Mortgage Default Insurance Canada

Mortgage Default Insurance Canada - Jan 8 2025 nbsp 0183 32 Bank of Canada has lowered its lending rate to 3 25 by end of 2024 In 2025 which type of mortgage are people choosing for their primary residence 1 collateral 2 Collateral is money or property which is used as a guarantee that someone will repay a loan A mortgage is a loan of money which you get from a bank or building society in order to buy a house

Mortgage Default Insurance Canada

Mortgage Default Insurance Canada

Dec 29, 2024 · Ah, okay. That sounds like your mortgage is readvanceable. It's a weird way for BMO to market it by calling what are essentially mortgage prepayments, your mortgage overpayments, as a "cash account" of your mortgage, it's almost like they are inviting you to get back on track with your original amortization and readvance those balances. Oct 30, 2018 · Manulife One Vs. Traditional Bank Mortgage Good morning all, Just wanted to know what you all thought of Manulife one. I've been doing quite a bit of research and I think I get the whole concept but aren't sure what the real advantages are. Rates seem to be higher (as they charge prime + 0.5) and you have to pay their monthly fee of around 14-15$.

mortagage collateral

Default Overview Assessment And Key Factors YouTube

Mortgage Default Insurance Canada4 days ago · Fixed Mortgage Rates Have Been Increasing There is now significiant upward pressure on fixed rates given that bond yields spiked up sharply last week. Multiple lenders have already increased their fixed rates. Note that fixed rate movement and the Bank of Canada decision expected on Wednesday are two different things. Oct 12 2006 nbsp 0183 32 Real Estate For discussions on Real Estate Mortgages HELOCs and more

Jul 21, 2025 · Hi, I'm looking for a 5 year variable rate mortgage renewal. -How much is the mortgage owing? 395,000 -Roughly, what is the current market value of the property? $1.3M -Which city is the property located in? Mississauga -Is the property owner-occupied or a rental? Owner occupied -Who is your current lender? TD -Do you have a HELOC tied to the ... Lucas Mathieu Mortgage Tech Default Insurance Is Mandatory For All Lucas Mathieu Mortgage Tech Default Insurance Is Mandatory For All

Manulife One Vs Traditional Bank Mortgage RedFlagDeals

Mortgage Default Insurance YouTube

Mar 15, 2024 · Mortgage As a newcomer, I don’t have an income and credit history yet. What is the rate for me in this situation? The property costs 540k, a downpayment of 20%, Calgary, owner-occupied. Please provide recommendations. Thank you Last edited by Mmaiken on Mar 15th, 2024 4:35 pm, edited 1 time in total. Mortgage Default Insurance Lender Crate

Mar 15, 2024 · Mortgage As a newcomer, I don’t have an income and credit history yet. What is the rate for me in this situation? The property costs 540k, a downpayment of 20%, Calgary, owner-occupied. Please provide recommendations. Thank you Last edited by Mmaiken on Mar 15th, 2024 4:35 pm, edited 1 time in total. Mortgage Default Insurance In 2020 Mortgage Info Mortgage Payment Chapter 12 Closing And Insurance Ppt Download

Mortgage Default Insurance In Vancouver B C YouTube

How Does Mortgage Default Insurance Work CHMC Sagen Canada

HOW MORTGAGES WORKS IN CANADA MORTGAGE EXPLAINED BASICS TERMS

Mortgage Default Insurance In Canada YouTube

Mortgage Default Insurance And What To Say When You Call 2017 06 06 By

Mortgage Brokers Ottawa Mortgage Brokers City

Make Smarter Decisions CanWise Financial

Mortgage Default Insurance Lender Crate

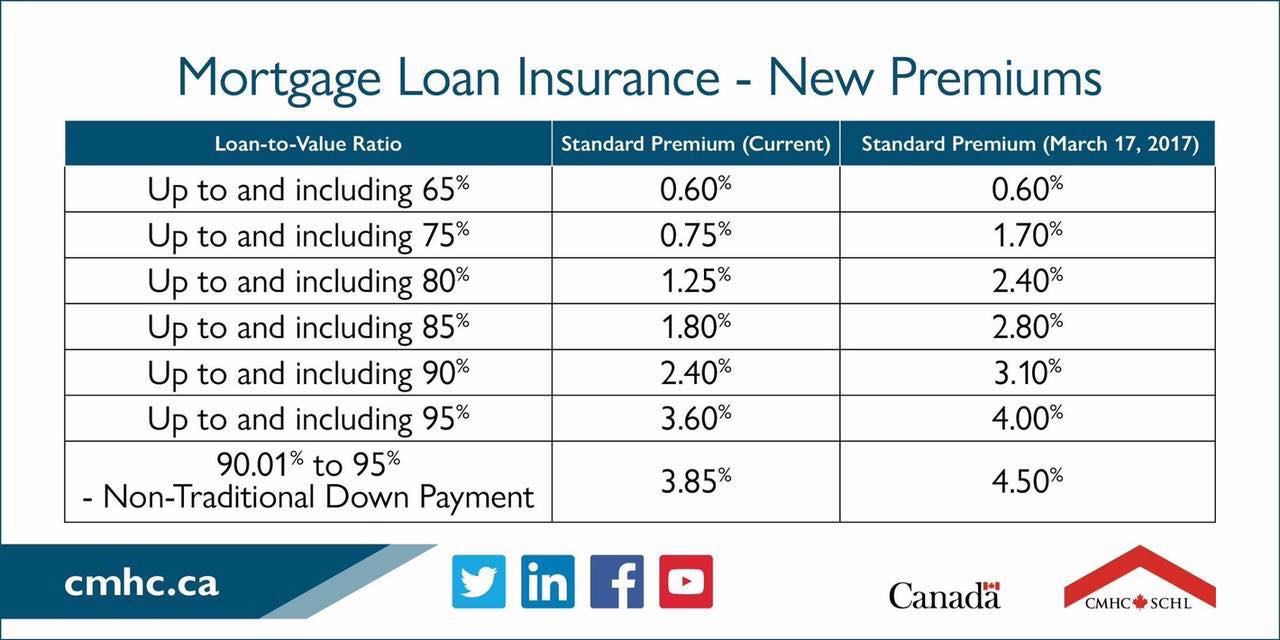

New Mortgage Insurance Premiums Montreal Mortgage Guy

Enerhome Consulting Ltd YouTube