Quickbooks Online Multiple Companies Setup

Quickbooks Online Multiple Companies Setup - May 28 2025 nbsp 0183 32 Aaron Patrick Chartered Accountant Head of Accounts at Boffix and a certified UK QuickBooks trainer has outlined how these functionalities allows accountants to prepare and submit limited company accounts and corporation tax Jun 10 2025 nbsp 0183 32 QuickBooks Sole Trader Released last year Sole Trader targets sole traders including landlords with single property income and subcontractors The solution allows users to manage receipts mileage expenses bank transactions and invoices in a web browser or via the mobile app while simplifying accounts production and tax preparation for QuickBooks

Quickbooks Online Multiple Companies Setup

Quickbooks Online Multiple Companies Setup

Jul 14, 2025 · QuickBooks is also building out its platform to accommodate a major complexity point within MTD for IT: multi-source income. The upcoming solution will support landlords, joint property owners, and sole traders with more diverse income profiles, directly addressing the 1.88 million individuals who fall into these more complicated tax scenarios. Jul 13, 2021 · Needed to submit VAT online to HMRC from QuickBooks as an agent. Client MTD for some time and we are registred as MTD agents as well. QB says cannot connect to HMRC. Then the hours on the phone started. QB agent support says all settings correct try disconnect/connect, try switch off MTD then swith ...

QuickBooks Gears Up Its Tech Stack For MTD IT AccountingWEB

How To Create And Customize An Invoice In QuickBooks Online YouTube

Quickbooks Online Multiple Companies SetupIf you use QuickBooks Online, there’s no need to import your info. You can do your taxes directly inside QuickBooks, without signing into TurboTax. If you use QuickBooks Solopreneur, follow these steps to file personal self-employed taxes. If you use other QuickBooks Online products, follow these steps to file business taxes. Apr 25 2025 nbsp 0183 32 This update positions QuickBooks Sole Trader as a highly viable solution for smaller businesses looking for efficient accountant friendly bookkeeping It brings greater accuracy accountability and flexibility to firms managing sole

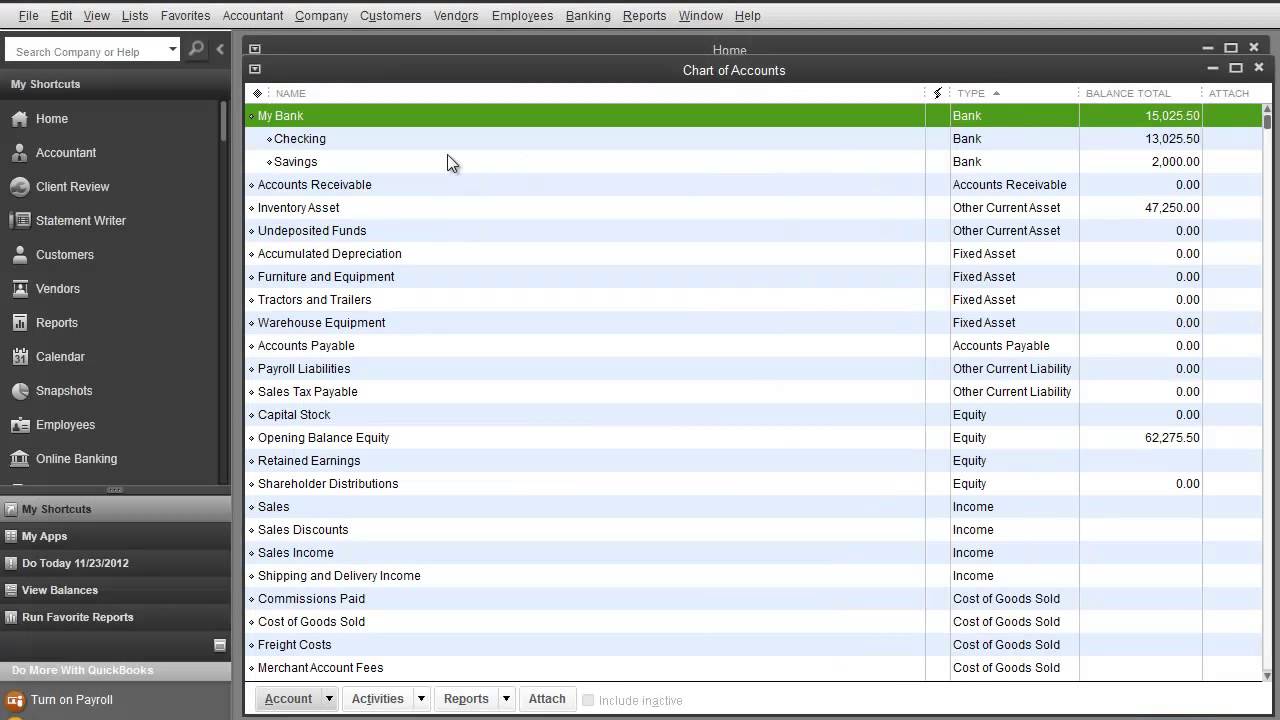

Feb 26, 2025 · Navigating the QuickBooks Dashboard – The dashboard provides a real-time overview of your bank balance, invoices, sales trends, and expenses, helping you stay in control of your business finances. Configuring Company Settings – Go to Settings > Company Settings to ensure your business details and financial year start month are correct. Quickbooks Chart Of Accounts Examples Minga QuickBooks Online All in One Business Solutions

VAT Online quot cannot Connect To HMRC quot Advice Please

How To Enter Opening Balance In QuickBooks Online YouTube

4 days ago · QuickBooks Payments, now available in beta, allows QuickBooks users to connect their bank account to a pay now button on invoices, allowing customers to complete a direct payment. Payments are automatically reconciled on the QuickBooks platform, and the functionality works across all devices. Quickbooks 2024 Update Tally Felicity

4 days ago · QuickBooks Payments, now available in beta, allows QuickBooks users to connect their bank account to a pay now button on invoices, allowing customers to complete a direct payment. Payments are automatically reconciled on the QuickBooks platform, and the functionality works across all devices. Quickbooks Report 2022 QuickBooks Desktop Discontinued What Happens Now

How Categories Work With Products And Services Using QuickBooks Online

QuickBooks Online Tutorial Access Multiple Company Files With Chrome

QuickBooks For Lending Companies Setup For Money Lending YouTube

Quickbooks Balance Sheet Report For Quick Book Reports Templates

Flutter Hexcolor Using Hexadecimal Color Strings In 48 OFF

Quickbooks Lessons Charts Of Accounts Setup www Quickbooks Tutorial

Quickbooks Logo Customer Paradigm

Quickbooks 2024 Update Tally Felicity

Account Overview Template Prntbl concejomunicipaldechinu gov co

Quickbooks Logo Symbol Meaning History PNG Brand