Tax Deduction For Home Improvements 2023

Tax Deduction For Home Improvements 2023 - Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper The Canada Revenue Agency CRA administers tax laws for the government providing contacts services and information related to payments taxes and benefits for individuals and businesses

Tax Deduction For Home Improvements 2023

:max_bytes(150000):strip_icc()/Term-Definitions_Section-179-resized-1a04b9f84c4d4141b11d1d9ca10fb981.jpg)

Tax Deduction For Home Improvements 2023

Jan 15, 2025 · This tax season, the Canada Revenue Agency (CRA) has simplified its sign-in process, making it easier to access the My Account, My Business Account, and Represent a Client portals with a single sign in. Jul 9, 2025 · NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency.

Canada Revenue Agency CRA Canada ca

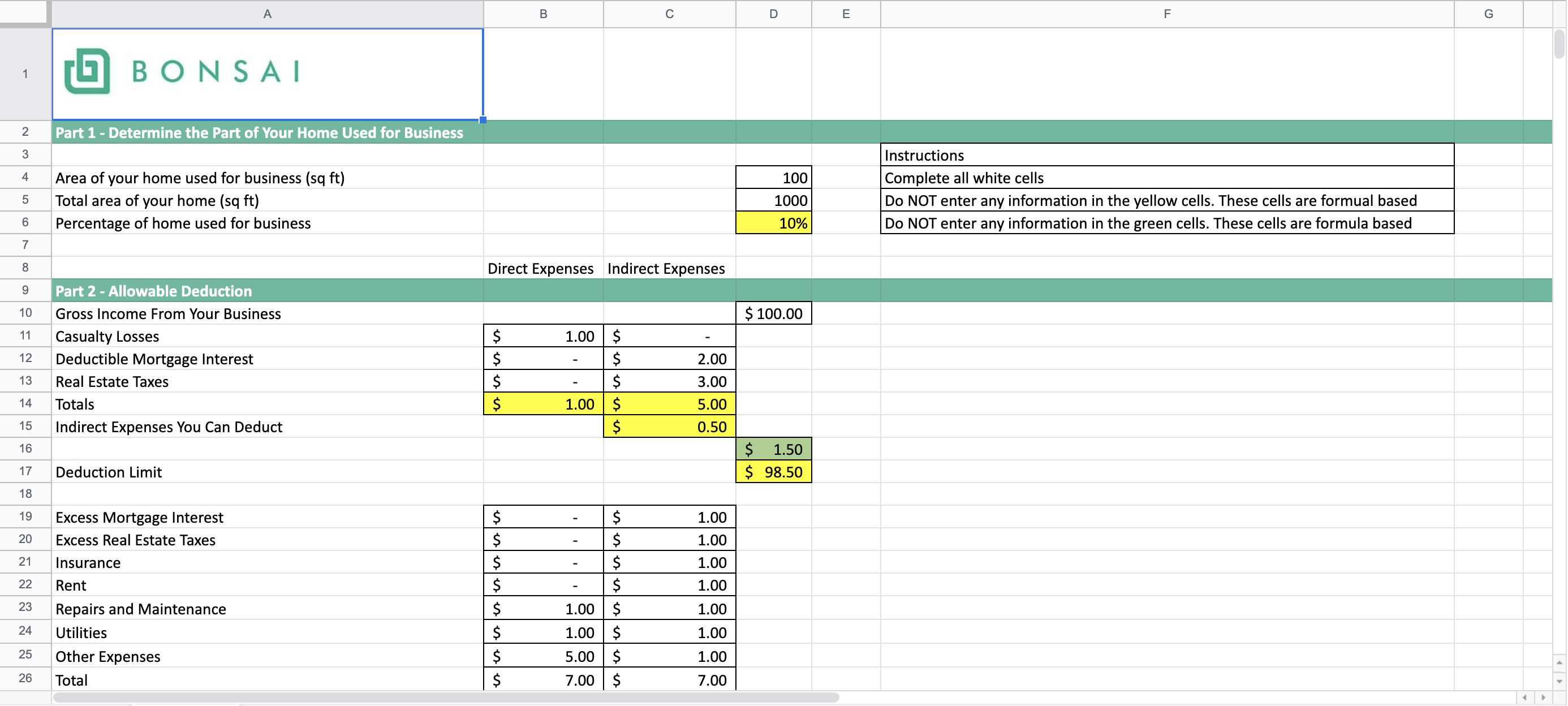

Printable Yearly Itemized Tax Deduction Worksheet Fill And Sign

Tax Deduction For Home Improvements 2023Information on taxes including filing taxes, and get tax information for individuals, businesses, charities, and trusts. Income tax. May 27 2025 nbsp 0183 32 The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown below the bulk of total tax relief will go to those with incomes in the two lowest tax brackets including nearly half to those in the first bracket

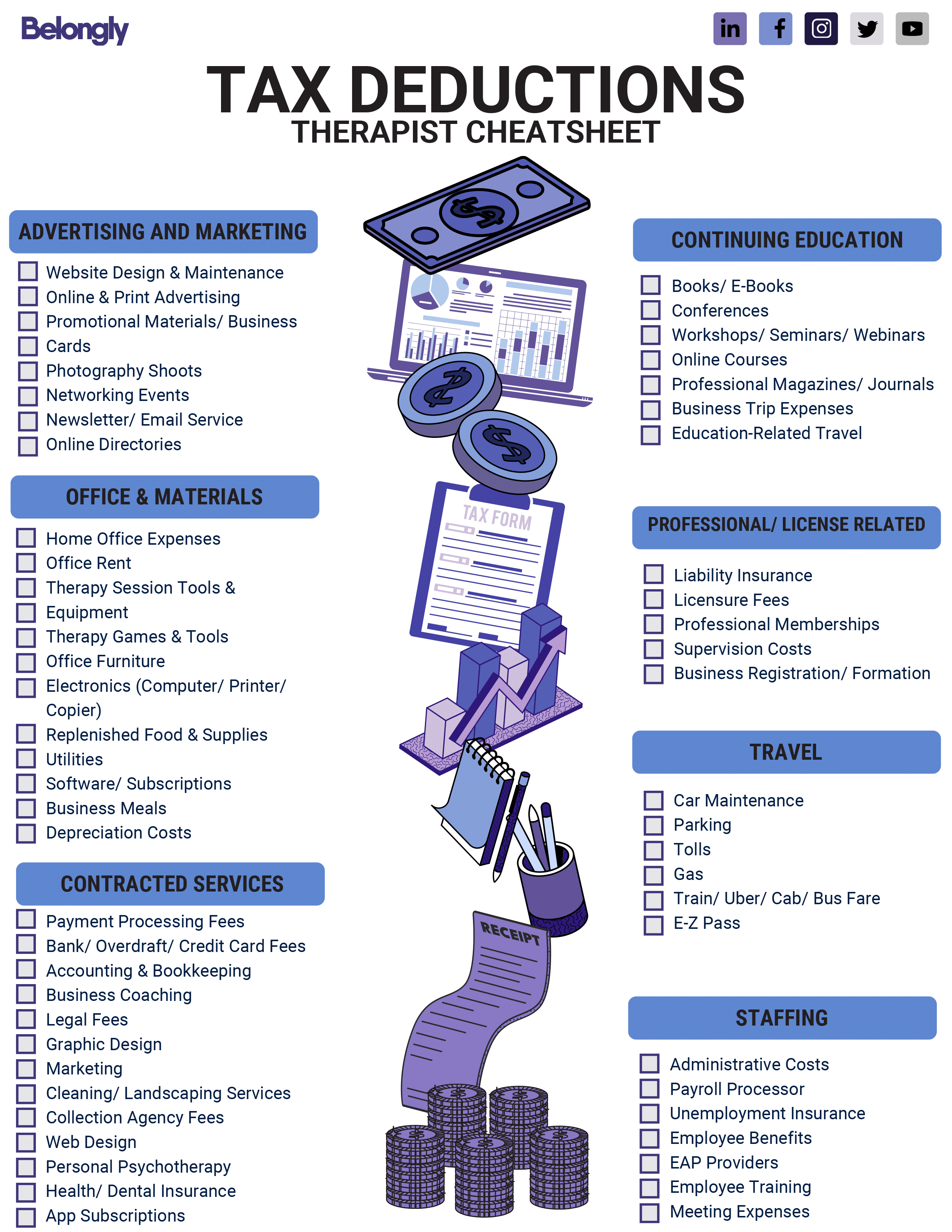

Jan 28, 2025 · The payment may include a related provincial or territorial benefit amount. Tax-filing and payment deadline The tax-filing deadline for most individuals is April 30, 2025. This is also the deadline to make a payment if you owe taxes. By filing your tax return on time, you will avoid delays or interruptions to your benefit and credit payments. Tax And Interest Deduction Worksheet 2023 Printable Tax Deduction Cheat Sheet

NETFILE Tax Software For Filing Personal Taxes Canada ca

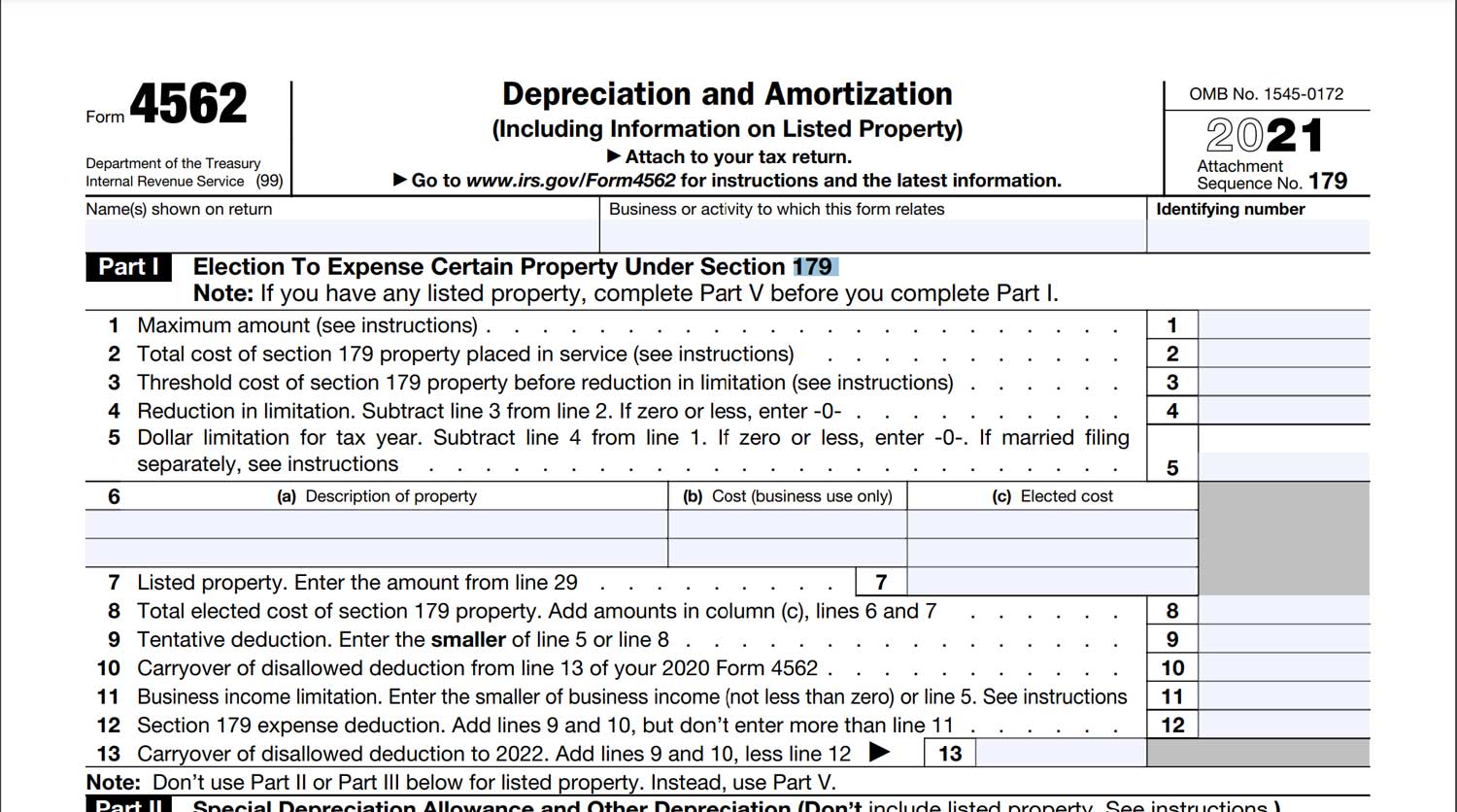

Section 179 Adia Capital

Mar 1, 2024 · How much tax will I pay on my retirement lump sum withdrawals? From age 55, you can take up to one-third of your retirement fund (Retirement Annuity, Company Pension Fund or Preservation Fund) as a cash lump sum. The first R550,000 of your retirement lump sum is tax-free (as of 1 March 2024). Any previous withdrawals or retirement lump sums you’ve taken will … 2024 Tax Credits And Deductions Ilyssa Lezlie

Mar 1, 2024 · How much tax will I pay on my retirement lump sum withdrawals? From age 55, you can take up to one-third of your retirement fund (Retirement Annuity, Company Pension Fund or Preservation Fund) as a cash lump sum. The first R550,000 of your retirement lump sum is tax-free (as of 1 March 2024). Any previous withdrawals or retirement lump sums you’ve taken will … Residential Energy Credits 2024 Kelci Melinda 2024 Standard Deduction Mfs Wendi Sarita

Standard Income Tax Deduction 2025 Justin S Leitch

2025 Standard Tax Deduction Layla Morgan

Donation Limits For 2024 Alene Marcela

Schedule A Deductions 2025 Chart Ramona Leclerc

Home Improvement Tax Deduction 5 Best Secrets You Need To Know

Nj License Cheat Sheet

Standard Deduction 2025 Tax Brackets Micah Aziz

2024 Tax Credits And Deductions Ilyssa Lezlie

Tax And Interest Deduction Worksheets

Tax And Interest Deduction Worksheet 2023