Irs Form 1125 A 2024

Irs Form 1125 A 2024 - WASHINGTON The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business charitable medical or moving purposes Beginning on Jan 1 2024 the standard mileage rates for the use of a car also vans pickups or panel trucks will be IR 2023 242 Dec 15 2023 The Internal Revenue Service today reminded taxpayers who didn t pay enough tax in 2023 to make a fourth quarter tax payment on or before Jan 16 to avoid a possible penalty or tax bill when filing in 2024

Irs Form 1125 A 2024

Irs Form 1125 A 2024

This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season. The Get ready page on IRS.gov outlines steps taxpayers can take now to make filing easier in 2024. Here's what's new and what to consider before filing next year. IRS Online Account enhancements IRS provides tax inflation adjustments for tax year 2024 IR-2023-208, Nov. 9, 2023 WASHINGTON — The Internal Revenue Service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024, including the tax rate schedules and other tax changes.

IRS reminds taxpayers Jan 16 due date for final 2023 quarterly

How To Fill Out Form 1125 A Cost Of Goods Sold For 2022 YouTube

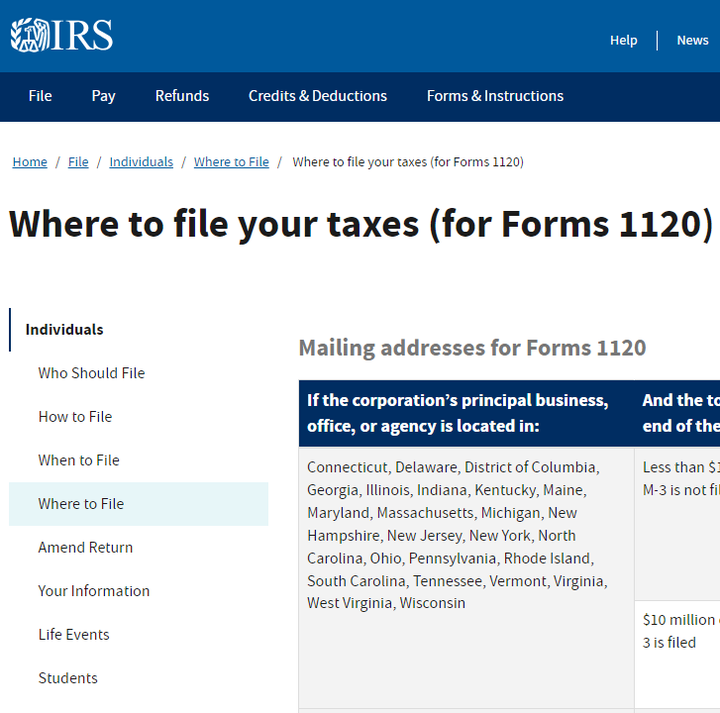

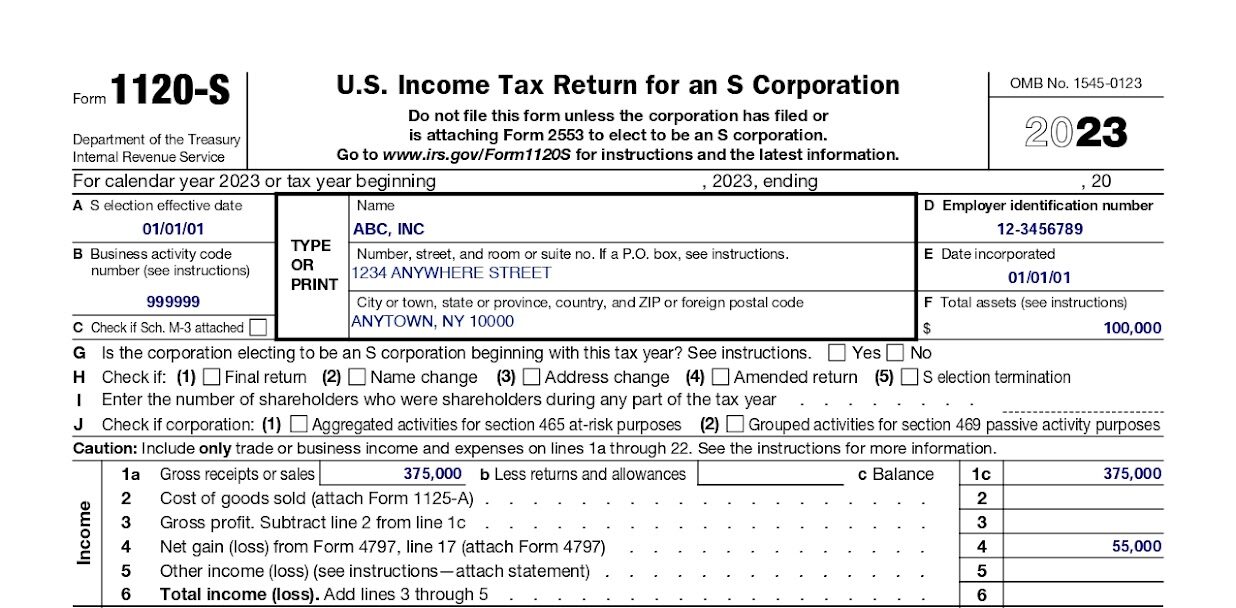

Irs Form 1125 A 2024Last quarterly payment for 2023 is due on Jan. 16, 2024. Taxpayers may need to consider estimated or additional tax payments due to non-wage income from unemployment, self-employment, annuity ... Home Forms and Instructions About Form 1125 A Cost of Goods Sold About Form 1125 A Cost of Goods Sold Filers of Form 1120 1120 C 1120 F 1120S 1065 or 1065 B complete and attach this form if they report a deduction for cost of goods sold Current Revision Form 1125 A PDF Recent Developments None at this time Other Items You May Find Useful

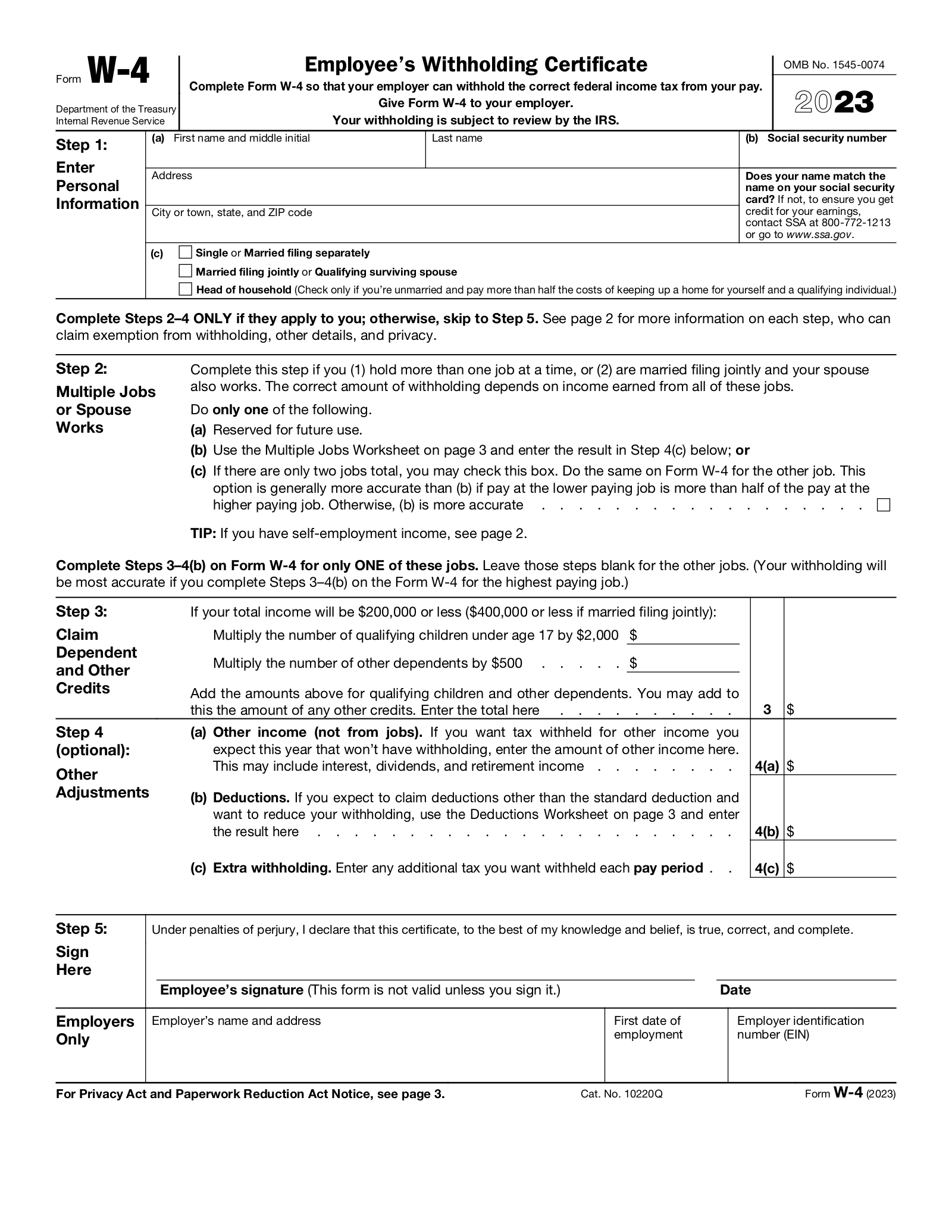

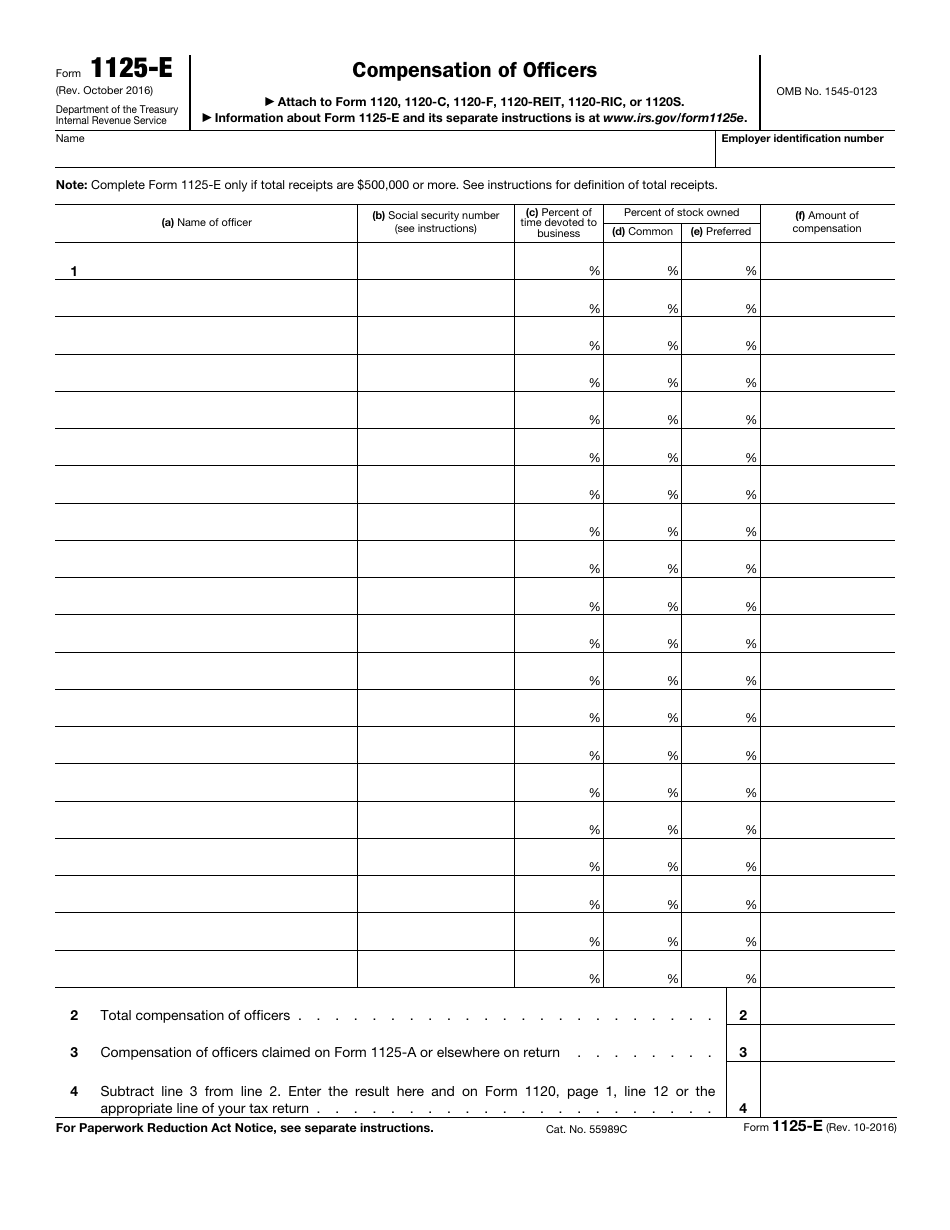

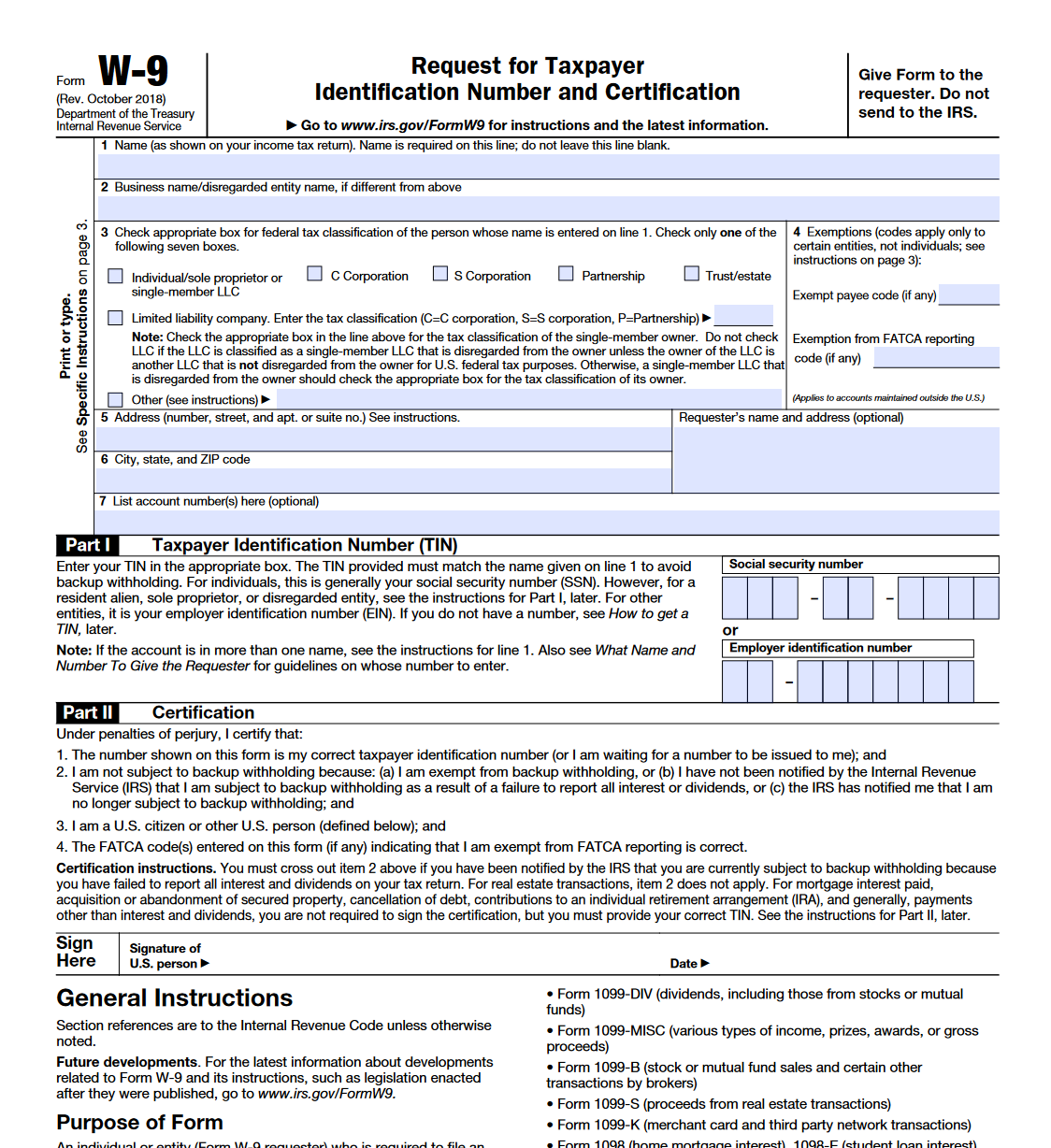

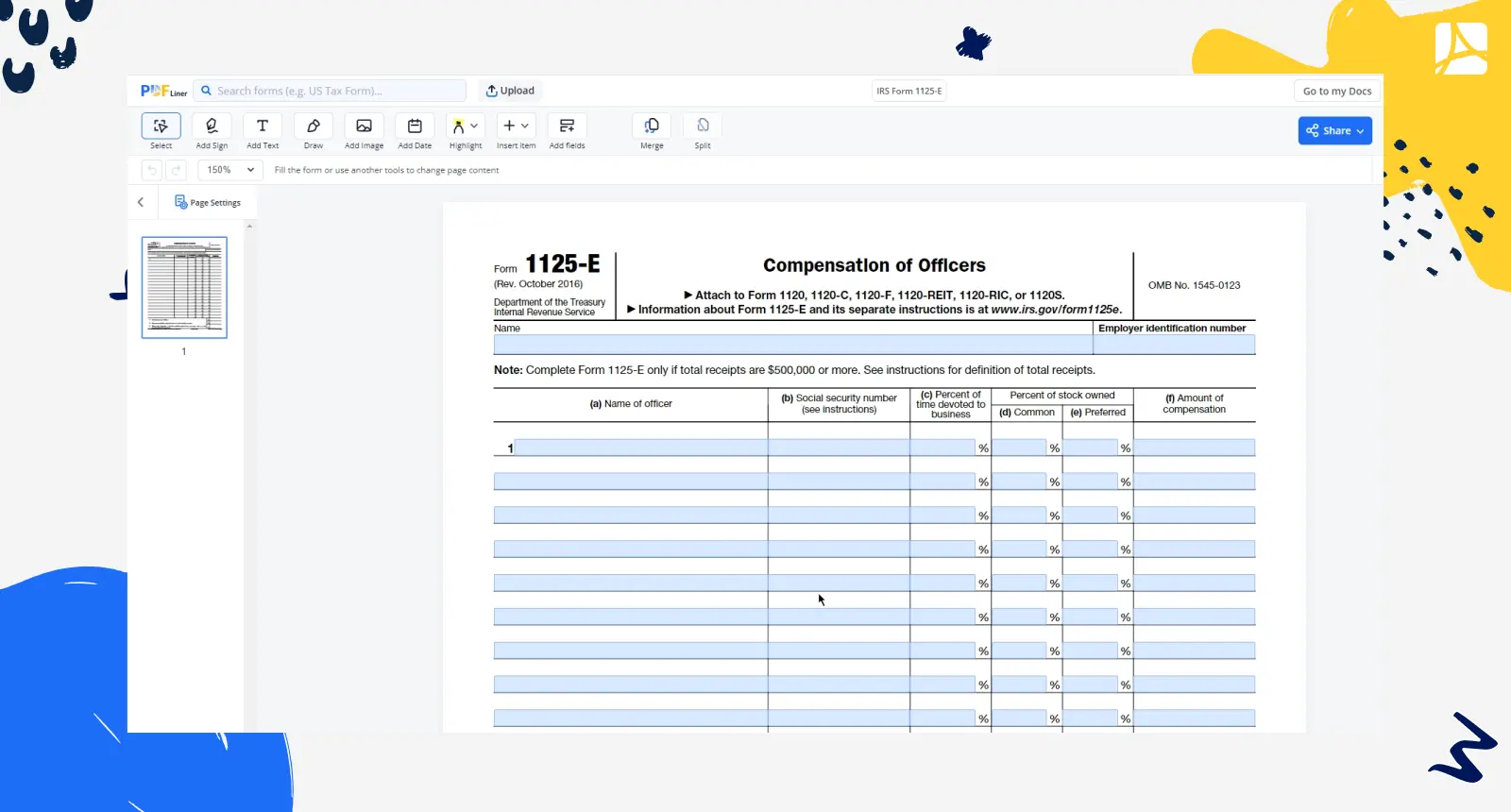

Overview. On December 12, 2023, the Internal Revenue Service (IRS) posted the 2024 version of Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions. Form W-4R, mandatory to use for many IRA distributions taken in 2023 and later, brought significant changes to the federal income tax withholding process. What Is Form 1125 E Example What Is Form 1125 E Example

IRS provides tax inflation adjustments for tax year 2024

LLC Form1120 Form5472

The standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased $900 from the previous year and rose to $13,850 ($27,700 for those married filing jointly). While for heads of households, the standard deduction will be $20,800, up $1,400. IRS Form 1125 E Printable IRS Form 1125 E Sign Online PDFliner

The standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased $900 from the previous year and rose to $13,850 ($27,700 for those married filing jointly). While for heads of households, the standard deduction will be $20,800, up $1,400. Irs Form 941 2024 Ora Lavena What Is Form 1125 A Example

Form 1125 E Instructions 2024 2025

Irs Forms 2024 Kip Rosene

Irs W4 Form 2025 Lachlan Asche

EN 1125 EN 179

EN 1125 EN 179

W9 Forms 2024 Aarika Anabelle

How Form 1125 E Can Help You Avoid IRS Accuracy Related Penalties

IRS Form 1125 E Printable IRS Form 1125 E Sign Online PDFliner

What Is Form 1125 A Example

What Is Form 1125 E Example