What Is A 1099r

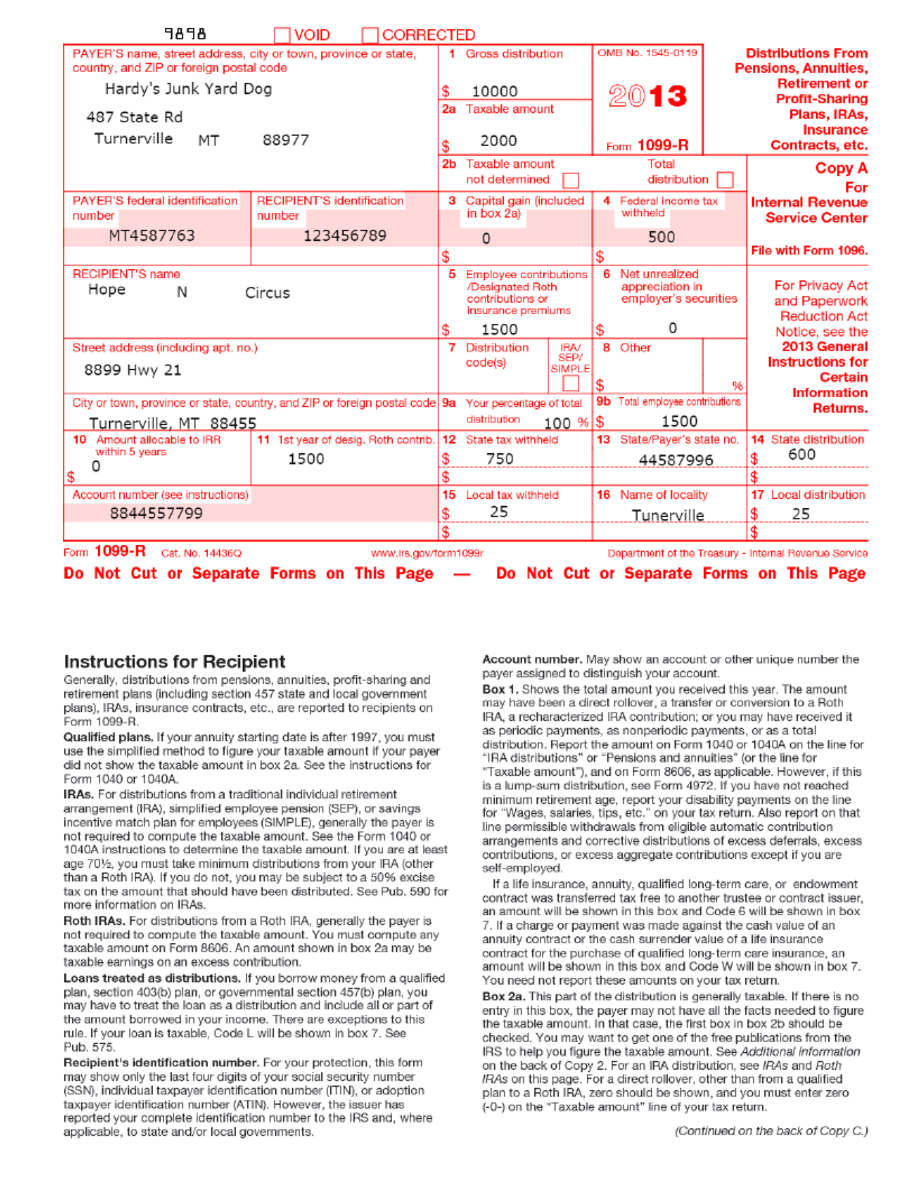

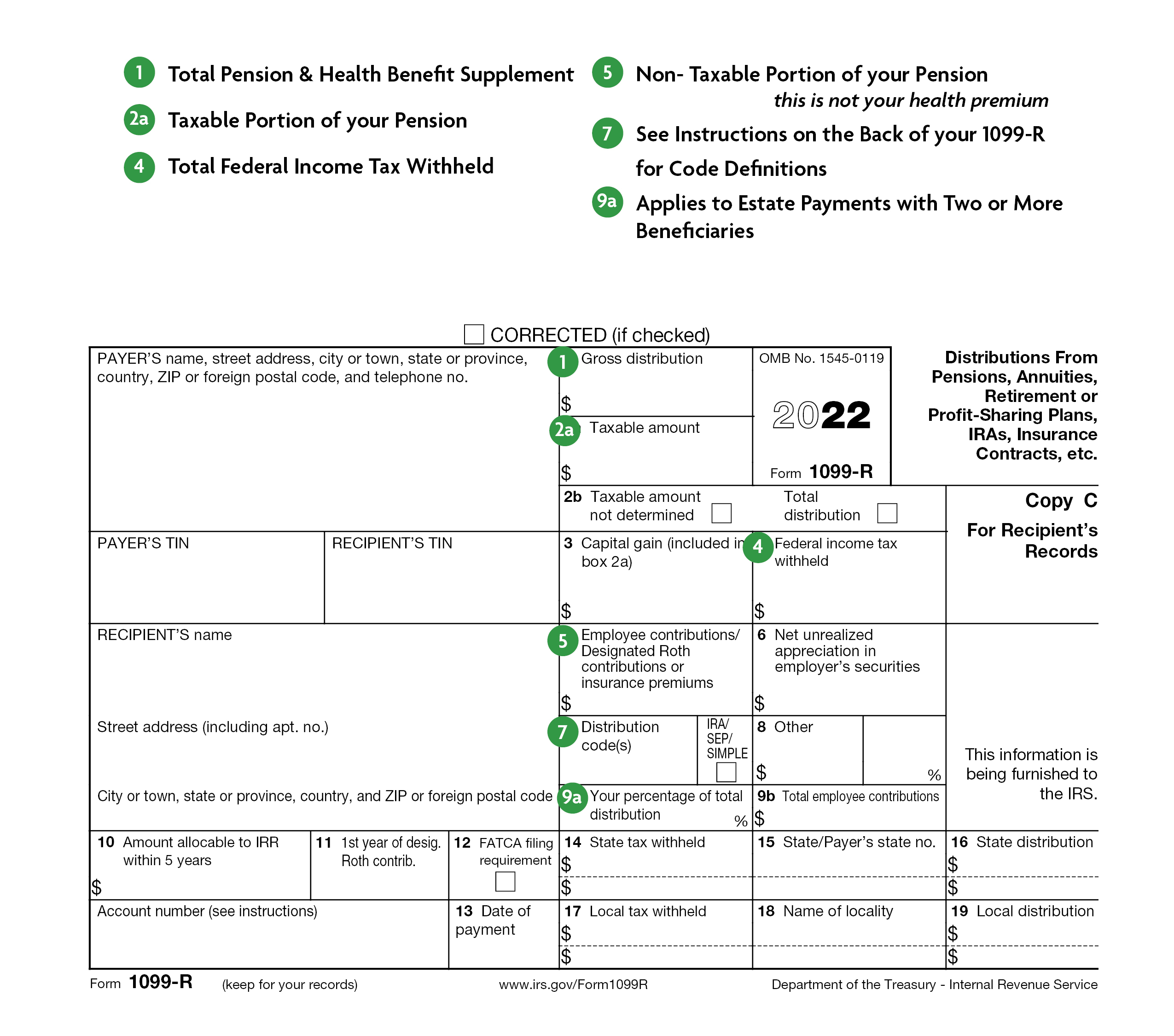

What Is A 1099r - Report on Form 1099 R not Form W 2 income tax withholding and distributions from a section 457 b plan maintained by a state or local government employer Distributions from a governmental section 457 b plan to a participant or beneficiary include all amounts that are paid from the plan Form 1099 R is used to report the distribution of retirement benefits such as pensions and annuities You should receive a copy of Form 1099 R or some variation if you received a distribution of 10 or more from your retirement plan

What Is A 1099r

What Is A 1099r

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans. Permanent and total disability payments . Form 1099-R is a tax document used to report certain types of income distributions to the IRS. Generally, anyone who receives distribution of at least $10 from an annuity, pension, profit-sharing plan or retirement vehicle will receive a 1099-R for the tax year in which the money was received.

When To Use Tax Form 1099 R Distributions From Pensions

Form SSA 1099 Walkthrough Social Security Benefit Statement YouTube

What Is A 1099r1099-R reports distributions from retirement savings accounts, pensions, annuities, profit-sharing plans and life insurance contracts. It shows whether any taxes were withheld from the . Form 1099 R is an IRS tax form used to report distributions from annuities profit sharing plans retirement plans or insurance contracts

What is the 1099-R form? If you take money out of your retirement account for any reason, you’ll get Form 1099-R. A 1099-R form, called the “Distributions From Pensions, Annuities, Retirement, or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.” Free IRS 1099 Form PDF EForms Form 1099 R Instructions Tips TaxFormExpress

What Is A 1099 R Tax Forms For Annuities amp Pensions

Understanding Your 1099 R Tax Form YouTube

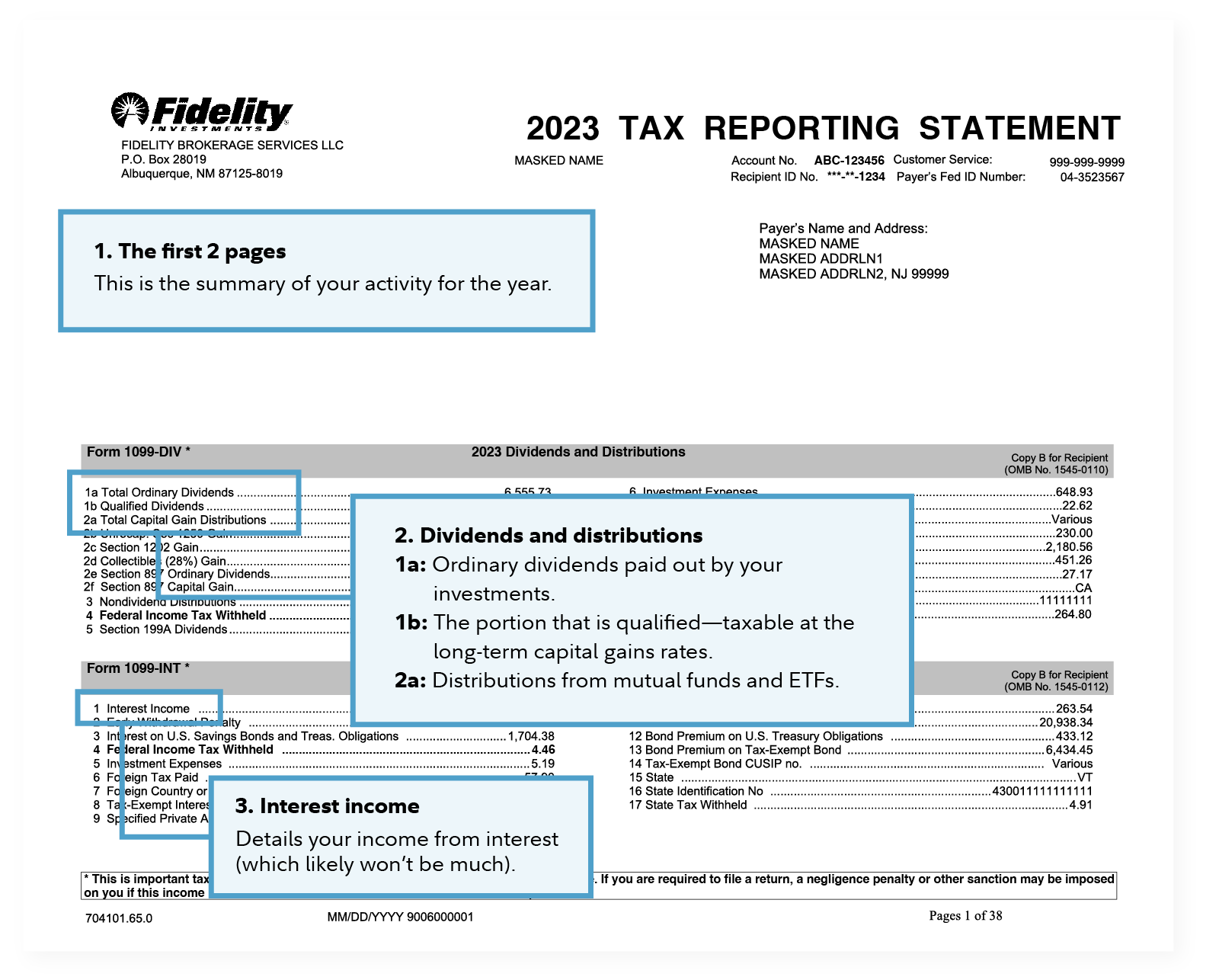

A 1099-R form is just one type of 1099 you might receive. Generally speaking, 1099 is used to report income that is received from an entity other than an employer. For instance, you might receive a Form 1099-INT if you have interest income from a savings account or certificates of deposit (CD). 1099 Pension

A 1099-R form is just one type of 1099 you might receive. Generally speaking, 1099 is used to report income that is received from an entity other than an employer. For instance, you might receive a Form 1099-INT if you have interest income from a savings account or certificates of deposit (CD). 1099 Pension 1099 Pension

:max_bytes(150000):strip_icc()/Screenshot2023-11-16at7.16.51PM-d34254919c9046c5ba06031f3f5fb7fb.png)

What Is A 1099 Form When To Use It And How It Works 59 OFF

1099 R Information MTRS Worksheets Library

1099 R Template Create A Free 1099 R Form

IRS Courseware Link Learn Taxes Worksheets Library

Pin On W 2 And 1099 Software

Show Me A 1099 B Example Form Factory Sale Emergencydentistry

1099 Pension

1099 Pension

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)

1099 Form Riset

Free 1099 R Worksheet Download Free 1099 R Worksheet Png Images Free