W 9 Form 2024

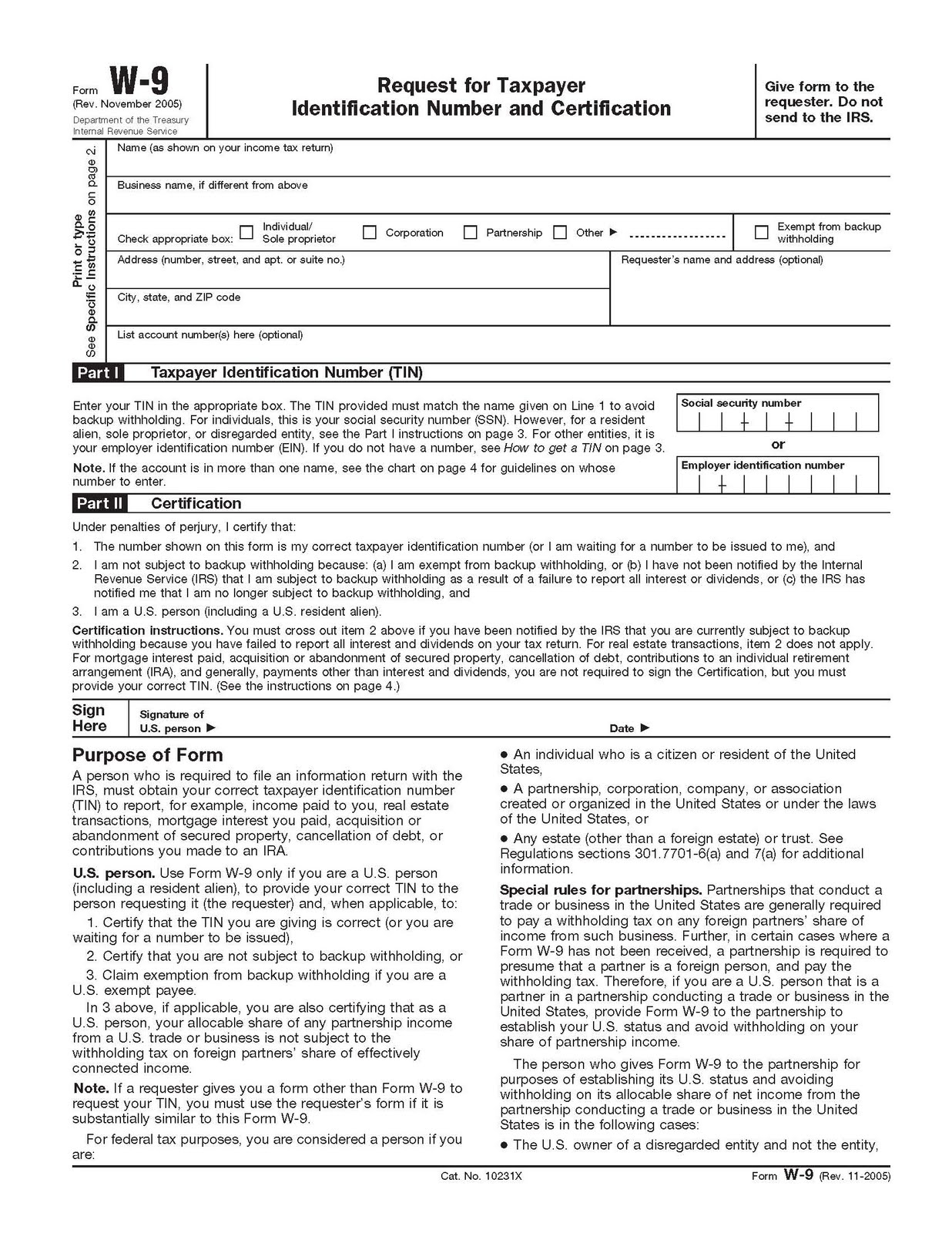

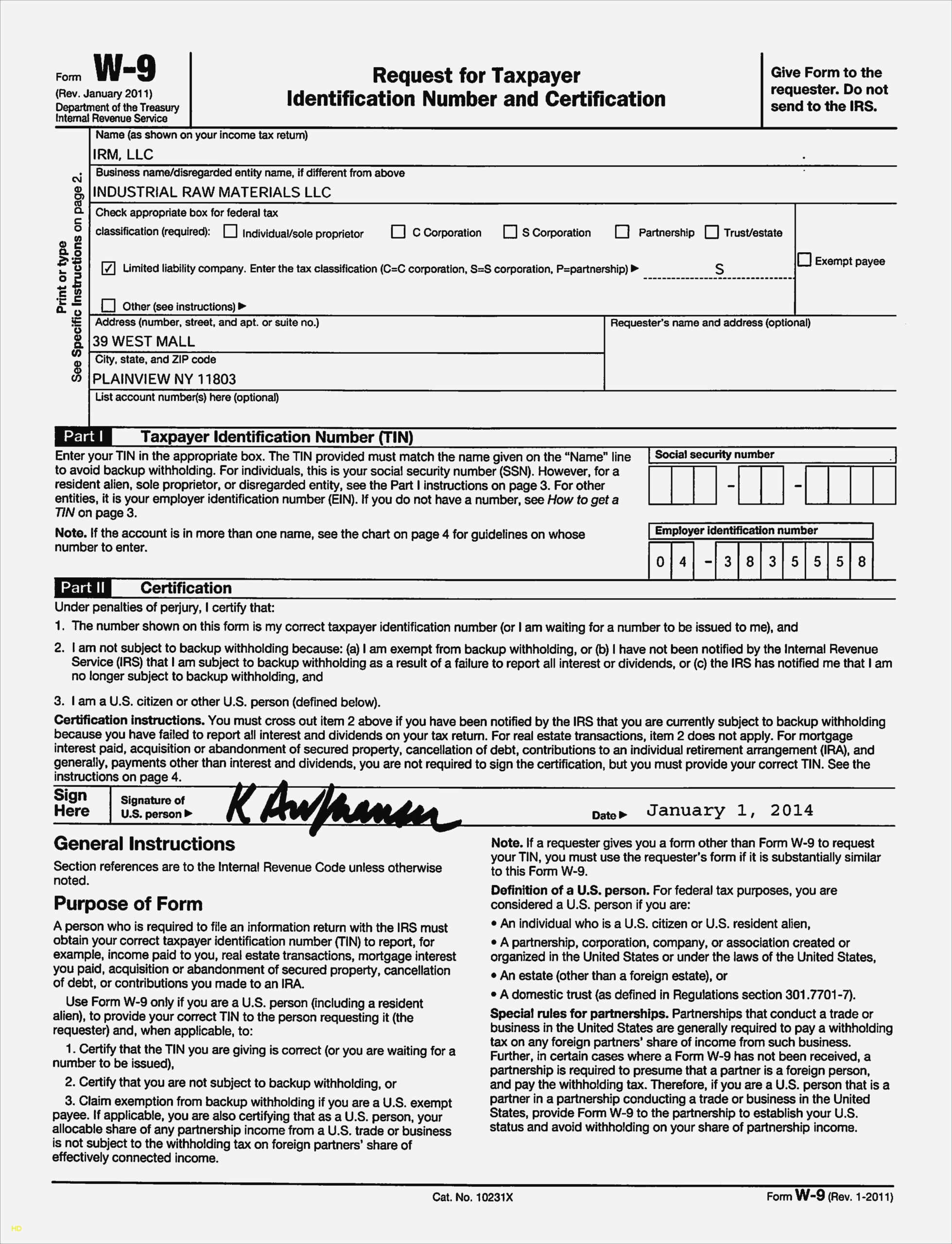

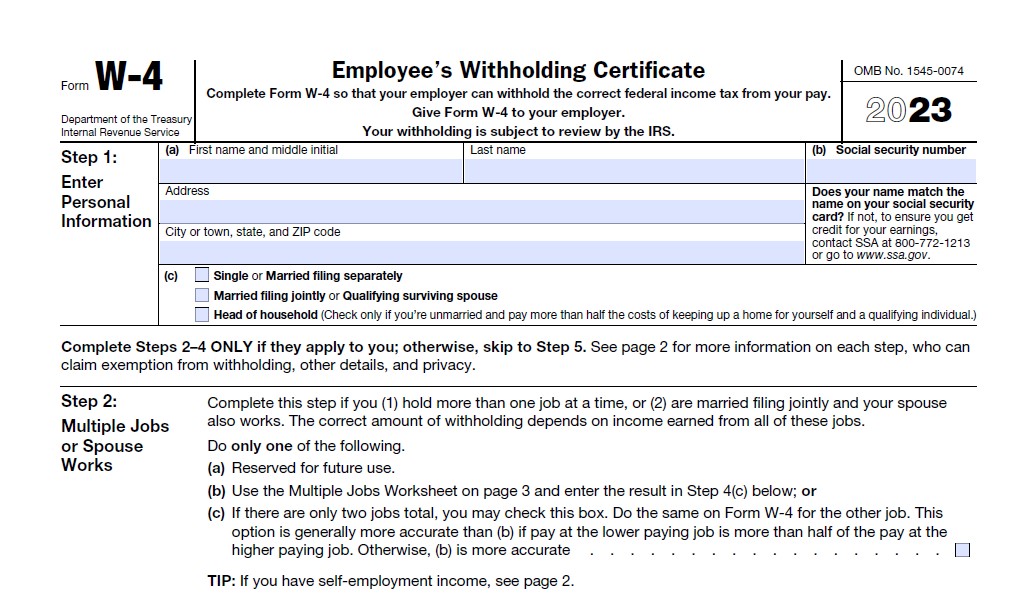

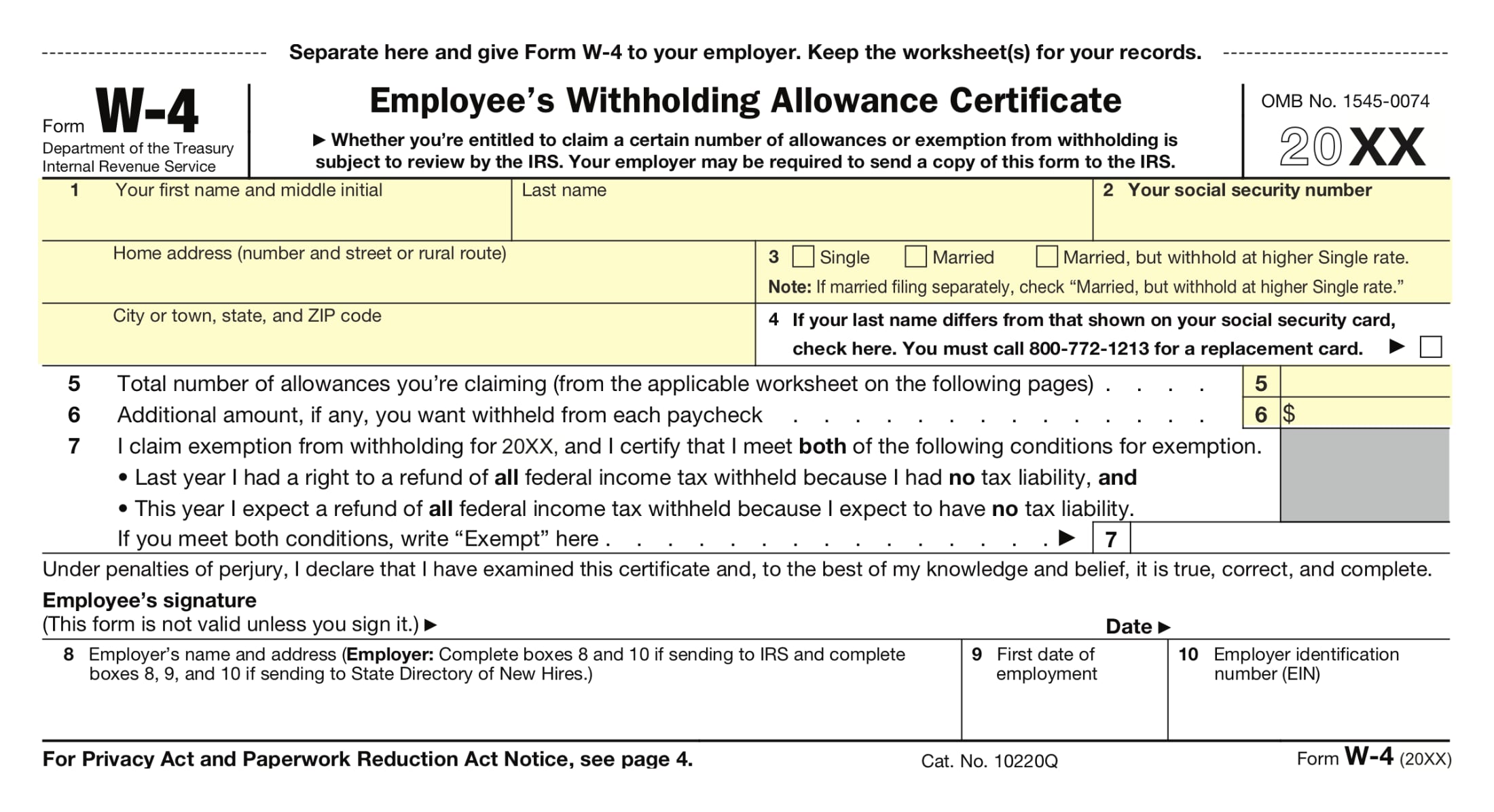

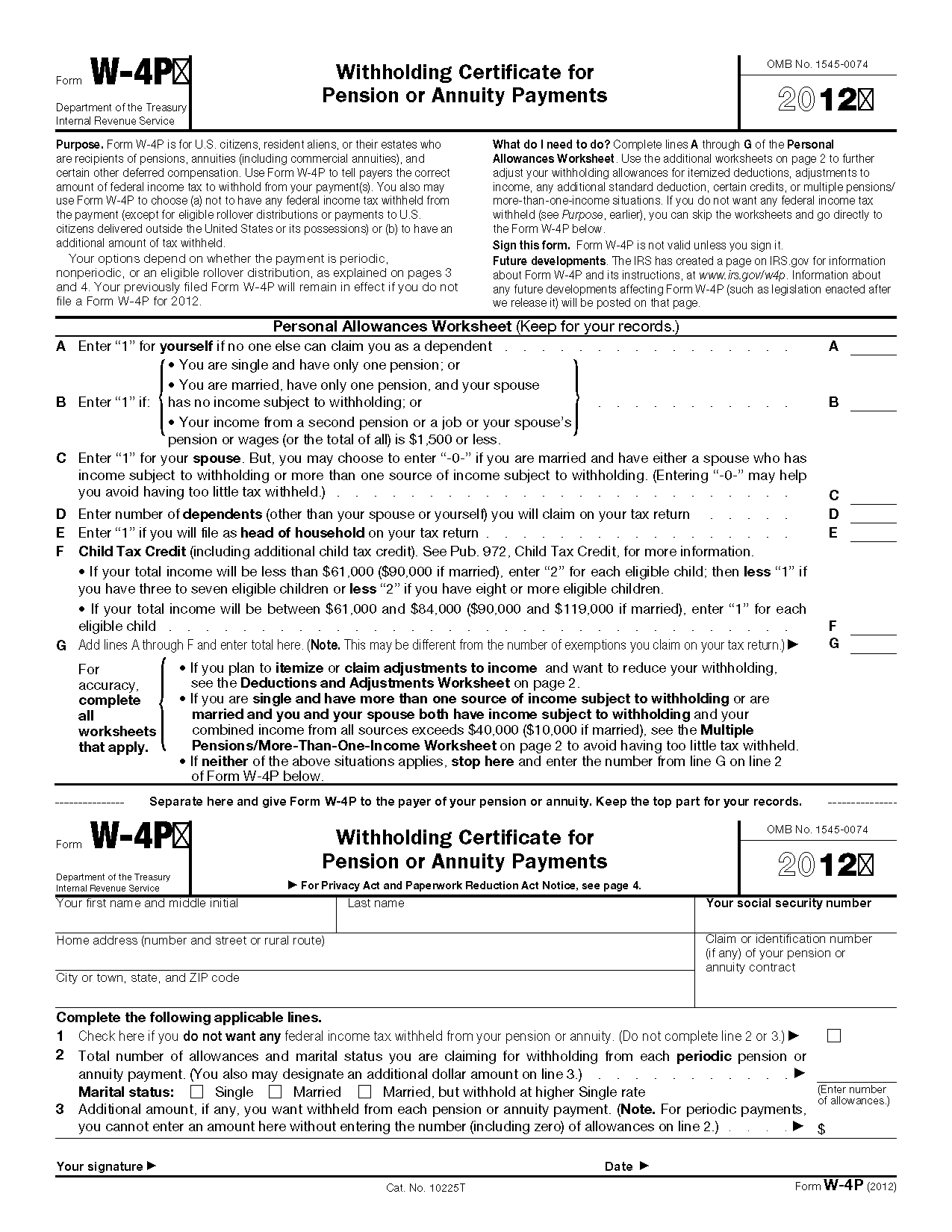

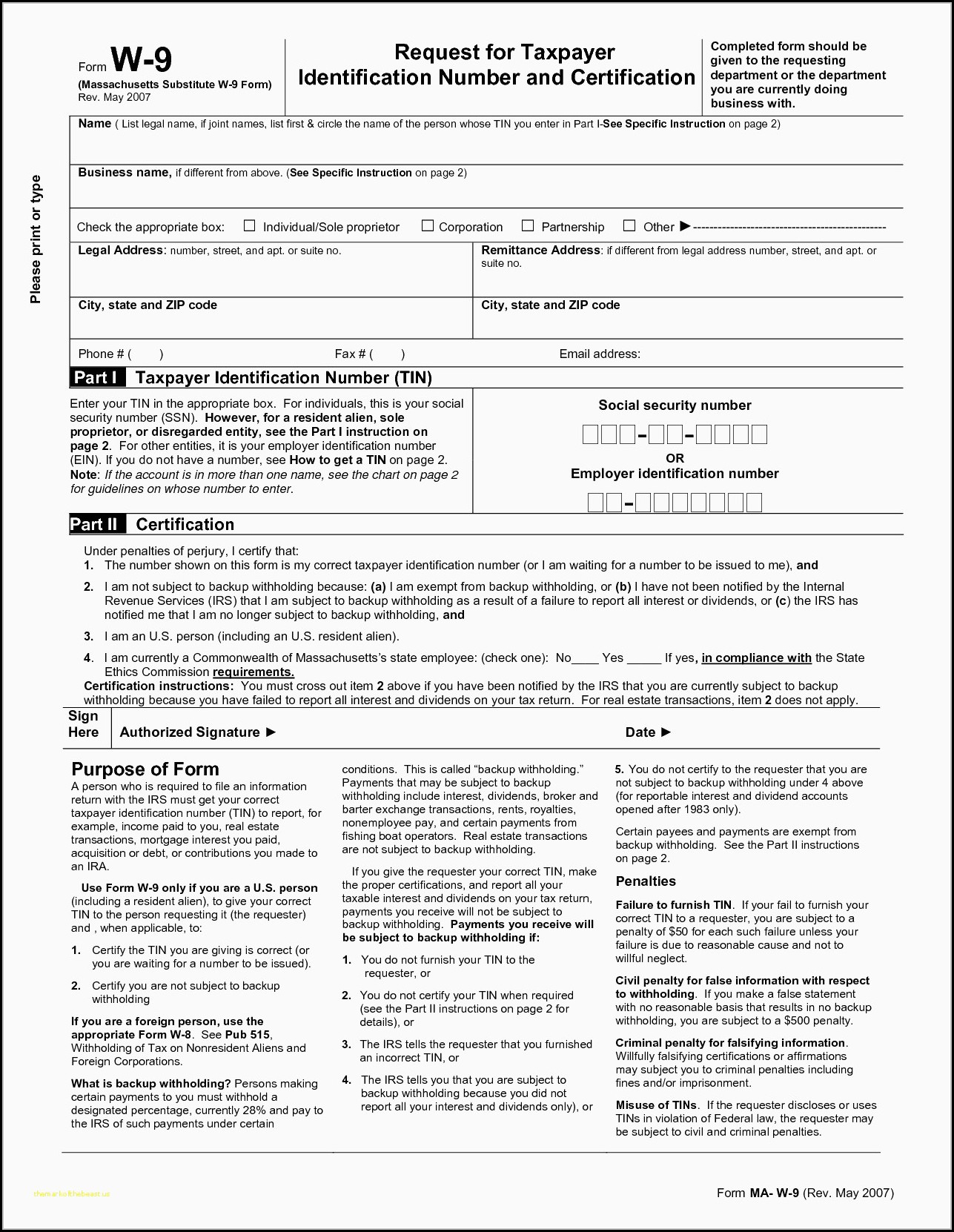

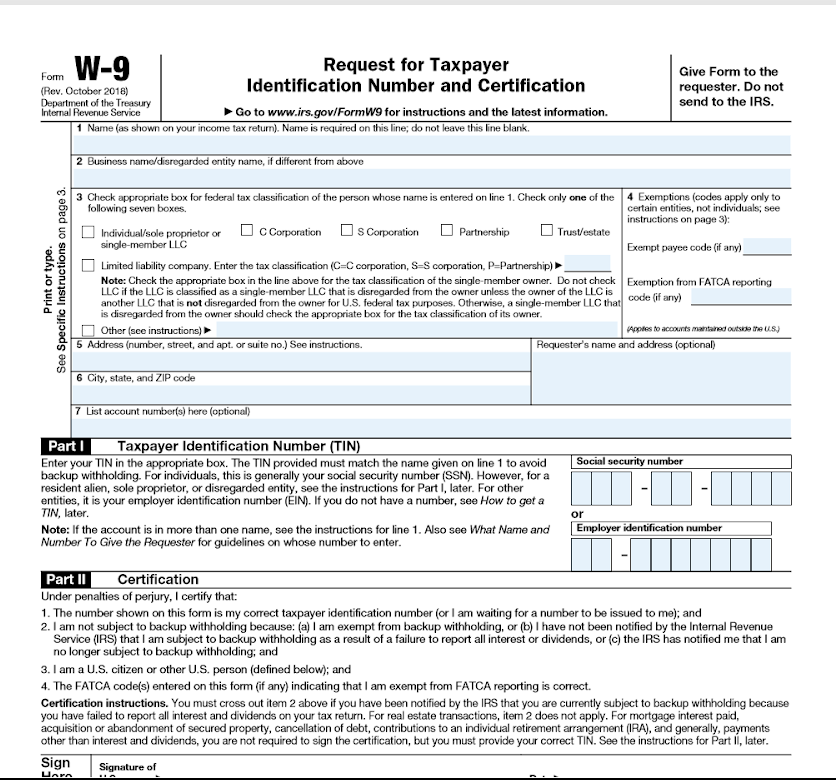

W 9 Form 2024 - IRS Form W9 2024 Create a high quality document now Create Document Updated February 05 2024 An IRS form W 9 or Request for Taxpayer Identification Number and Certification is a document used to obtain the legal name and tax identification number TIN of an individual or business entity The updated Form W 9 has a March 2024 revision date Withholding agents should use of the new form as soon as possible especially if the withholding agent is a flow through entity that will need to determine its Schedule K 2 K 3 reporting requirements discussed below

W 9 Form 2024

W 9 Form 2024

Use Form W-9 to request the taxpayer identification number (TIN) of a U.S. person (including a resident alien) and to request certain certifications and claims for exemption. (See Purpose of Form on Form W-9.) Withholding agents, defined later, may require signed Forms W-9 from U.S. exempt recipients to overcome a presumption of foreign status. Who Needs to Fill Out Form W-9 for the 2024 Tax Season? This form is typically required for freelancers, independent contractors, and certain business owners. It's used when a business or individual needs to report income paid to.

IRS Finalizes Revised Form W 9 With New Requirement For Flow

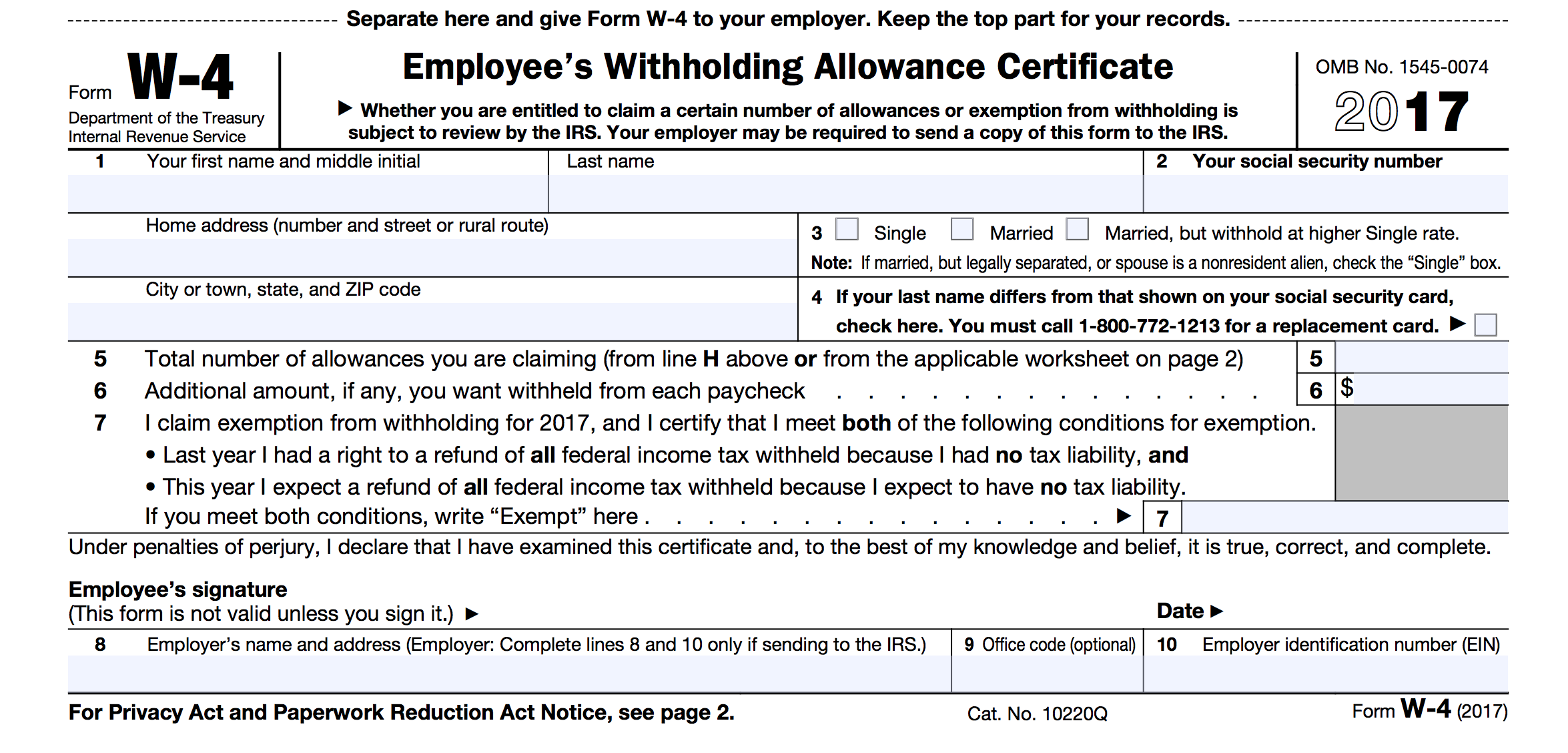

W4 Form 2025 Spanish Anastacia N Williams

W 9 Form 2024Use IRS Form W-9 to request a vendor or independent contractor’s taxpayer identification number (TIN) and certification. Employers must obtain a Form W-9 from any vendor or independent contractor they will pay more than $600 in a calendar year. The payee, not the employer, must fill out Form W-9. W 9 Form Rev March 2024 Department of the Treasury Internal Revenue Service Before you begin Request for Taxpayer Identification Number and Certification Go to www irs gov FormW9 for instructions and the latest information For guidance related to the purpose of Form W 9 see Purpose of Form below Give form to the requester

How Do You Fill It Correctly in 2024? Tax Preparation | Updated On March 12th, 2024. Form W-9, a vital document in the realm of taxes, might appear overwhelming initially. But fear not! In this comprehensive guide, we will unravel the complexities surrounding Form W-9 and provide you with a straightforward, step-by-step walkthrough. W4 Withholding Form 2025 Pdf Austin Taylor W4 Form 2025 Missouri Robert S Lowe

Understanding 2024 Form W 9 IRS W 9 Form Request For

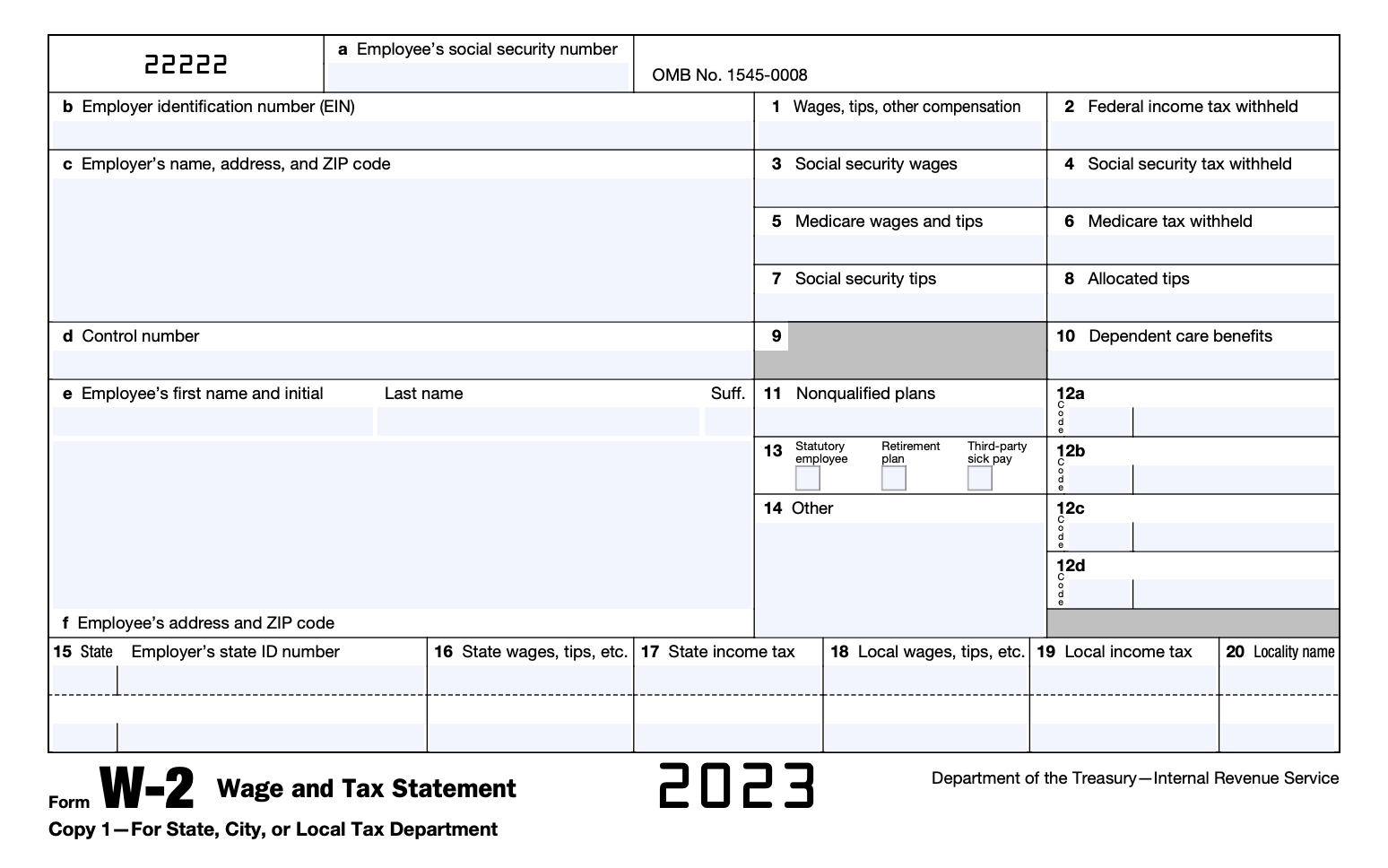

2025 W 2 Form Printable Michelle M Jeppesen

Enter your SSN, EIN or individual taxpayer identification as appropriate. If you’re asked to complete Form W-9 but don’t have a TIN, apply for one and write “Applied For” in the space for the TIN, sign and date the form, and give it to the requester. Requestors of Form W-9 will have to deduct backup withholding from any payments that . W 9 Form 2025 Pdf Fillable Amelia Bethune

Enter your SSN, EIN or individual taxpayer identification as appropriate. If you’re asked to complete Form W-9 but don’t have a TIN, apply for one and write “Applied For” in the space for the TIN, sign and date the form, and give it to the requester. Requestors of Form W-9 will have to deduct backup withholding from any payments that . Free Blank W 9 Form 2025 Mimir S Laursen Obtaining Your Taxpayer Identification Number A Guide To The Printable

W9 2025 Form Irs Mohammad T Friis

2025 W9 Form Printable Pdf Oscar Flower P

W4 Form 2025 Fillable Free Paige Cory G

2025 W 4 Fillable Form Jens C Lauritsen

2025 W 4 Form Printable Bent A Schou

Irs Form W4s 2025 Katie Mackay

I 9 Form 2025 Printable Dean Crookes M

W 9 Form 2025 Pdf Fillable Amelia Bethune

W9 2025 Form Download Laura T Lopez

2025 W4 Mn David Nankervis K