Irs Tax Forms 2024

Irs Tax Forms 2024 - The tax year 2024 adjustments described below generally apply to income tax returns filed in 2025 The tax items for tax year 2024 of greatest interest to most taxpayers include the following dollar amounts The standard deduction for married couples filing jointly for tax year 2024 rises to 29 200 an increase of 1 500 from tax year 2023 Taxpayers should gather Forms W 2 Wage and Tax Statement Forms 1099 MISC Miscellaneous Information and other income documents before filing their return Don t forget to notify the IRS of an address change and be sure to notify the Social Security Administration of any legal name changes as soon as possible

Irs Tax Forms 2024

Irs Tax Forms 2024

The Internal Revenue Service will soon release a comprehensive set of 1040 tax forms, schedules, and instructions for the tax year 2024. TRAVERSE CITY, MI, US, November 27, 2023 / EINPresswire.com ... Furnish copies of Form W-2 for 2023 to employees and file Copy A with the Social Security Administration. Furnish Form 1099-NEC information returns for 2023 to payees of nonemployee compensation and file returns with the IRS. File Form 945, Annual Return of Withheld Federal Income Tax, for 2023 to report income tax withheld on non-payroll items.

Tax season rapidly approaching Get ready now to file 2023 federal

W 9 Form 2023 Michigan Printable Forms Free Online

Irs Tax Forms 2024The IRS will meet the second goal of the Paperless Processing Initiative by the start of Filing Season 2024 by providing the option for taxpayers to e-File 20 additional tax forms, enabling up to 4 million additional tax documents to be digitally filed every year. This includes amendments to Forms 940, 941, 941-SS and 941(PR), which are some of ... Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

IR-2023-87, April 18, 2023. WASHINGTON — The Internal Revenue Service today suggested taxpayers who filed or are about to file their 2022 tax return use the IRS Tax Withholding Estimator to help update the amount of tax to have taken out of their 2023 pay.. The IRS says now is a good time to use this online tool. Irs Form W 4V Printable IRS W 4T PDFfiller The Internal Revenue Service Announced That It IRS Form 1120S Small Corporation Income Tax Return Editorial Stock Image Image Of

January 2024 tax and compliance deadlines Tax Pro Center Intuit

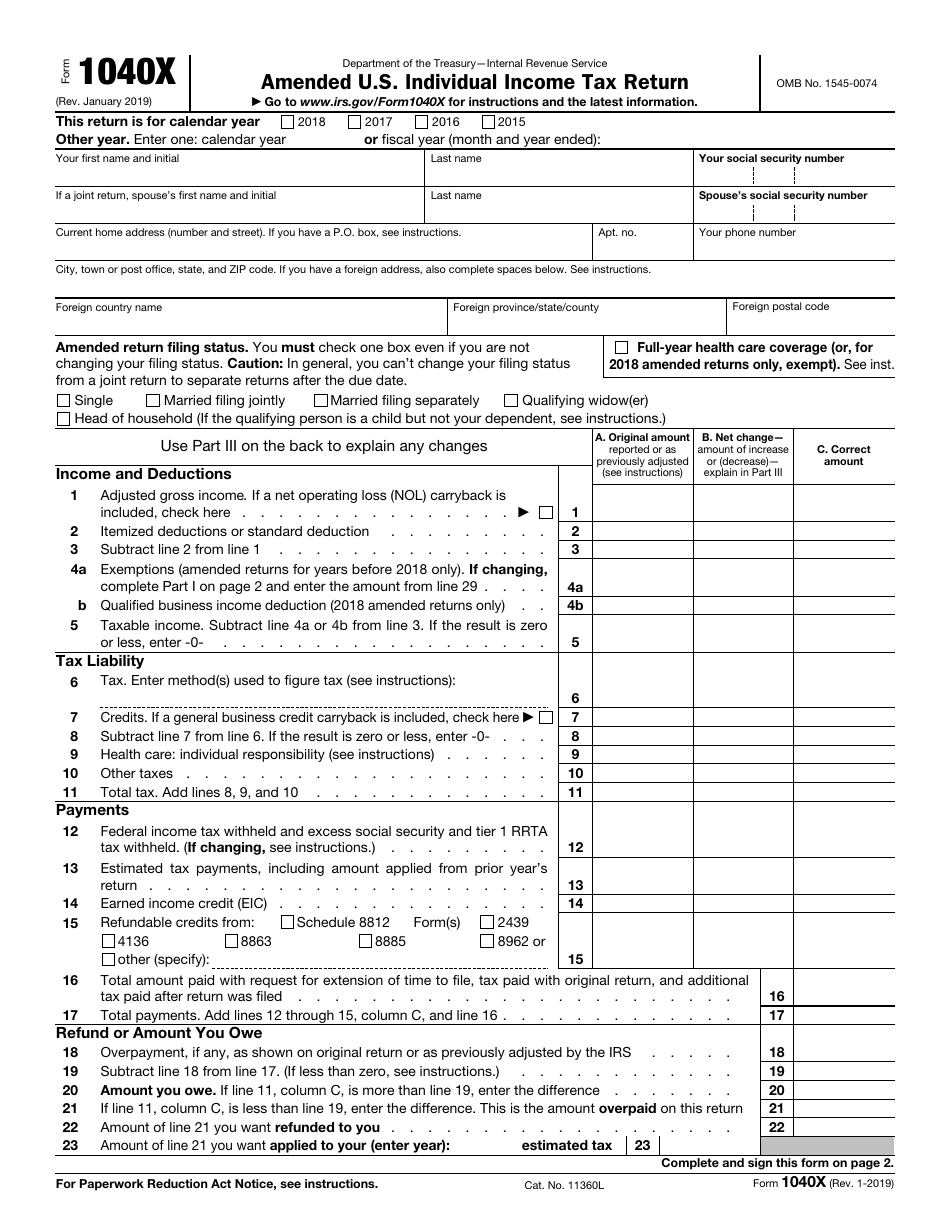

IRS Form 1040X Fill Out Sign Online And Download Fillable PDF Templateroller

IRS Form Updates and Threshold Adjustments. : The threshold for mandatory electronic filing has been significantly reduced. Starting January 1, 2024, entities with 10 or more forms in total ... 10 Most Common IRS Tax Forms Explained

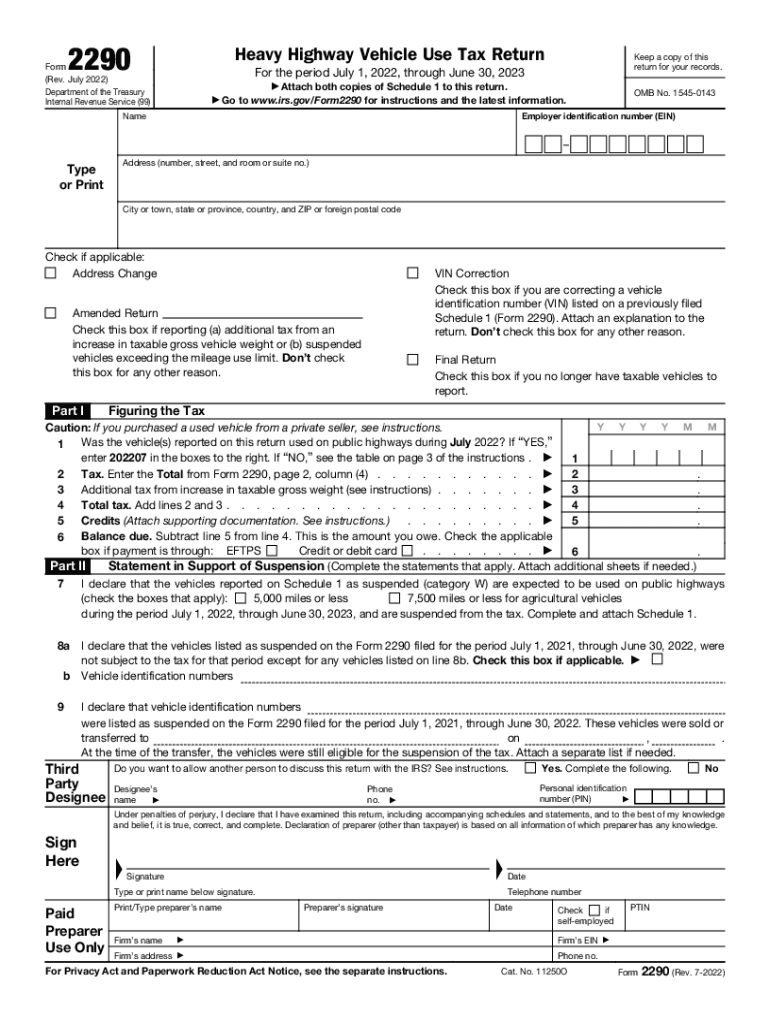

IRS Form Updates and Threshold Adjustments. : The threshold for mandatory electronic filing has been significantly reduced. Starting January 1, 2024, entities with 10 or more forms in total ... How To File Form 2290 Electronically For The Tax Year 2021 2022 By Form 2290 Filing Issuu Irs Tax Form 1040 E File TAXP

File IRS 2290 Form Online For 2023 2024 Tax Period

Gov Irs 2022 2023 Form Fill Out And Sign Printable PDF Template SignNow

IRS 1120 2020 Fill Out Tax Template Online US Legal Forms

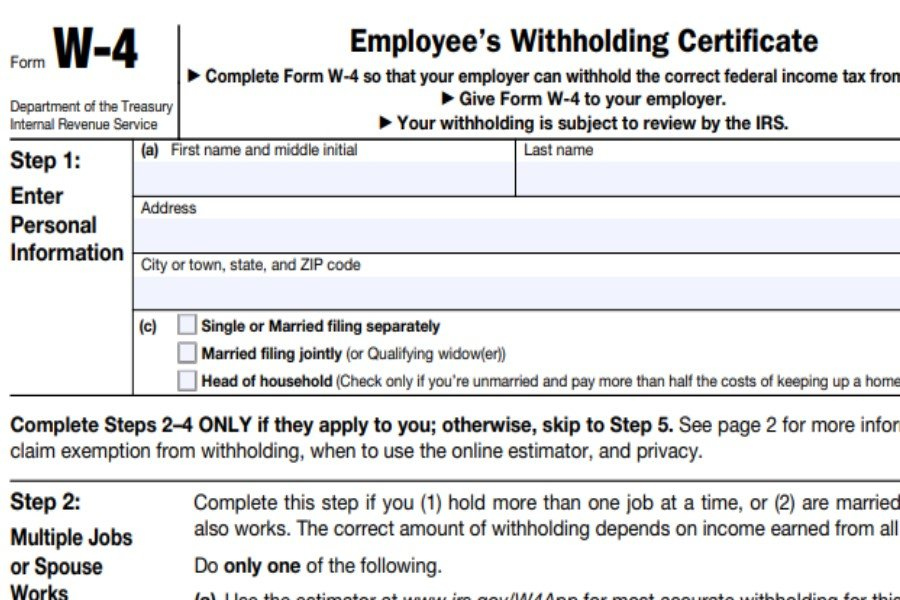

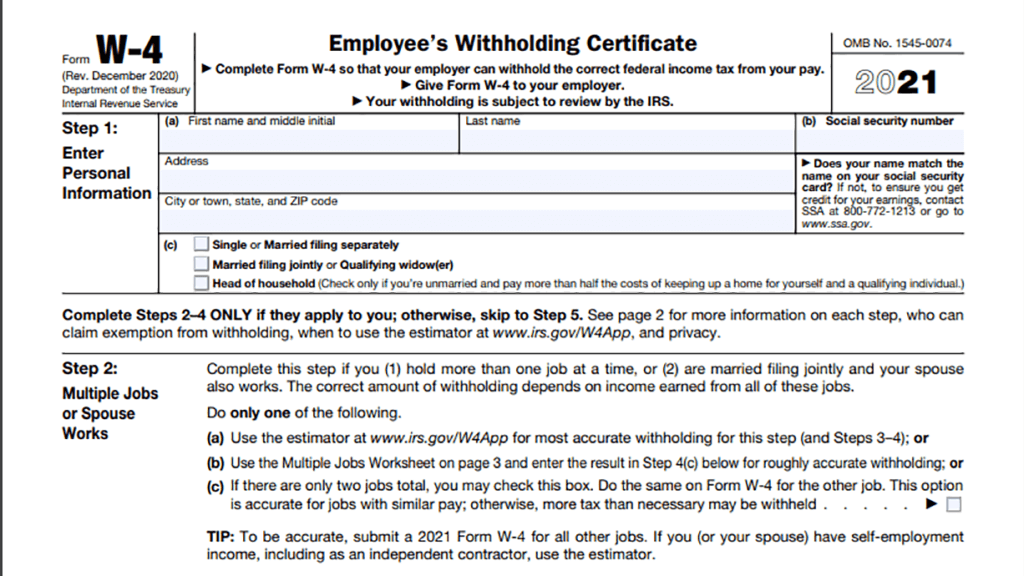

Form W 4 Employee S Withholding Allowance Certificate South Carolina Vrogue

Financial Irs Tax Return Forms Stock Photo Download Image Now IStock

IRS Tax Forms In Stock

IRS Form 656 The Offer In Compromise Application Lake Placid New York Global Gate IRS Tax

10 Most Common IRS Tax Forms Explained

What You Should Know About The New Form W 4 Atlantic Payroll Partners

A Tax Form Is Shown With The Text Choose File It s Fast Easy And Safe