Schedule B Form 2024

Schedule B Form 2024 - Federal Individual Form Availability Print E file Schedule A Form 1040 Itemized Deductions 01 17 2024 01 17 2024 Schedule C Form 1040 Profit or Loss from Business 01 10 2024 01 10 2024 Schedule B Form 1040 Interest and Dividend Income 12 20 2023 01 04 2024 Schedule D Form 1040 Capital Gains and Losses 12 20 2023 01 04 2024 The Forms and Schedules on this page are for Tax Year 2024 January 1 until December 31 2024 Prepare and e File 2024 Tax Returns starting in January 2025 We will update this page for Tax Year 2024 as the Forms Schedules and Instructions become available 2024 Tax Returns are expected to be due in April 2025

Schedule B Form 2024

Schedule B Form 2024

Schedule B reports the interest and dividend income you receive during the tax year. However, you don't need to attach a Schedule B every year you earn interest or dividends. It is only required when the total exceeds certain thresholds. For most taxpayers, a Schedule B is only necessary when you receive more than $1,500 of taxable interest ... Department of the Treasury Internal Revenue Service Go to Interest and Ordinary Dividends Attach to Form 1040 or 1040-SR. OMB No. 1545-0074 Attachment 2023 www.irs.gov/ScheduleB Name(s) shown on return for instructions and the latest information. Sequence No. 08 Your social security number on that form.

Tax Forms For 2024 Tax Returns Due in 2025 Tax Calculator e File

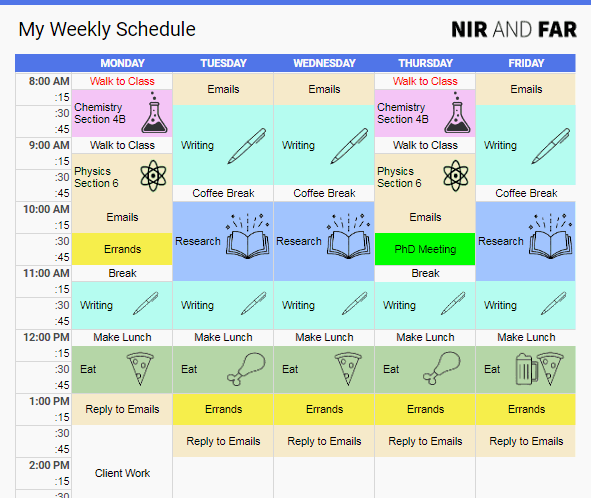

How To Organize Your Schedule Tips For Effective Scheduling

Schedule B Form 2024The IRS is currently planning for a threshold of $5,000 for tax year 2024 (the taxes you file in 2025) as part of the phase in to implement the lower over $600 threshold enacted under the American Rescue Plan. This is not a tax law change, but a change in the reporting requirement for third party payment processors. Schedule B is a form used by the IRS for taxpayers to report their income from interest and ordinary dividends It s an attachment to the main tax form Form 1040 This form is essential for individuals who have earned income from interest or dividends during the tax year

Starting in the first quarter of 2023, the payroll tax credit is first used to reduce the employer share of social security tax up to $250,000 per quarter and any remaining credit reduces the employer share of Medicare tax for the quarter. Effective Scheduling In 6 Steps How To Make An Effective Schedule

span class result type

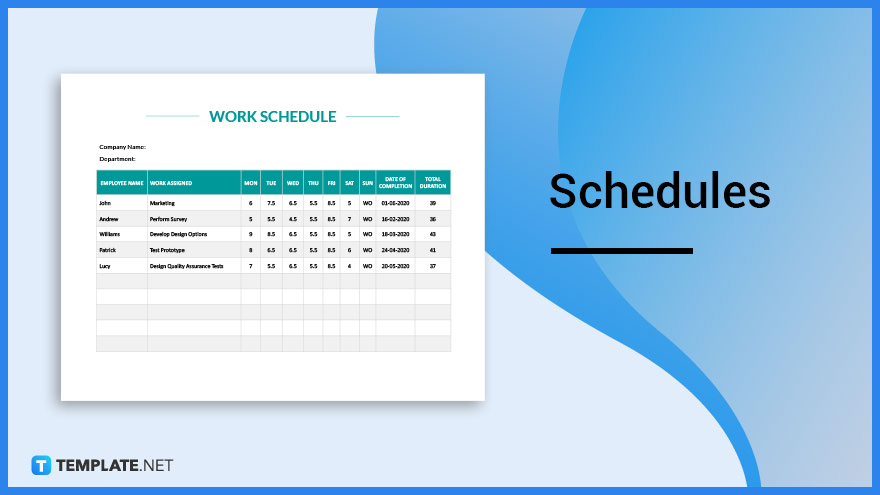

14 Types Of Work Schedules Explained Quidlo

Use Schedule B (Form 1040) if any of the following applies. You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond. Schedule What Is A Schedule Definition Types Uses

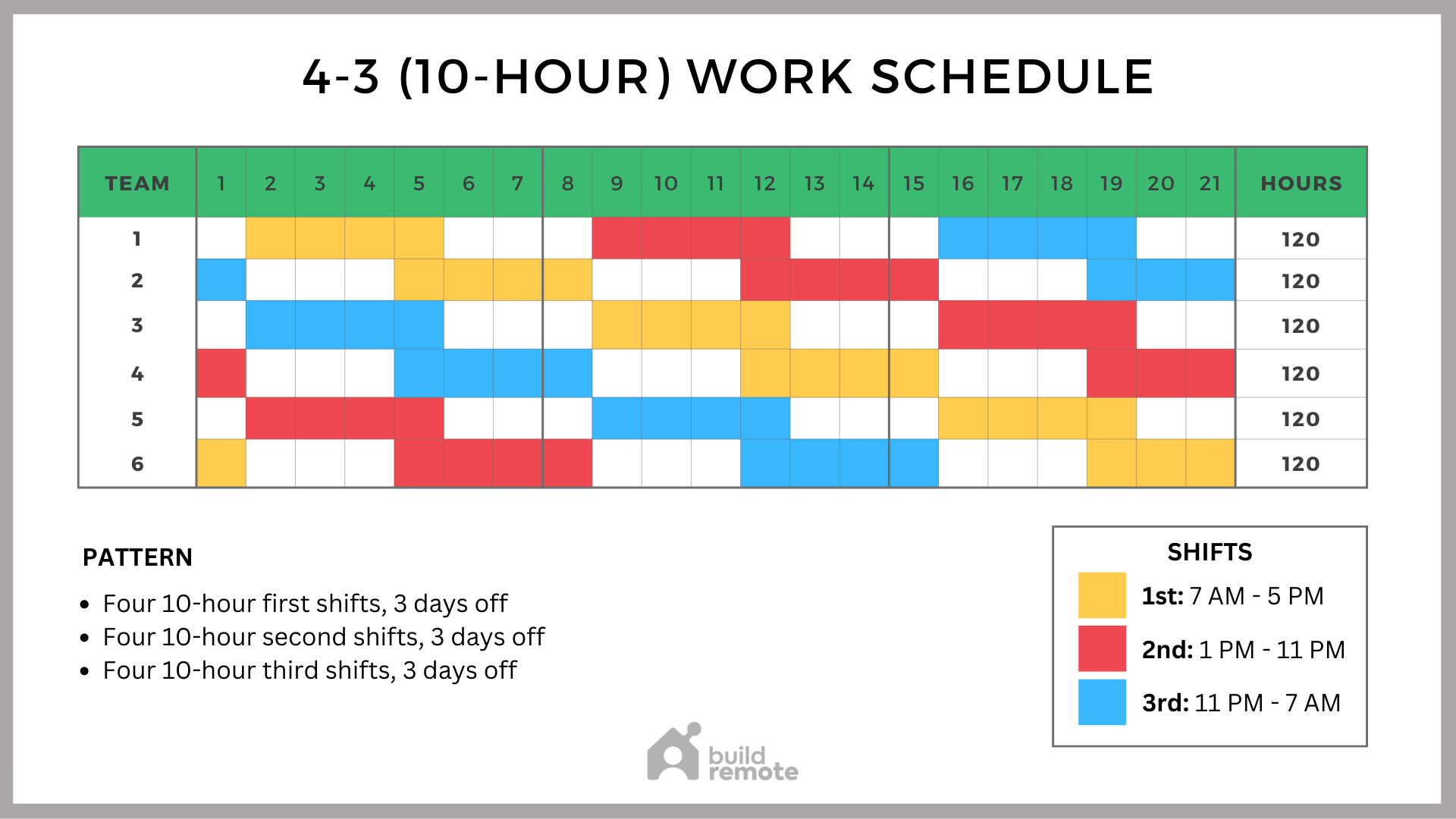

Use Schedule B (Form 1040) if any of the following applies. You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond. Schedule Creator Excel Chartsgaret 4 On 4 Off Schedule Template 12 Hour Shifts Buildremote

Cute Weekly Schedule Template

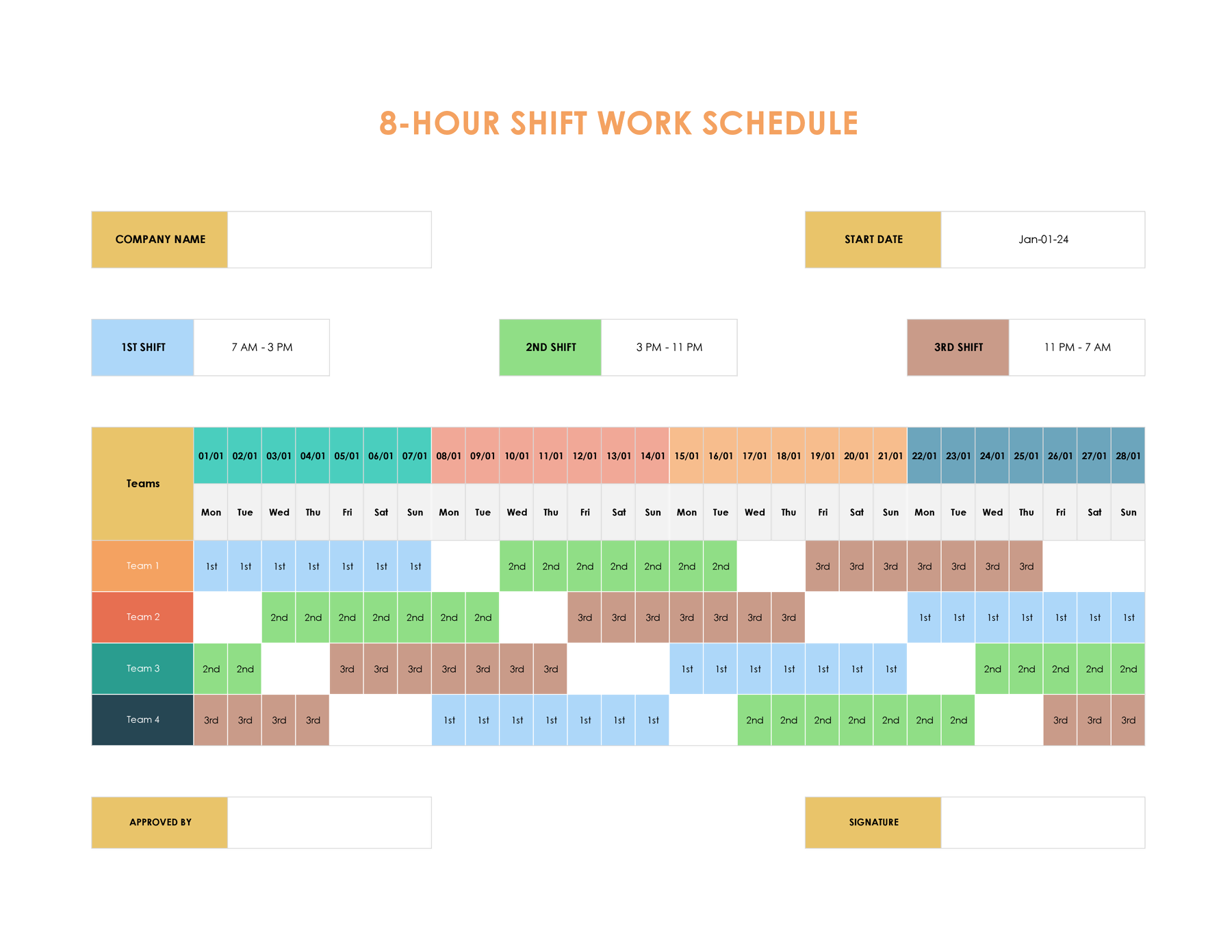

Free DuPont Shift Schedule Template For Excel

How To Create A Schedule That Works For You And Your Productivity Style

Schedule Helper

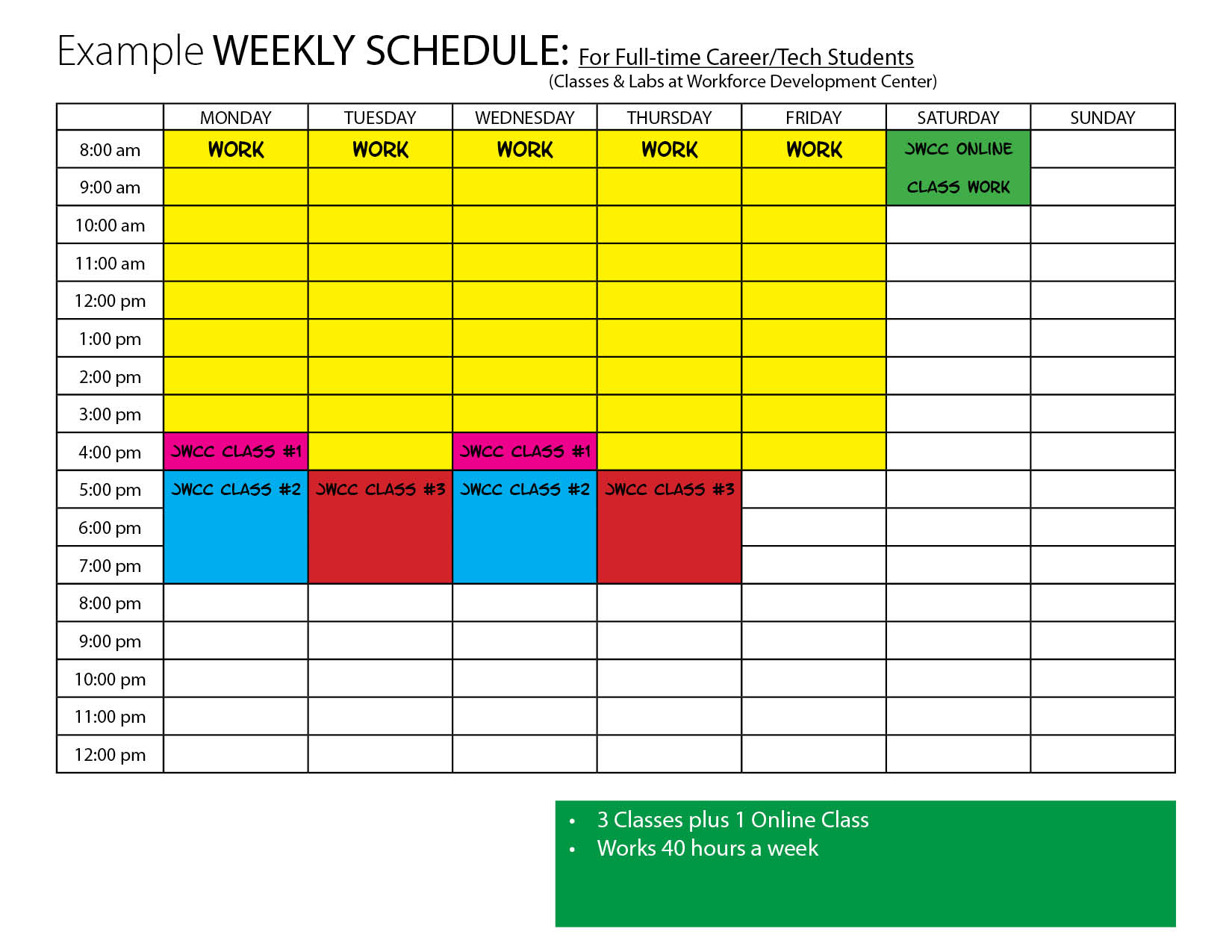

Sample Schedules JWCC

Productive Schedule Structuring Your Day For Success Rethink Risk

Free Online Class Schedules Design A Custom Class Schedule In Canva

Schedule What Is A Schedule Definition Types Uses

Online Schedule Builder And Time Clock Ximble

Schedule Maker Use This Google Sheet To Plan Your Week