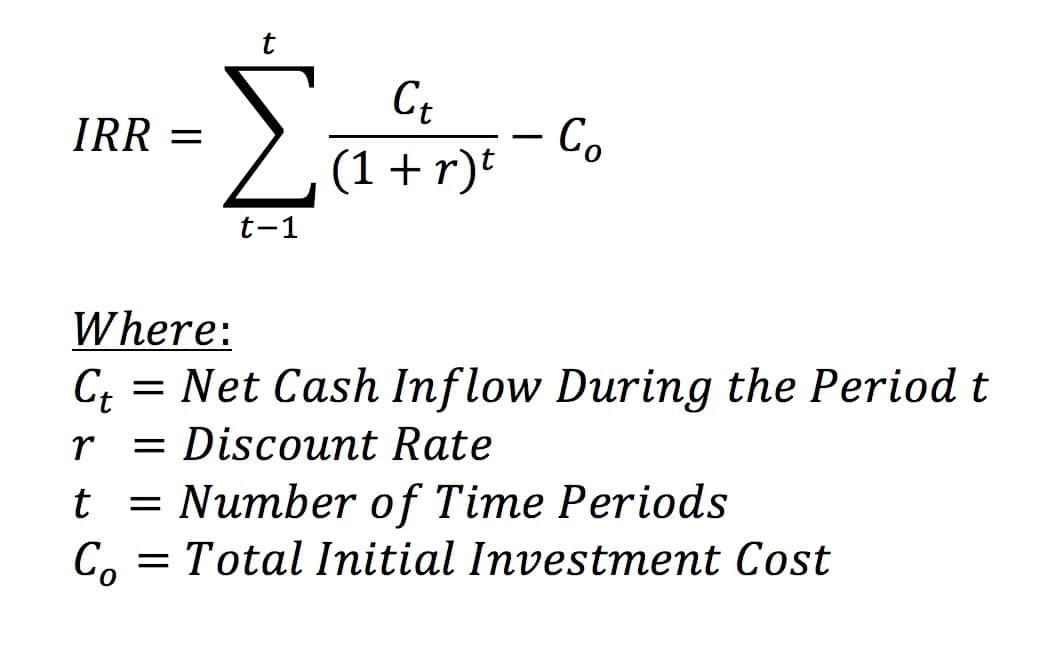

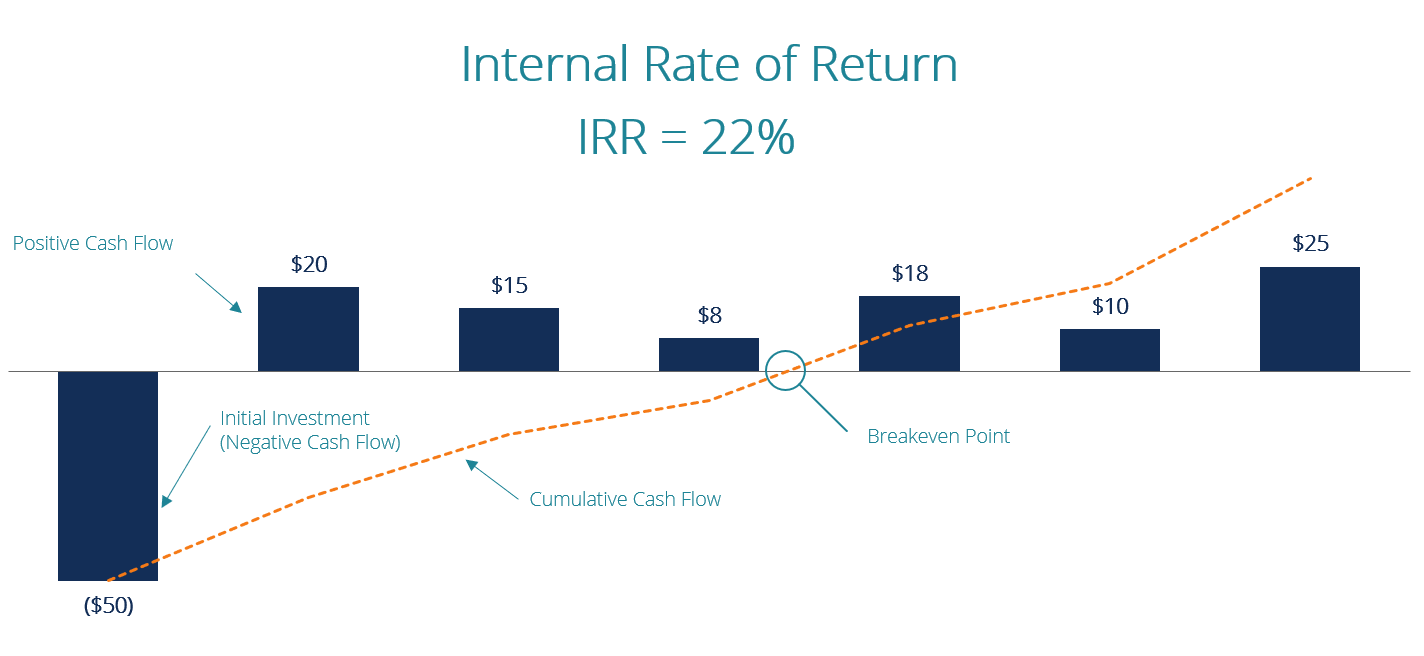

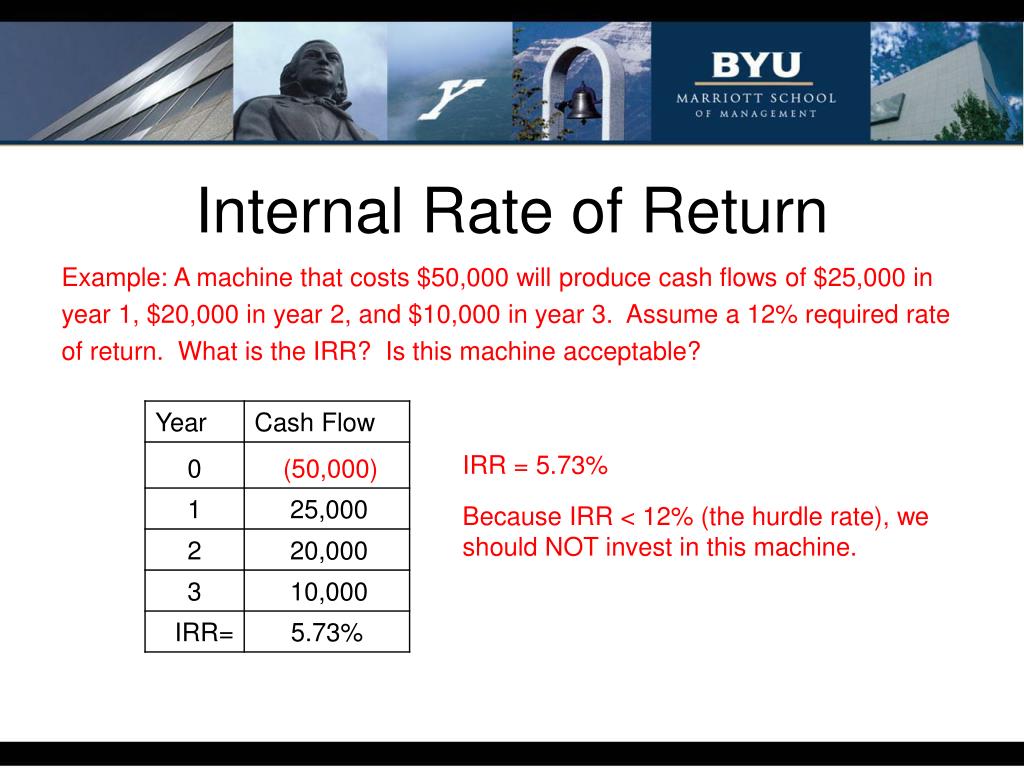

Internal Rate Of Return - Internal Rate of Return IRR is a formula used to evaluate the returns of a potential investment IRR calculates the projected annual growth rate of a specific investment over time The internal rate of return is used to evaluate projects or investments The IRR estimates a project s breakeven discount rate or rate of return which indicates the project s potential for profitability Based on IRR a company will decide to either accept or reject a project If the IRR of a new project exceeds a company s required

Internal Rate Of Return

Internal Rate Of Return

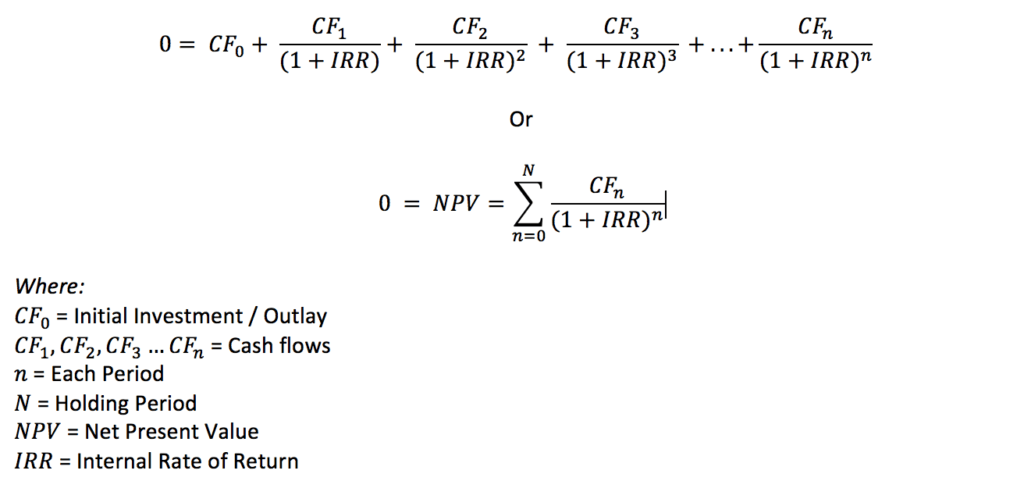

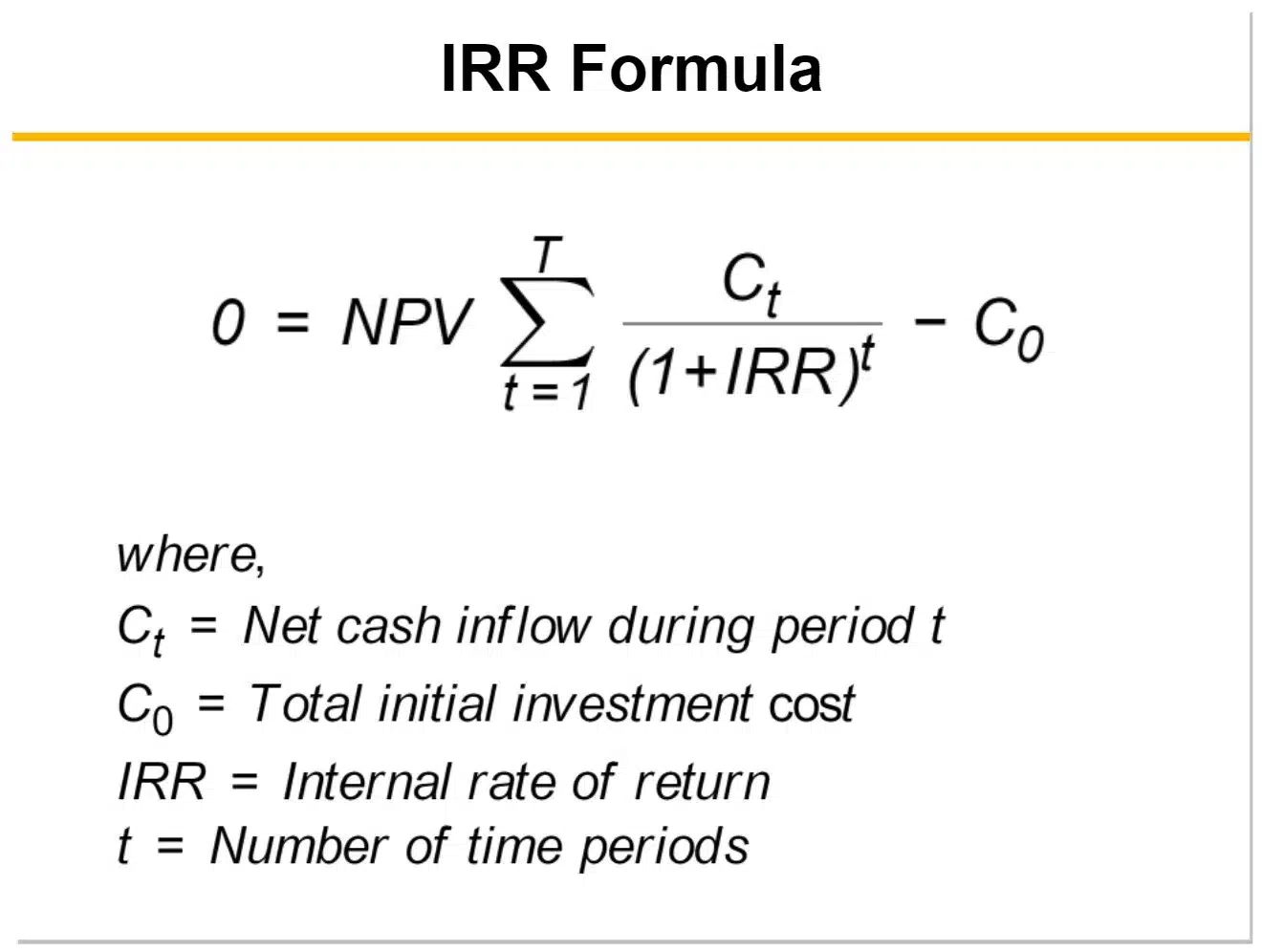

After subtracting the initial investment, the net present value of the project is $545.09, suggesting this is a good investment at the current discount rate. The internal rate of return is the discount rate that would bring this project to breakeven, or $0 NPV. In this case, an internal rate of return of 18.95% brings the net present value of . How to Calculate IRR. The internal rate of return (IRR) metric is an estimate of the annualized rate of return on an investment or project. Capital Budgeting → The internal rate of return (IRR) is the discount rate at which the net present value (NPV) on a project or investment is equal to zero, i.e. the discounted series of cash flows are of.

Internal Rate Of Return Formula amp Definition InvestingAnswers

Internal Rate Of Return In Investments Assetmonk

Internal Rate Of ReturnInternal rate of return (IRR) is a method of calculating an investment's rate of return. The term internal refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk. The Internal Rate of Return IRR is the discount rate that makes the net present value NPV of a project zero In other words it is the expected compound annual rate of return that will be earned on a project or investment When calculating IRR expected cash flows for a project or investment are given and the NPV equals zero Put another

The internal rate of return, or IRR, is the rate of return of an investment (a cash outlay) where external factors, such as inflation or the cost of capital, aren't considered. Advantages And Disadvantages Of Internal Rate Of Return IRR Dr Jiw IRR Internal Rate Of Return

Internal Rate Of Return IRR Formula Calculator Wall Street

How To Calculate Irr With Different Cash Flows Haiper

The Purpose of the Internal Rate of Return . The IRR is the discount rate at which the net present value (NPV) of future cash flows from an investment is equal to zero. Functionally, the IRR is . Internal Rate Of Return IRR How To Use The IRR Formula

The Purpose of the Internal Rate of Return . The IRR is the discount rate at which the net present value (NPV) of future cash flows from an investment is equal to zero. Functionally, the IRR is . The Internal Rate Of Return SimTrade Blog Internal Rate Of Return IRR Method COMMERCESTUDYGUIDE

Internal Rate Of Return IRR FundsNet

What Is IRR Formula Calculation Examples Bizness Professionals

Internal Rate Of Return IRR Formula STRATAFOLIO

Internal Rate Of Return IRR How To Use The IRR Formula

Internal Rate Of Return IRR Formula Calculator

:max_bytes(150000):strip_icc()/IRR_final-9761b2cb70aa42eca108db9f04d3e8c5.png)

Internal Rate Of Return IRR Formula And Examples Levelized Cost Of

Internal Rate Of Return IRR Definition Formula Example Tipalti

Internal Rate Of Return IRR How To Use The IRR Formula

:max_bytes(150000):strip_icc()/DDM_INV_internal-rate-of-return-rule_final-4x3-4a81608802ef484692bce139ddb8dfcc.jpg)

Internal Rate Of Return IRR Rule Definition And Example Internal

PPT Capital Equipment Planning PowerPoint Presentation ID 339945