Irs 1099 Form 2024

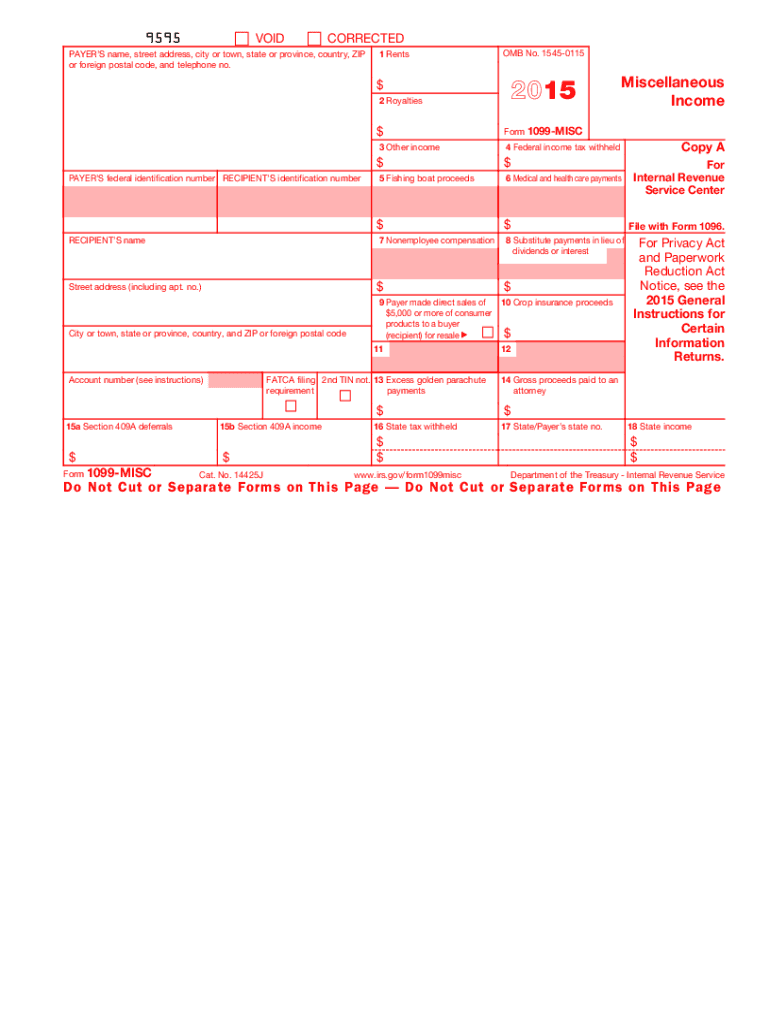

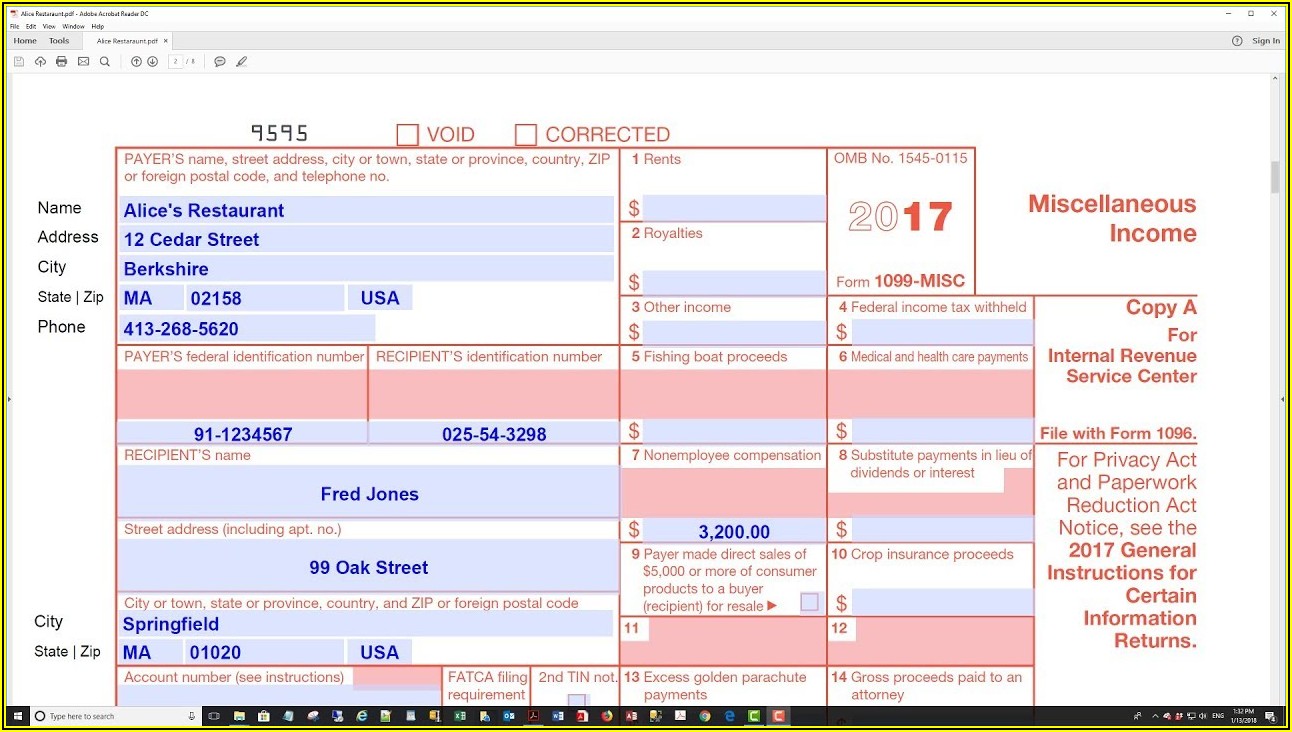

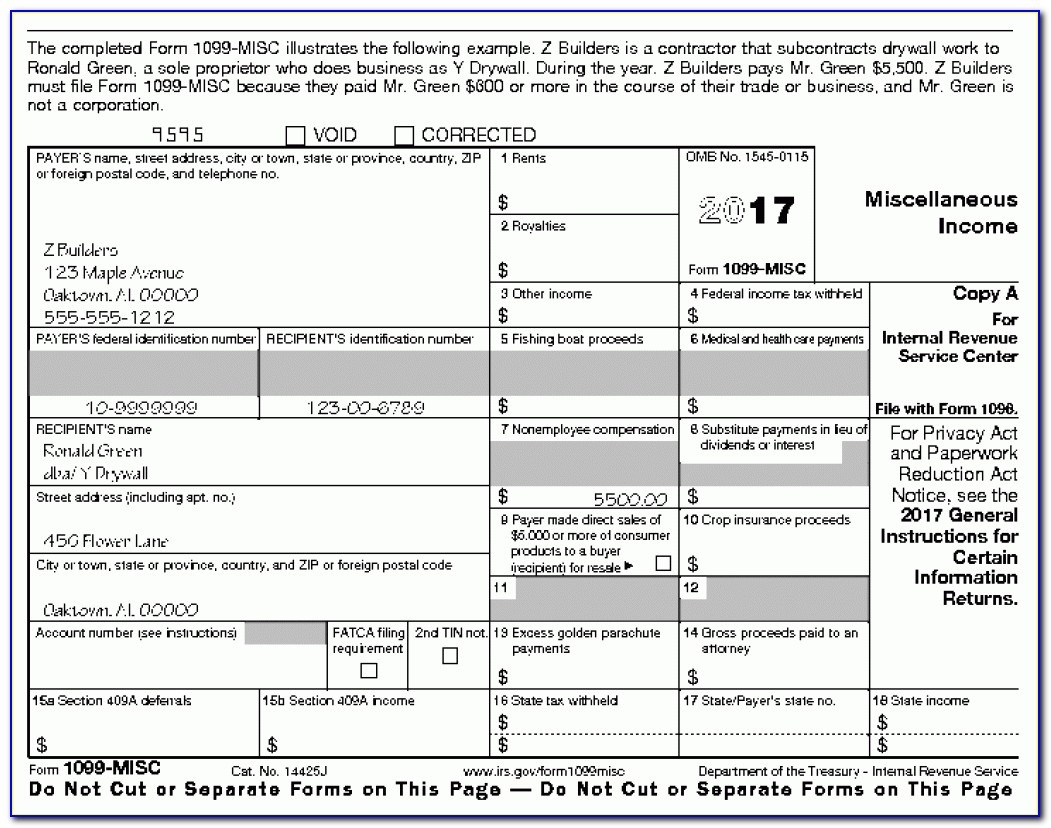

Irs 1099 Form 2024 - If you pay independent contractors you may have to file Form 1099 NEC Nonemployee Compensation to report payments for services performed for your trade or business File Form 1099 NEC for each person in the course of your business to whom you have paid the following during the year at least 600 in Beginning in 2024 for information returns filed for tax year 2023 including Forms 1099 MISC and 1099 NEC employers will have to file electronically if they file at least 10 information returns in a year Medlock said Currently employers do not have to file electronically unless they file at least 250 returns in a year

Irs 1099 Form 2024

Irs 1099 Form 2024

Electronically file any Form 1099 for free with the Information Returns Intake System (IRIS). Individual and bulk forms. File direct through the taxpayer portal or use software through IRIS Application to Application. Now that tax year 2023 is coming to a close, employers will be expected to fulfill their IRS requirements by the 2024 Form 1099 deadlines. 2024 Form 1099 Deadlines. As a best practice, we recommend getting started on your filings as early as possible. This ensures that you have ample time to collect the required information, complete the ...

IRS Makes Major Changes to Form 1099 Filing Reporting Rules

Tax Form Focus IRS Form 1099 R STRATA Trust Company

Irs 1099 Form 2024The deadline for distributing 1099s to vendors is Jan. 31, 2024. If you use paper 1099s, you must then file another information return, Form 1096, to transmit the 1099 information to the IRS by Feb. 28, 2024. If you use an authorized provider of electronic 1099 transmission, no Form 1096 is required and the due date for eFiling is March 31, 2024. WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season

IRS Postpones Implementation of $600 Form 1099-K Reporting Until 2024. On December 23, 2022, the IRS issued Notice 2023-10 delaying the implementation of new reporting requirements for electronic payment networks to report transactions over $600 to the IRS on a Form 1099-K, Payment Card and Third Party Network Transactions, until 2024. Irs Form 1099 K 2014 Form Resume Examples File IRS 2290 Form Online For 2023 2024 Tax Period

2024 Form 1099 Deadlines TY2023 The Boom Post

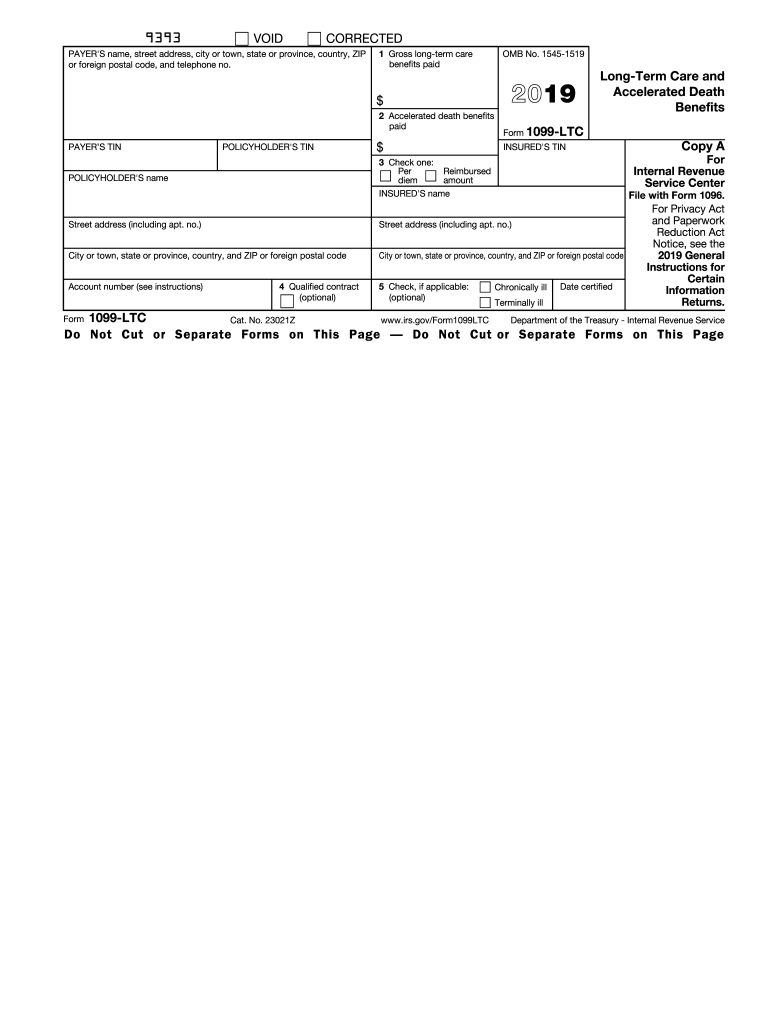

IRS 1099 LTC 2019 2022 Fill And Sign Printable Template Online US Legal Forms

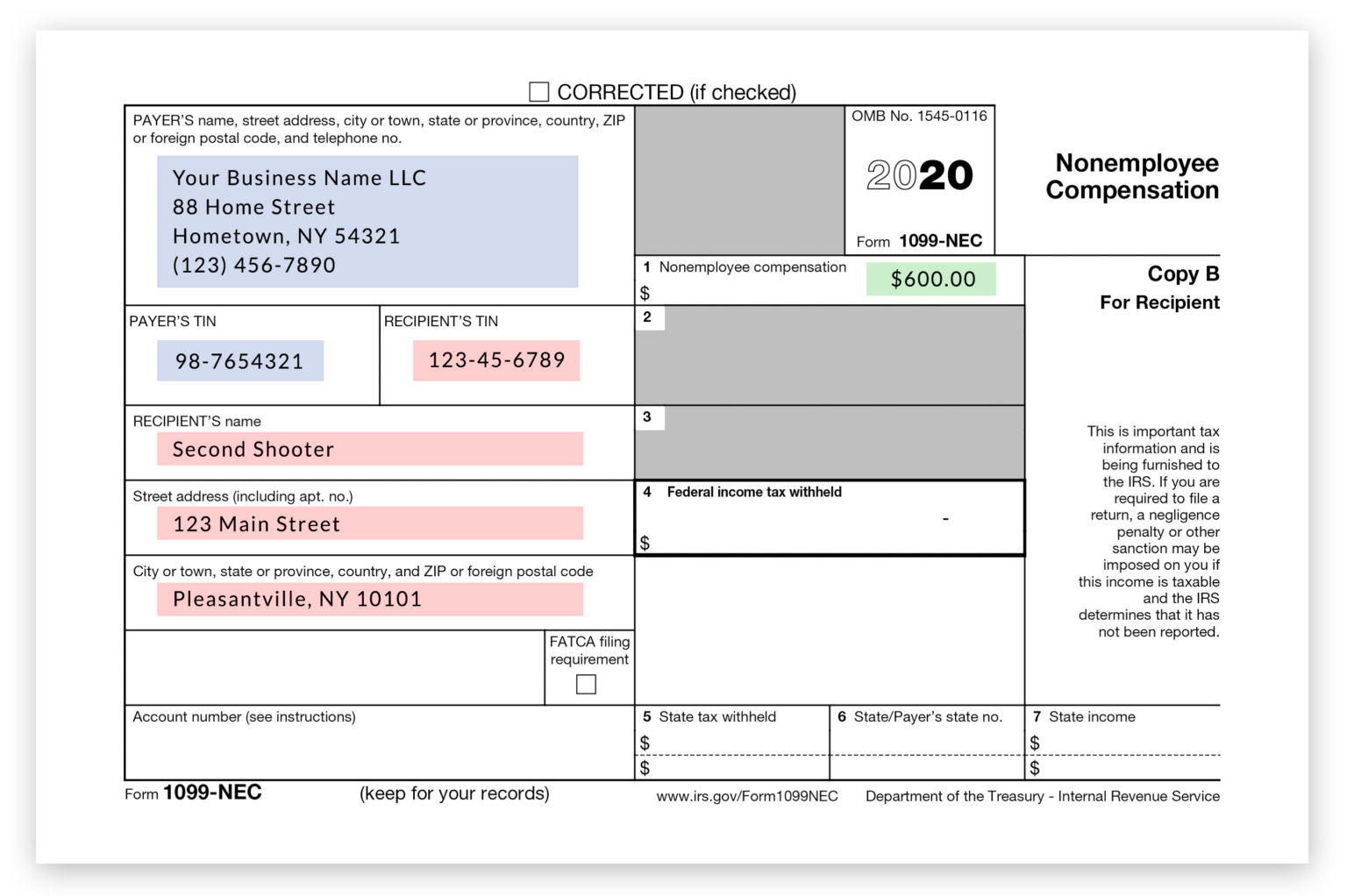

Penalties under IRC Section 6721 may apply for non-electronic filing of information returns (e.g., Forms W-2, 1099-series, etc.) when electronic filing is required. Such penalties may also apply for non-filing, late filing or incorrect information. The potential penalty in 2022 is up to $290 per Form W-2, up to an annual maximum of $3,532,500. The New 1099 NEC IRS Form For Second Shooters Independent Contractors formerly 1099 MISC

Penalties under IRC Section 6721 may apply for non-electronic filing of information returns (e.g., Forms W-2, 1099-series, etc.) when electronic filing is required. Such penalties may also apply for non-filing, late filing or incorrect information. The potential penalty in 2022 is up to $290 per Form W-2, up to an annual maximum of $3,532,500. IRS 1099 K 2020 Fill And Sign Printable Template Online US Legal Forms 1099 MISC Form 2023 2024

11 Common Misconceptions About Irs Form 11 Form Information Free Printable 1099 Misc Forms

Irs Form 1099 Misc Form Resume Examples dP9l7NZW2R

New IRS Form 1099 NEC Used To Report Payments To Nonemployee Service Providers

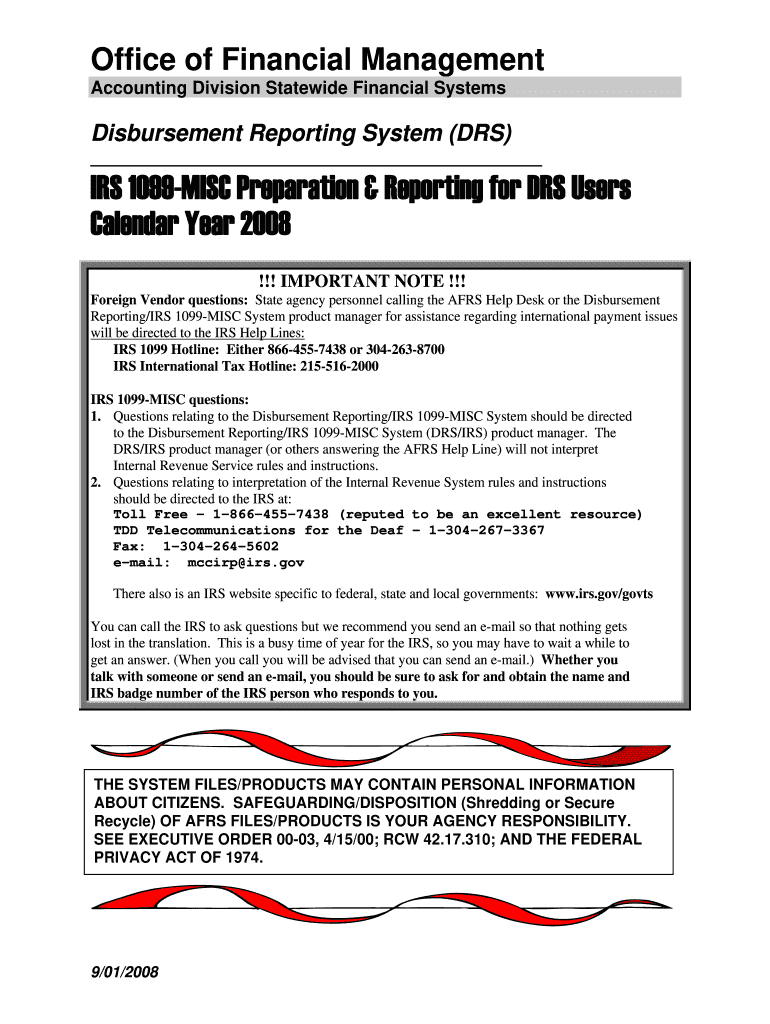

IRS 1099 MISC Preparation Reporting For DRS Users 2008 2021 Fill Out Tax Template Online

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

11 Common Misconceptions About Irs Form 11 Form Information Free Printable 1099 Misc Forms

Irs Form 1099 N Form Resume Examples

The New 1099 NEC IRS Form For Second Shooters Independent Contractors formerly 1099 MISC

1099 c Instructions 2020 185848 1099 C Instructions 2020

Irs 1099 Transmittal Form Form Resume Examples