Irs Form 4868 2024

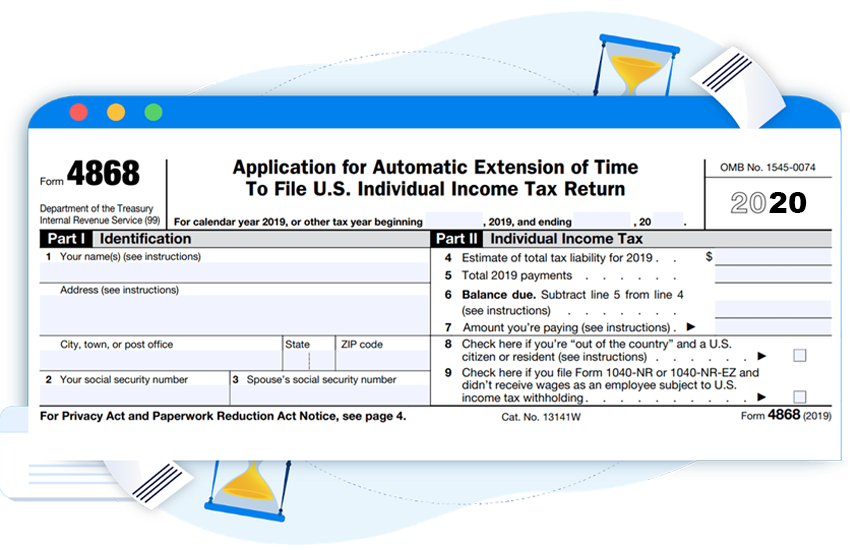

Irs Form 4868 2024 - IRS Form 4868 also known as an Application for Automatic Extension of Time to File U S Individual Income Tax Return is a form that taxpayers can file with the IRS if they need more In 2024 individuals filing taxes for the 2023 tax year can avail of the Earned Income Tax Credit EITC which ranges from 600 to 7 430 The amount eligible for this credit is determined by income level number of dependents and tax filing status If individuals do not have qualifying children they must be between the ages of 25 and 65 to

Irs Form 4868 2024

Irs Form 4868 2024

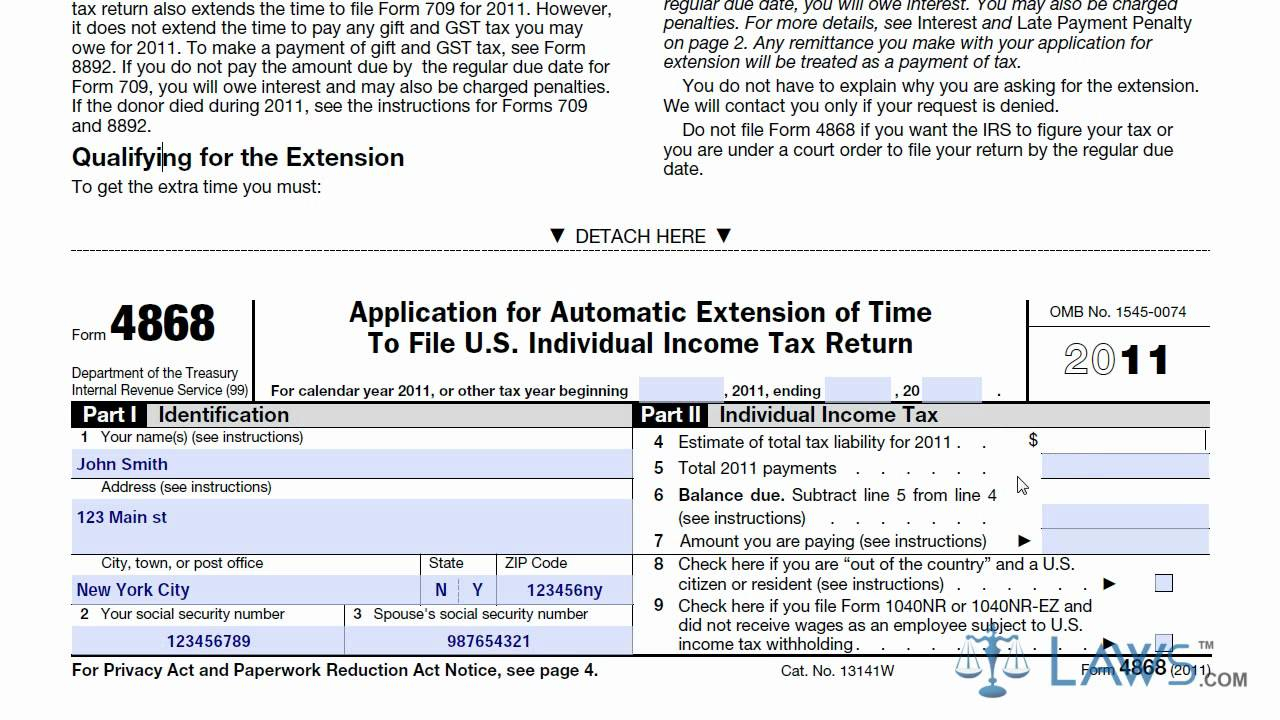

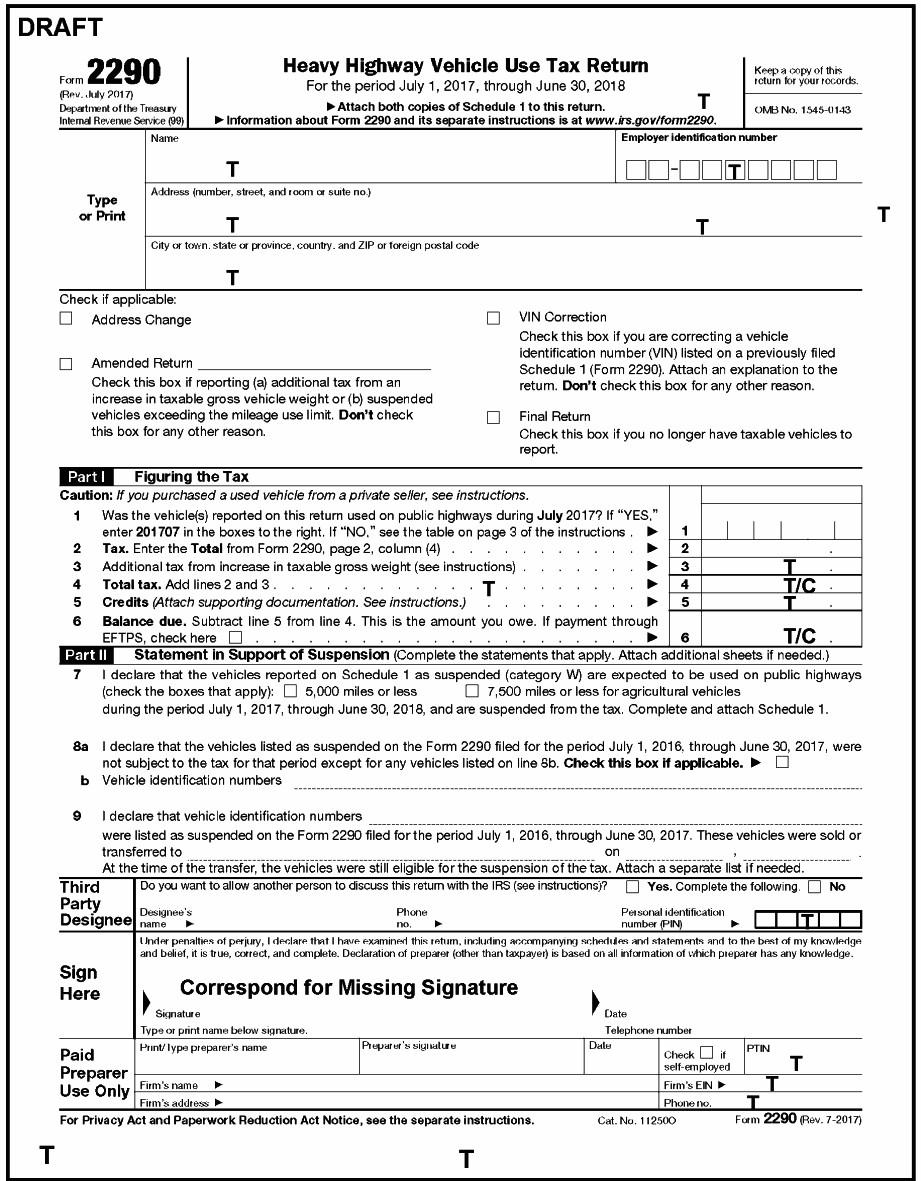

Estimated 2024 IRS Income Tax Return Chart. If the IRS Accepts an E-Filed Return By: Then Direct Deposit refund may be sent as. early as 10 days after e-file received. (Paper check mailed sent apx ... A tax extension is a request for additional time to file your federal income tax return with the IRS. Tax extensions can help you avoid incurring a late-filing penalty. You can submit Form 4868 to ...

2024 Tax Filing PriorTax Blog

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Irs Form 4868 2024The deadline for 2023 taxes is April 15, 2024, with an optional extension until Oct. 15, 2024. ... Internal Revenue Service. "Form 4868, Application for Automatic Extension of Time to File U.S ... Form 4868 Application for Automatic Extension of Time To File U S Individual Income Tax Return Individual tax filers regardless of income can use IRS Free File to electronically request an automatic tax filing extension Special rules may apply if you are Serving in a combat zone or a qualified hazardous duty area

Published: Dec 15, 2023 9 min read SHARE Shutterstock Tax Day may feel eons away, but April has a tendency to sneak up on even the savviest of taxpayers. There are several important dates Americans should be aware of in 2024. Form 4868 Deadline Is Approaching File Today To Get 6 months Extension 4868extension Irs Tax Extension Form 4868

Tax Extension What It Is and How to File One NerdWallet

Form 4868 Printable

WASHINGTON — The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning on Jan. 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 4868 Form 2023 2024 IRS Forms TaxUni

WASHINGTON — The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning on Jan. 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: Irs Tax Extension Form 4868 IRS Personal Extension Tax Form 4868 Online Reporting Taxgarden

How To File An IRS Tax Extension Online A Step by Step Guide Pullce Platform

IRS File For Tax Extension How To Apply And Where To Apply To IRS Form 4868 AS USA

Know About IRS Tax Extension Form 4868 TaxEz

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

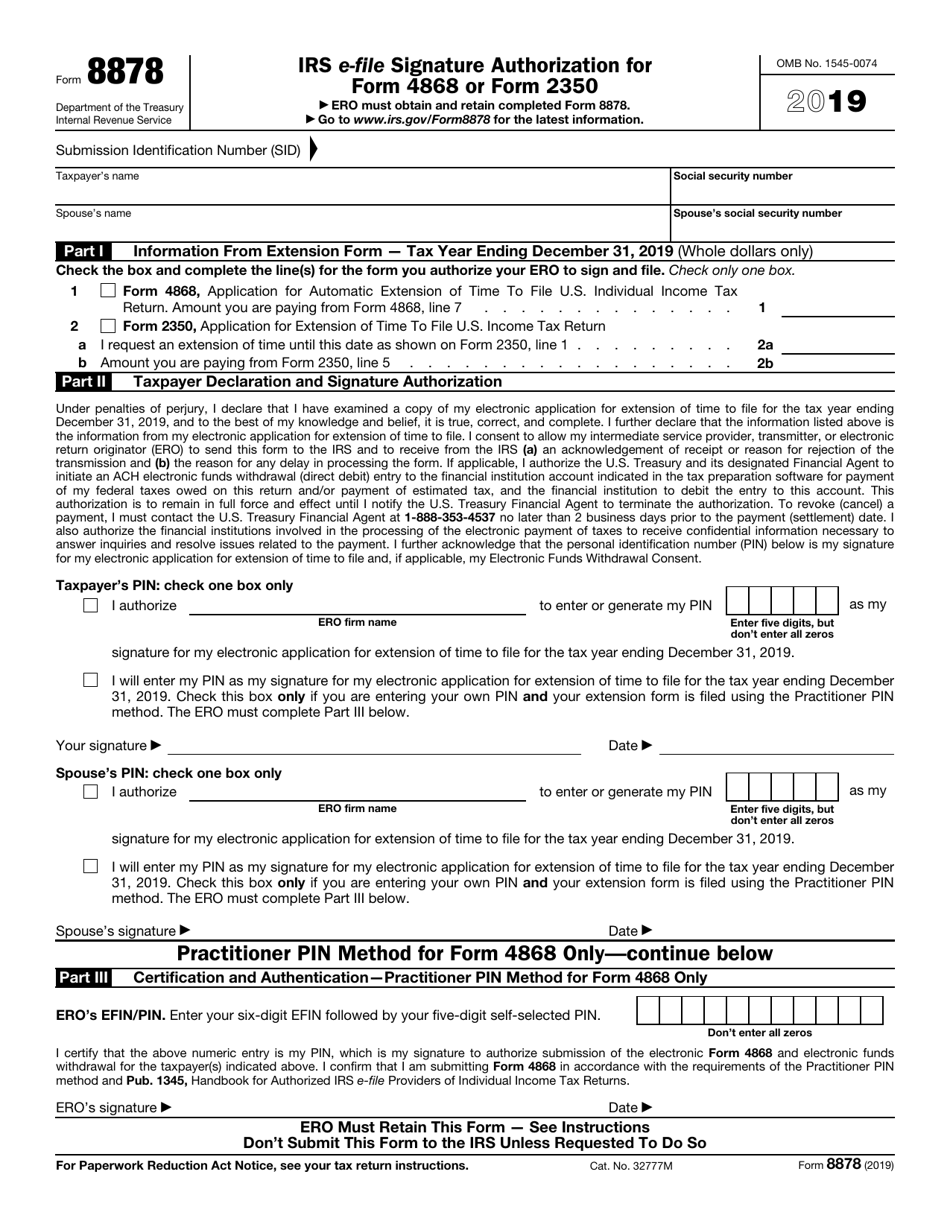

IRS Form 8878 Download Fillable PDF Or Fill Online IRS E File Signature Authorization For Form

File IRS Form 4868 Online E File IRS 4868 For 2022 Tax Year

E File IRS Form 4868 File Personal Tax Extension Online

4868 Form 2023 2024 IRS Forms TaxUni

Printable Business Irs Extension Form Printable Forms Free Online

U S TREAS Form Treas irs 4868 2000