Weighted Average Interest Rate Meaning

Weighted Average Interest Rate Meaning - Weighted Average Interest Rate means the net interest cost of the bonds derived by adding together all the interest payments for the term of the Bonds and dividing that sum by the sum amount of each bond multiplied by the number of years it is outstanding To calculate the weighted average interest rates of a set of loans divide the total interest paid per year by the total balance on the loans This can give you a good handle on how much you are paying overall in terms of loan interest and give you a

Weighted Average Interest Rate Meaning

Weighted Average Interest Rate Meaning

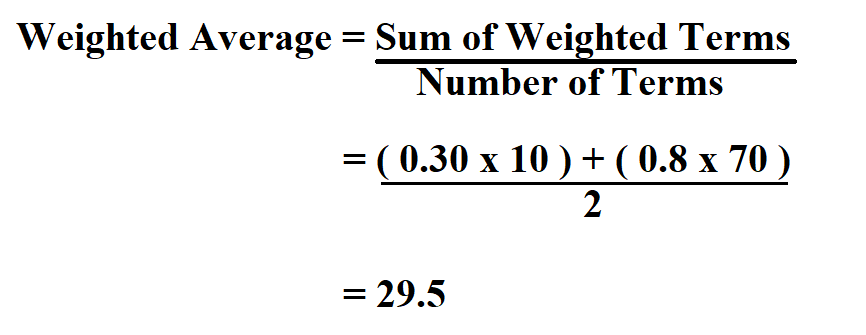

A weighted average interest rate is an average that is adjusted to reflect the contribution of each loan to the total debt. The weighted average multiplies each loan’s interest rate by the loan balance and divides the sum by the total loan balance. A weighted average is a type of mean that gives differing importance to the values in a dataset. In contrast, the regular average, or arithmetic mean, gives equal weight to all observations. The weighted average is also known as the weighted mean, and I’ll use those terms interchangeably.

How To Calculate Weighted Average Interest Rates Sapling

How To Calculate The Weighted Average Interest Rate

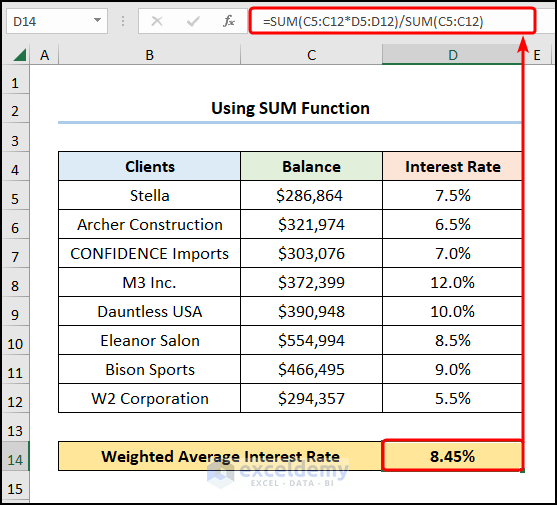

Weighted Average Interest Rate MeaningThe weighted average coupon (WAC) is calculated by taking the gross of the interest rates owed on the underlying mortgages of the MBS and weighting them according to the percentage of the. The weighted average interest rate is the aggregate rate of interest paid on all debt The calculation for this percentage is to aggregate all interest payments in the measurement period and divide by the total amount of debt The formula is Aggregate interest payments Aggregate debt outstanding Weighted average interest rate

Interest Tax Shield. Notice in the Weighted Average Cost of Capital (WACC) formula above that the cost of debt is adjusted lower to reflect the company’s tax rate. For example, a company with a 10% cost of debt and a 25% tax rate has a cost of debt of 10% x (1-0.25) = 7.5% after the tax adjustment. Interest Rate Calculation In Excel YouTube Effective Interest Rates EIR

Weighted Average Formula amp Calculation Examples Statistics

Weighted Average Interest Rate Calculator Mentor

Interest Rate (i): The interest rate associated with each loan or investment. Weight (w): The weight assigned to each loan or investment, typically determined by the outstanding balance or the amount invested. The formula for calculating the weighted average interest rate is as follows: What Is Interest Rate Definition And Examples Market Business News

Interest Rate (i): The interest rate associated with each loan or investment. Weight (w): The weight assigned to each loan or investment, typically determined by the outstanding balance or the amount invested. The formula for calculating the weighted average interest rate is as follows: How To Calculate Average Grade In Excel Haiper Guide To Paying Back Student Loan Debt Stephan D Shipe

How To Calculate Weighted Average

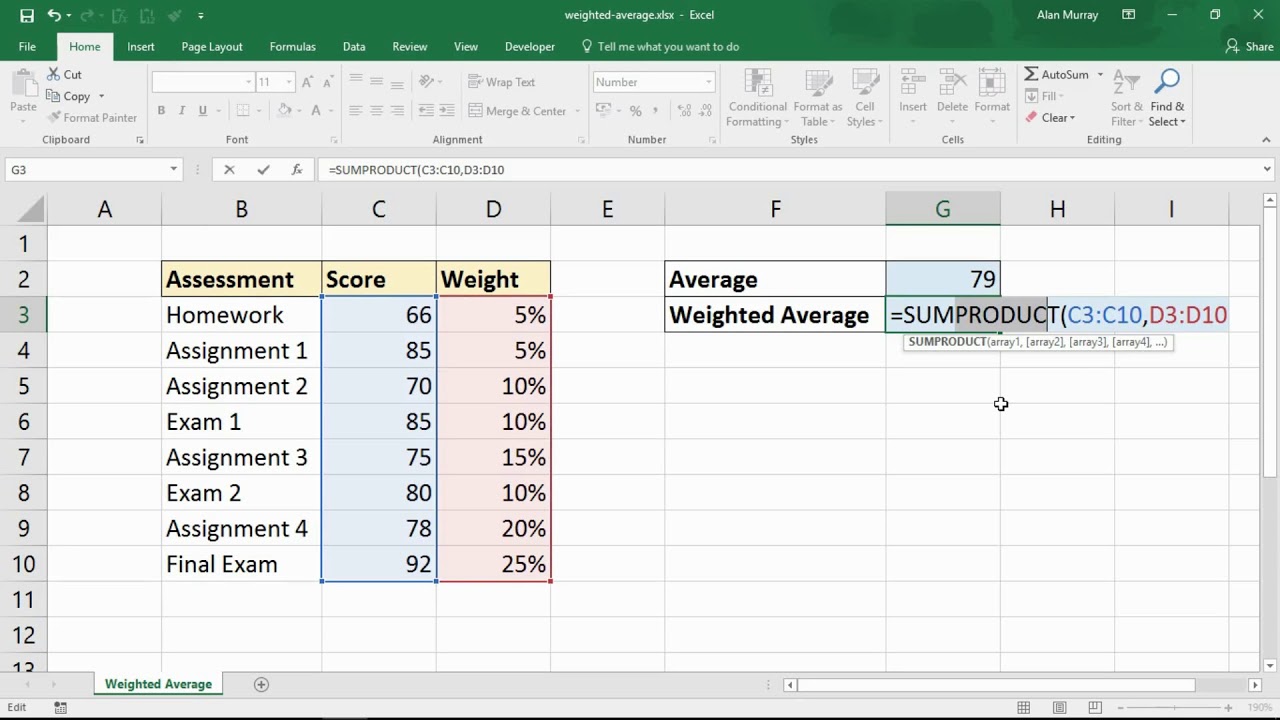

How To Calculate Weighted Average Interest Rate In Excel 3 Ways

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)

Tigger About Life

Interest Rate Explained Currency

Weighted Average Interest Rates On Borrowings By All Farmer And Small

How To Calculate A Weighted Average In Excel Haiper

Weighted Average Interest Rates On Borrowings By All Farmer And Small

What Is Interest Rate Definition And Examples Market Business News

What Is Interest Rate Definition And Examples Market Business News

How To Calculate Weighted Average