Irs 1040 2024 Form

Irs 1040 2024 Form - We will update this page for Tax Year 2024 as the Forms Schedules and Instructions become available 2024 Tax Returns are expected to be due in April 2025 Estimate and plan your 2023 Tax Return with the 2024 Tax Calculator In 2023 tax plan your W 4 based tax withholding for W 2 1099 etc income with the Paycheck Calculator Instructions for Form 8912 Credit to Holders of Tax Credit Bonds Dec 2023 12 11 2023 Form 944 X sp Adjusted Employer s ANNUAL Federal Tax Return or Claim for Refund Spanish Version Feb 2024 12 11 2023 Instruction 1120 F Schedule P Instructions for Schedule P Form 1120 F List of Foreign Partner Interests in Partnerships

Irs 1040 2024 Form

Irs 1040 2024 Form

Last quarterly payment for 2023 is due on Jan. 16, 2024. Taxpayers may need to consider estimated or additional tax payments due to non-wage income from unemployment, self-employment, annuity income or even digital assets. The Tax Withholding Estimator on IRS.gov can help wage earners determine if there's a need to consider an additional tax ... IR-2023-192, Oct. 17, 2023 — As part of larger transformation efforts underway, the Internal Revenue Service announced today key details about the Direct File pilot for the 2024 filing season with several states planning to join the innovative effort.

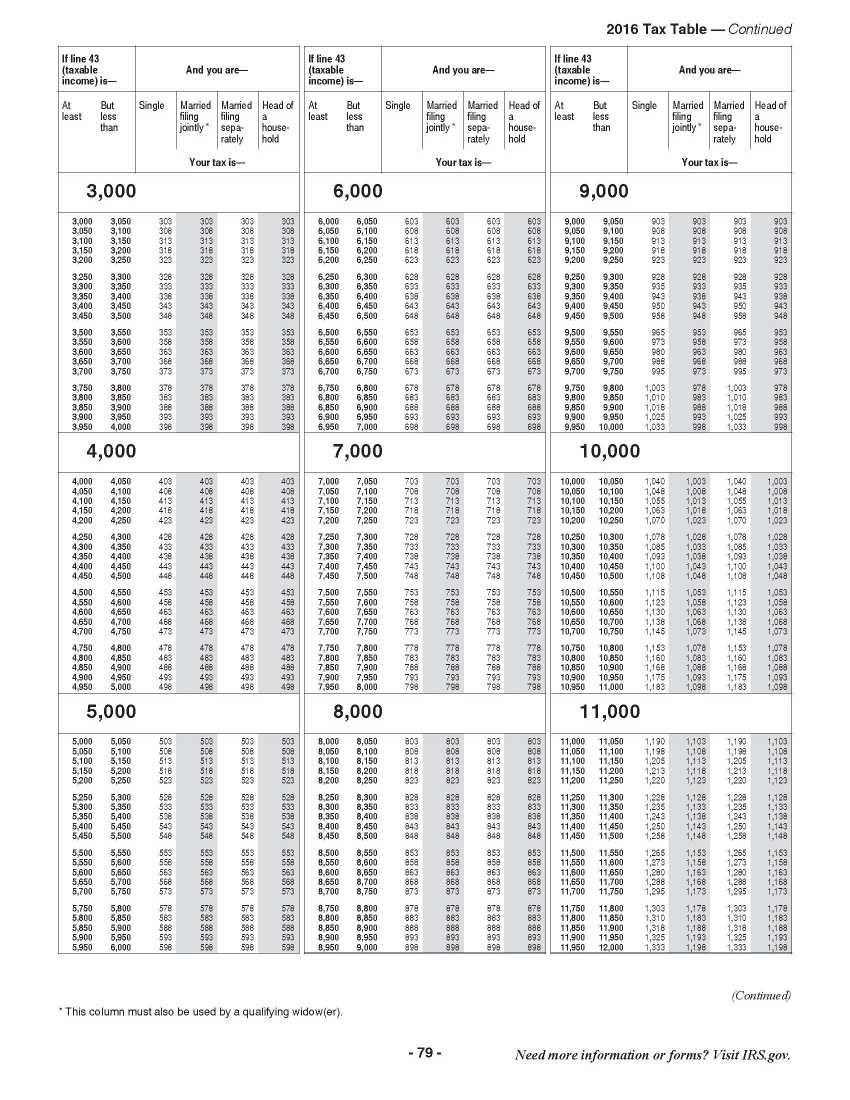

Draft Tax Forms Internal Revenue Service

IRS Form 1040 The CT Mirror

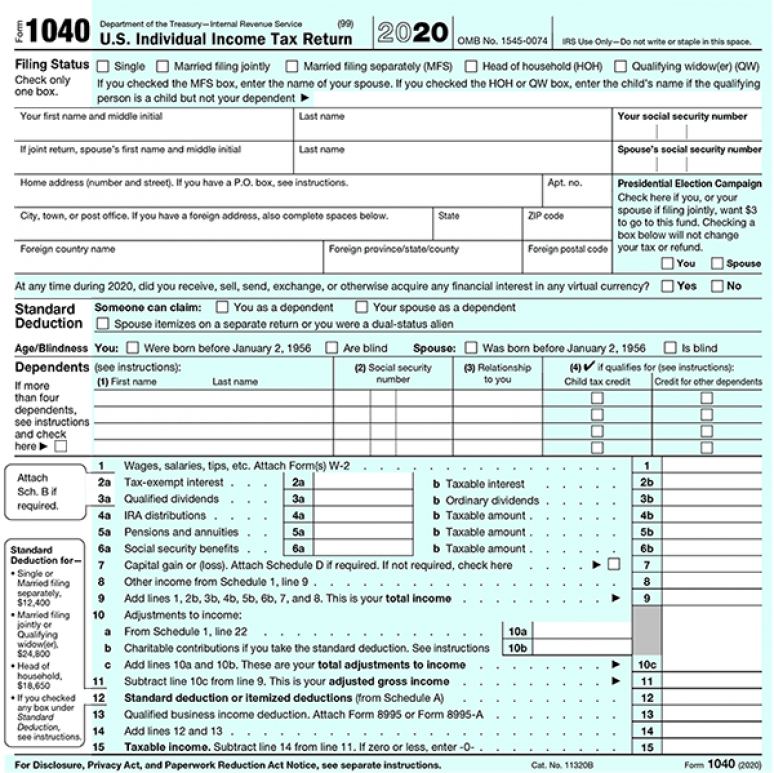

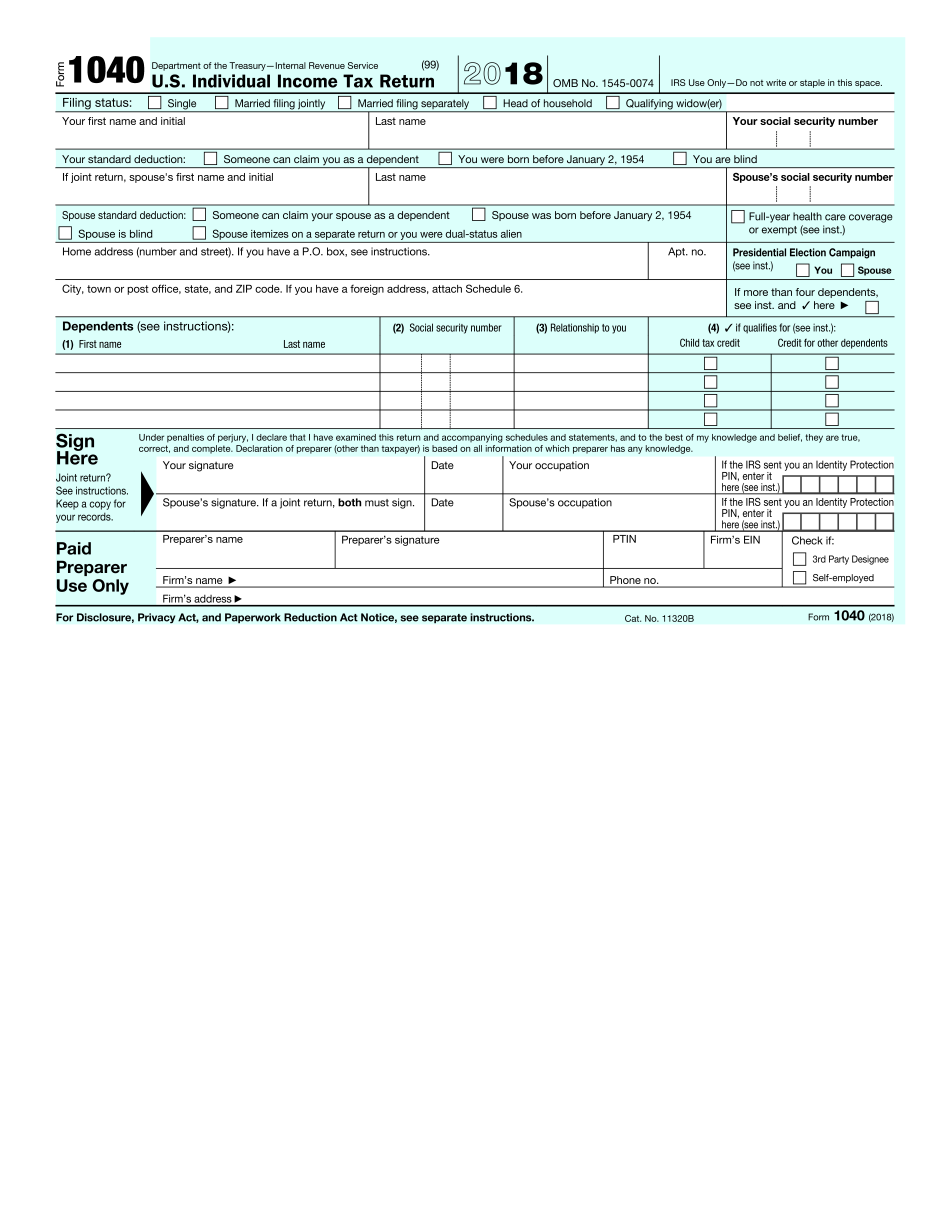

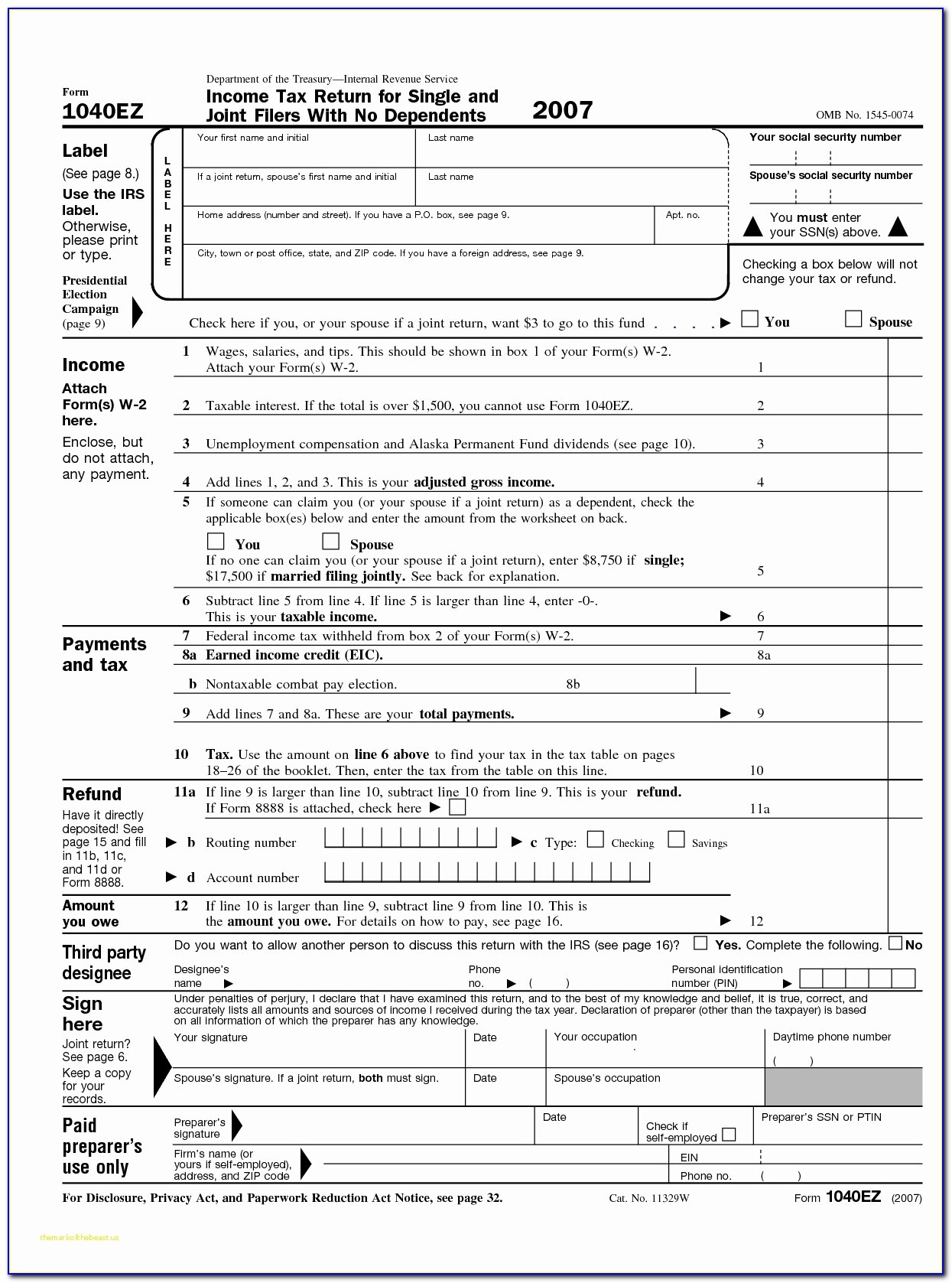

Irs 1040 2024 FormThere are two different types: Form 1040 and Form 1040-SR. Form 1040-SR is specifically designed for people 65 and over. Both forms calculate your taxable income, how much you should pay in taxes, and determine whether you are due a tax refund or owe the IRS. There are three schedules, or additional documents, that may need to be included with ... The Internal Revenue Service will soon release a comprehensive set of 1040 tax forms schedules and instructions for the tax year 2024 TRAVERSE CITY MI US November 27 2023 EINPresswire

Pay your estimated tax for 2023 using Form 1040-ES. You have until April 15 to file your 2023 income tax return (Form 1040 or Form 1040-SR). If you don't pay your estimated tax by Jan. 15, you must file your 2023 return and pay all tax due by March 1, 2024 to avoid an estimated tax penalty. Social Security, Medicare, and withheld income tax. IRS Form 1040 Download Fillable PDF Or Fill Online U S Individual Income Tax Return 2020 Form 1040 Instructions 2020

IRS advances innovative Direct File project for 2024 tax season free

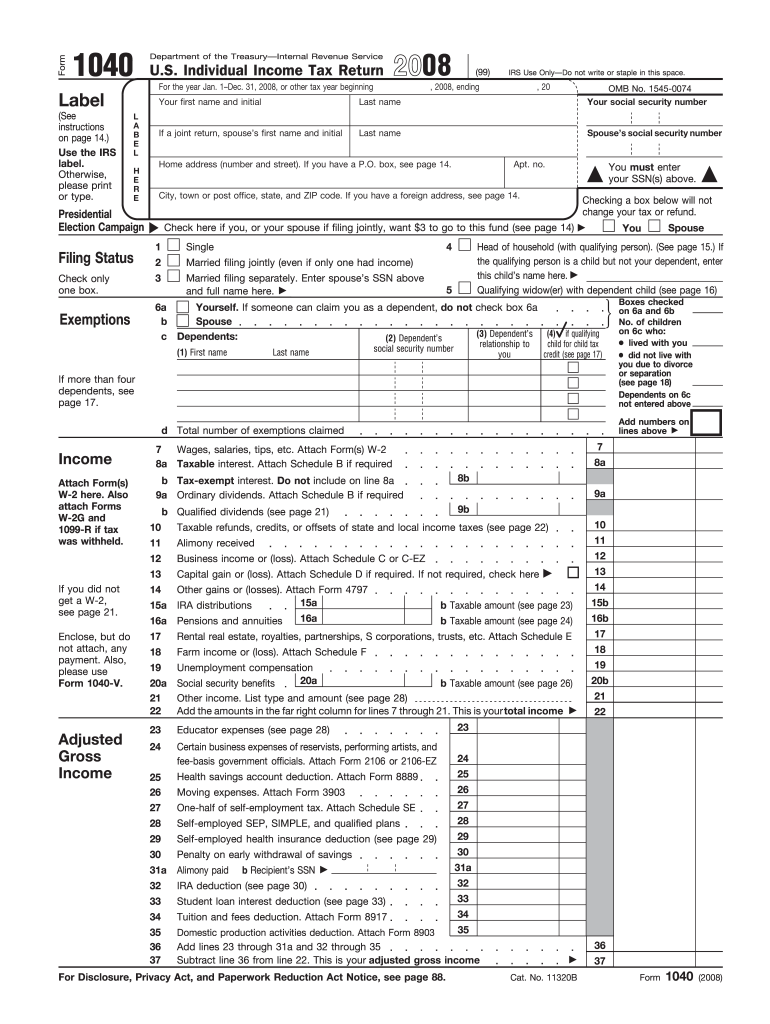

IRS 1040 2008 Fill Out Tax Template Online US Legal Forms

IR-2023-210, Nov. 13, 2023 — With the nation's tax season rapidly approaching, the Internal Revenue Service reminds taxpayers there are important steps they can take now to help "get ready" to file their 2023 federal tax return. 2019 Con Los Campos En Blanco IRS 1040 PR El Formulario Se Puede Rellenar En L nea Imprimir

IR-2023-210, Nov. 13, 2023 — With the nation's tax season rapidly approaching, the Internal Revenue Service reminds taxpayers there are important steps they can take now to help "get ready" to file their 2023 federal tax return. IRS 1040 2009 Fill And Sign Printable Template Online US Legal Forms IRS 1040 1999 Fill And Sign Printable Template Online US Legal Forms

2020 Tax Form 1040 U S Government Bookstore

File IRS 2290 Form Online For 2023 2024 Tax Period

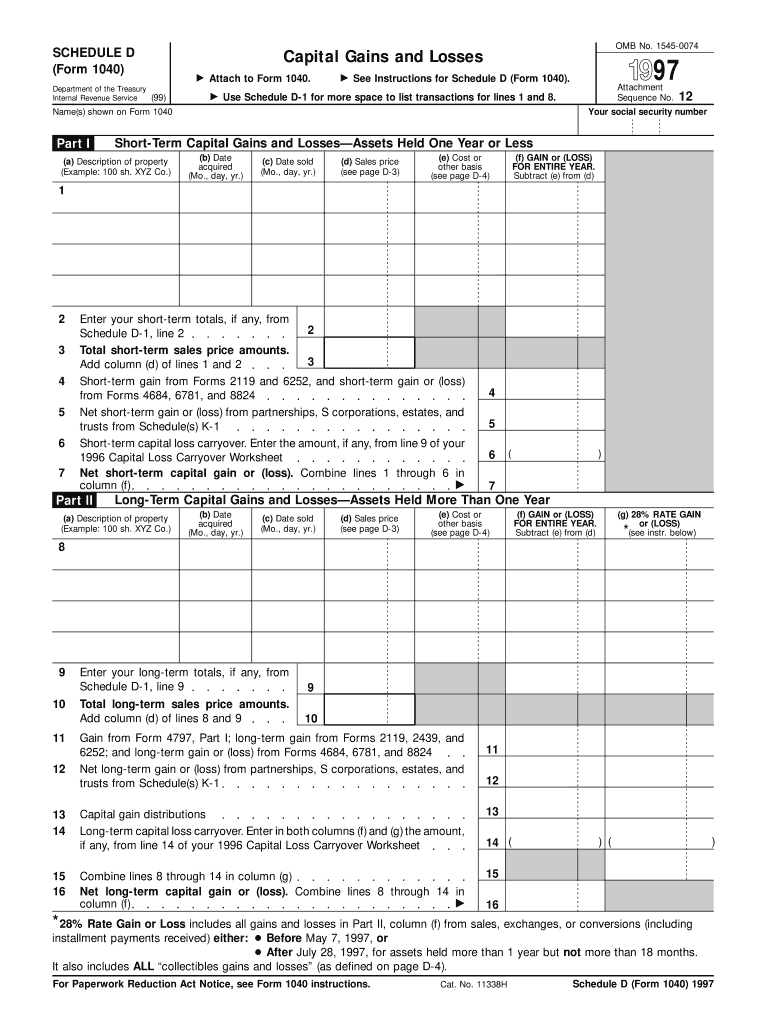

IRS 1040 Schedule D 1997 Fill Out Tax Template Online US Legal Forms

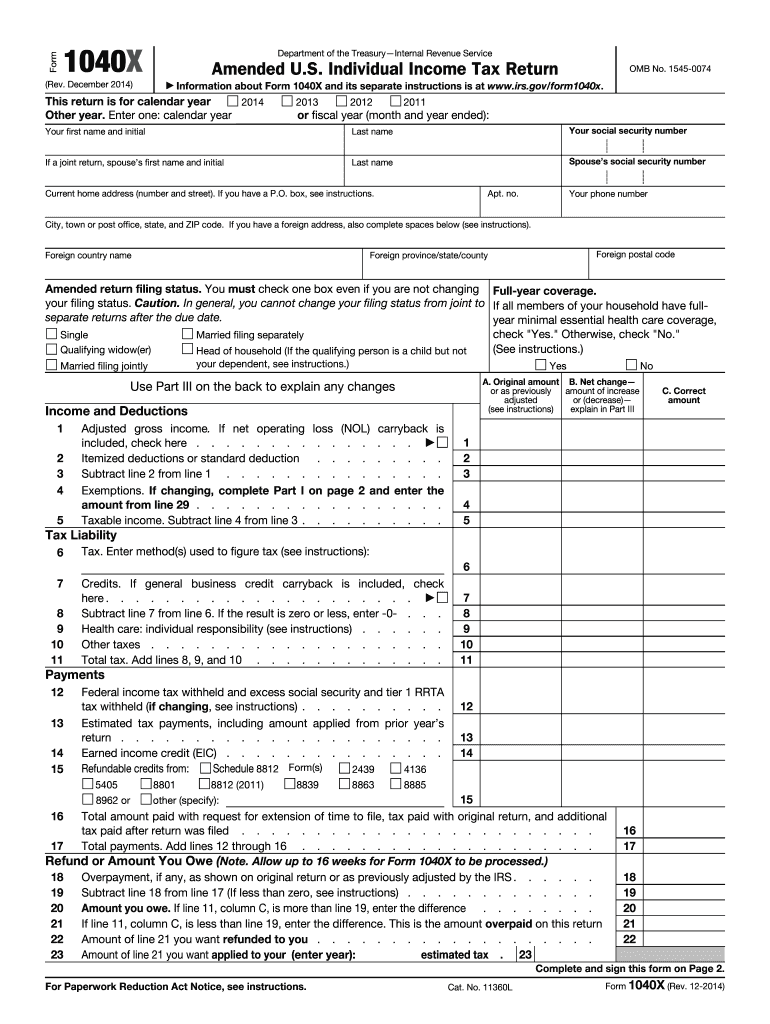

IRS 1040 X 2014 Fill And Sign Printable Template Online US Legal Forms

1040 Printable Tax Form

Free Printable Irs 1040 Forms Printable Free Templates Download

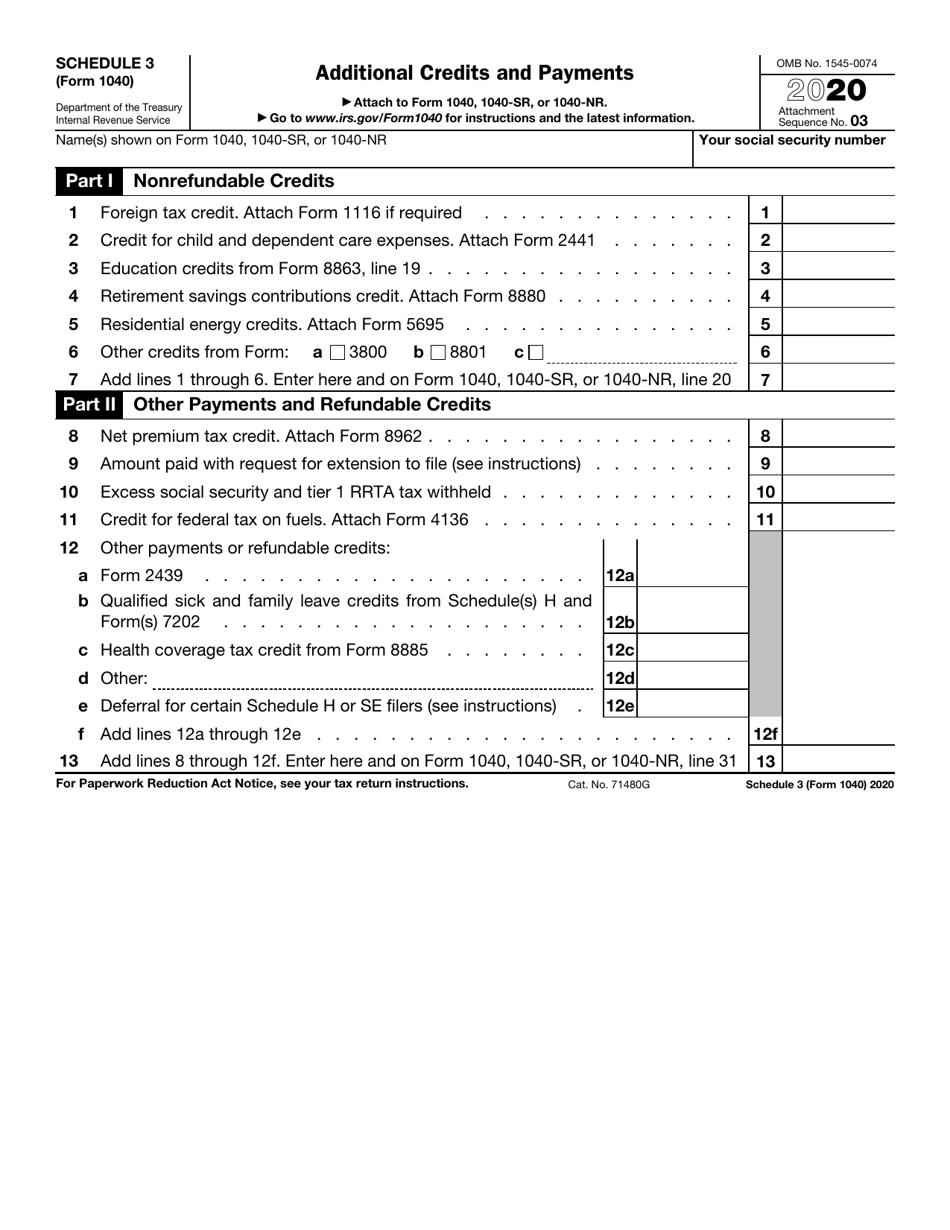

IRS Form 1040 Schedule 3 Download Fillable PDF Or Fill Online Additional Credits And Payments

2019 Con Los Campos En Blanco IRS 1040 PR El Formulario Se Puede Rellenar En L nea Imprimir

1040 ES Form 2021 1040 Forms

Irs Printable Form 1040 Printable Forms Free Online