What Is A 501c3

What Is A 501c3 - Section 501 c 3 is the portion of the US Internal Revenue Code that allows for federal tax exemption of nonprofit organizations that meet the code s requirements These nonprofits may be considered public charities private foundations or private operating foundations which we ll explain in more detail later A 501 c 3 nonprofit organization is generally a business entity that adds to the public good The name comes from section 501 c 3 of the IRS tax code which defines the primary purposes of an organization that may qualify it for exemption from federal income tax liability The organization must receive a formal designation from the IRS

What Is A 501c3

What Is A 501c3

Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Organizations described in section 501 (c) (3), other than testing for public safety organizations, are eligible to receive tax-deductible contributions in accordance with Code section 170. Fact checked by. Daniel Rathburn. What Is 501 (c)? 501 (c) is a designation under the United States Internal Revenue Code (IRC) that confers tax-exempt status on.

What Is A 501 c 3 Organization Types Rules And Pros amp Cons

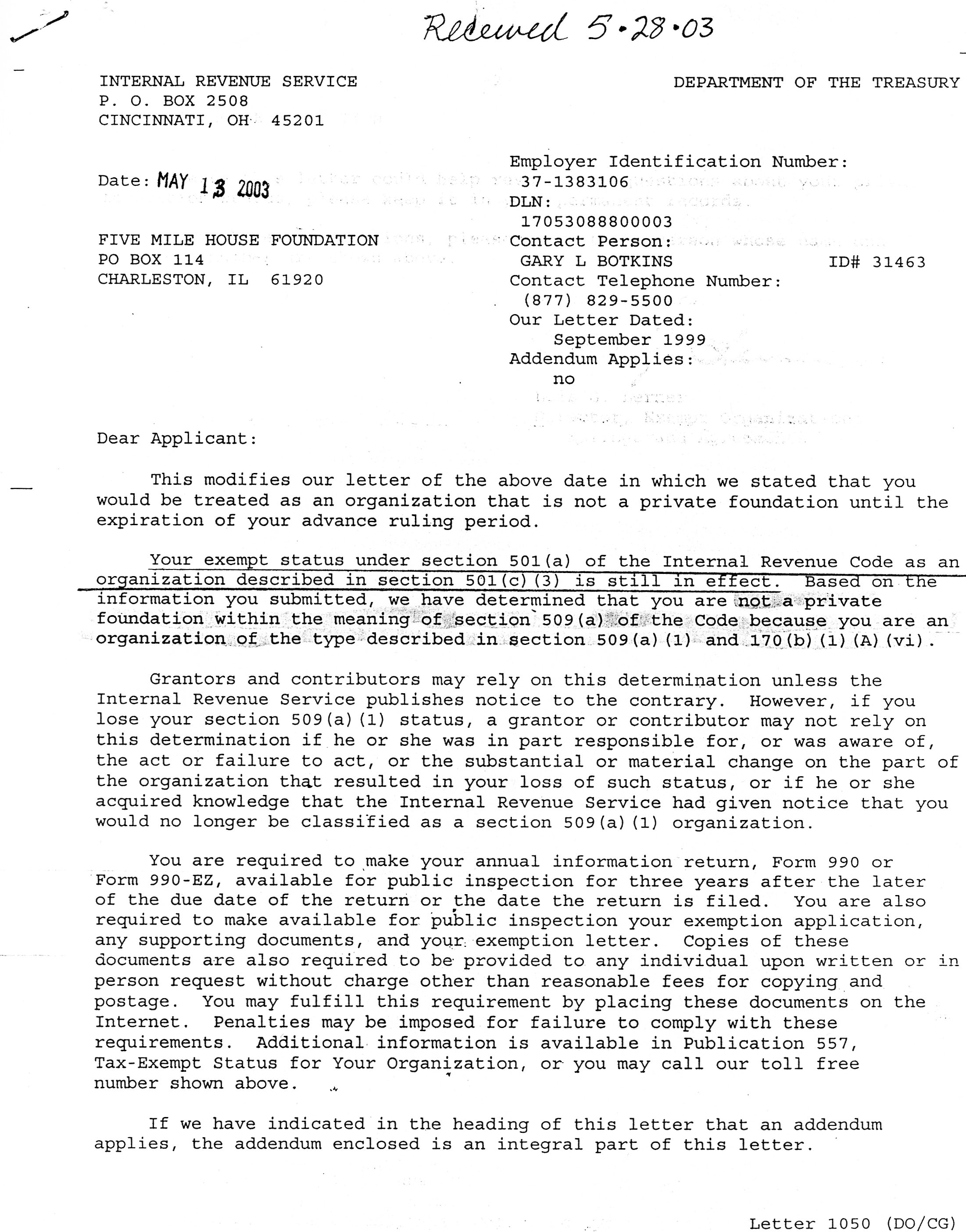

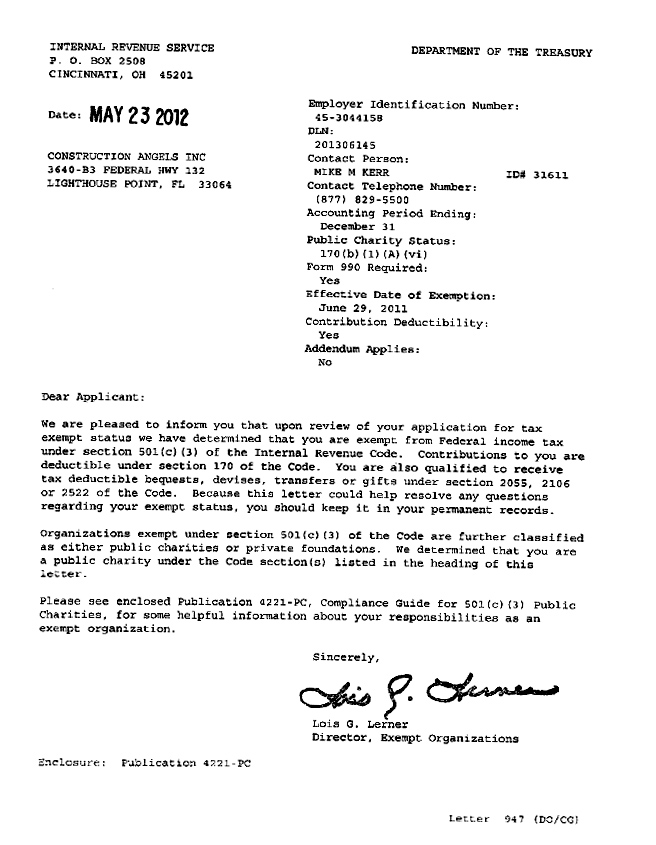

501C3 Determination Letter Thankyou Letter

What Is A 501c3Being “501 (c) (3)” means that a particular nonprofit organization has been approved by the Internal Revenue Service as a tax-exempt, charitable organization. 501 c 3 tax exemptions apply to entities that are organized and operated exclusively for religious charitable scientific literary or educational purposes for testing for public safety to foster national or international amateur sports competition or for the prevention of cruelty to children or animals 501 c 3 exemption applies als

The exempt purposes set forth in section 501 (c) (3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals. What Is The Difference Between Nonprofit And Tax Exempt 501c3 Form PDF Complete With Ease AirSlate SignNow

501 c Organization What They Are Types And Examples Investopedia

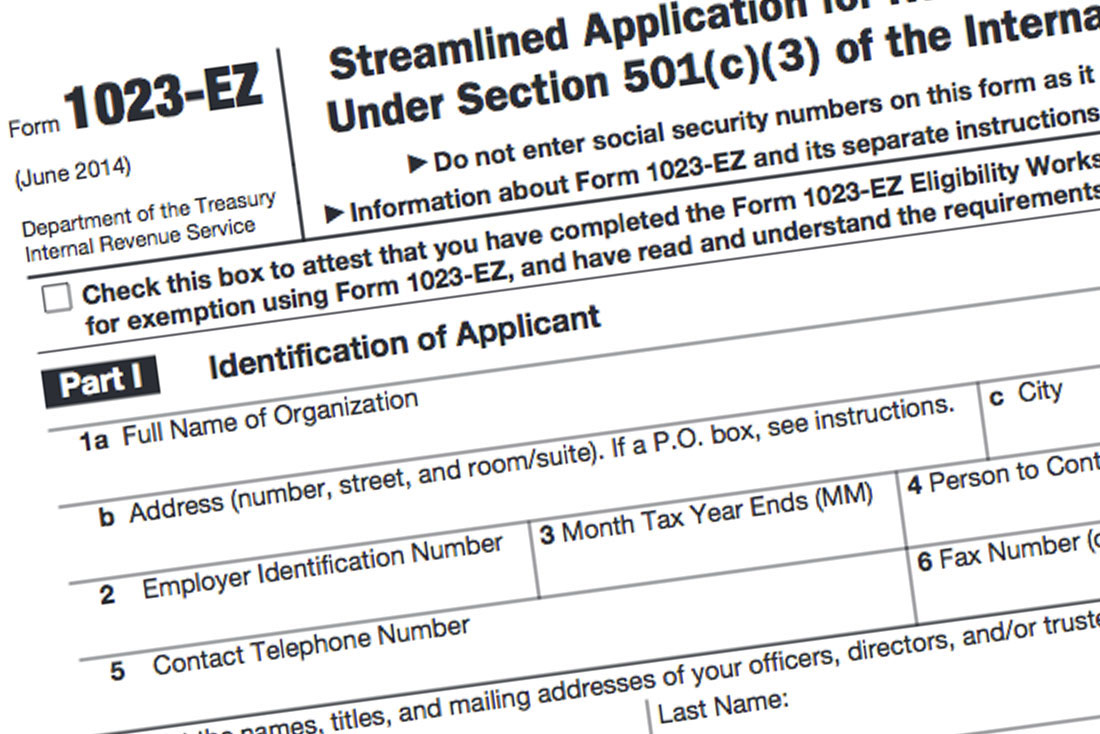

Form 1023 EZ The Faster Easier 501 c 3 Application For Small

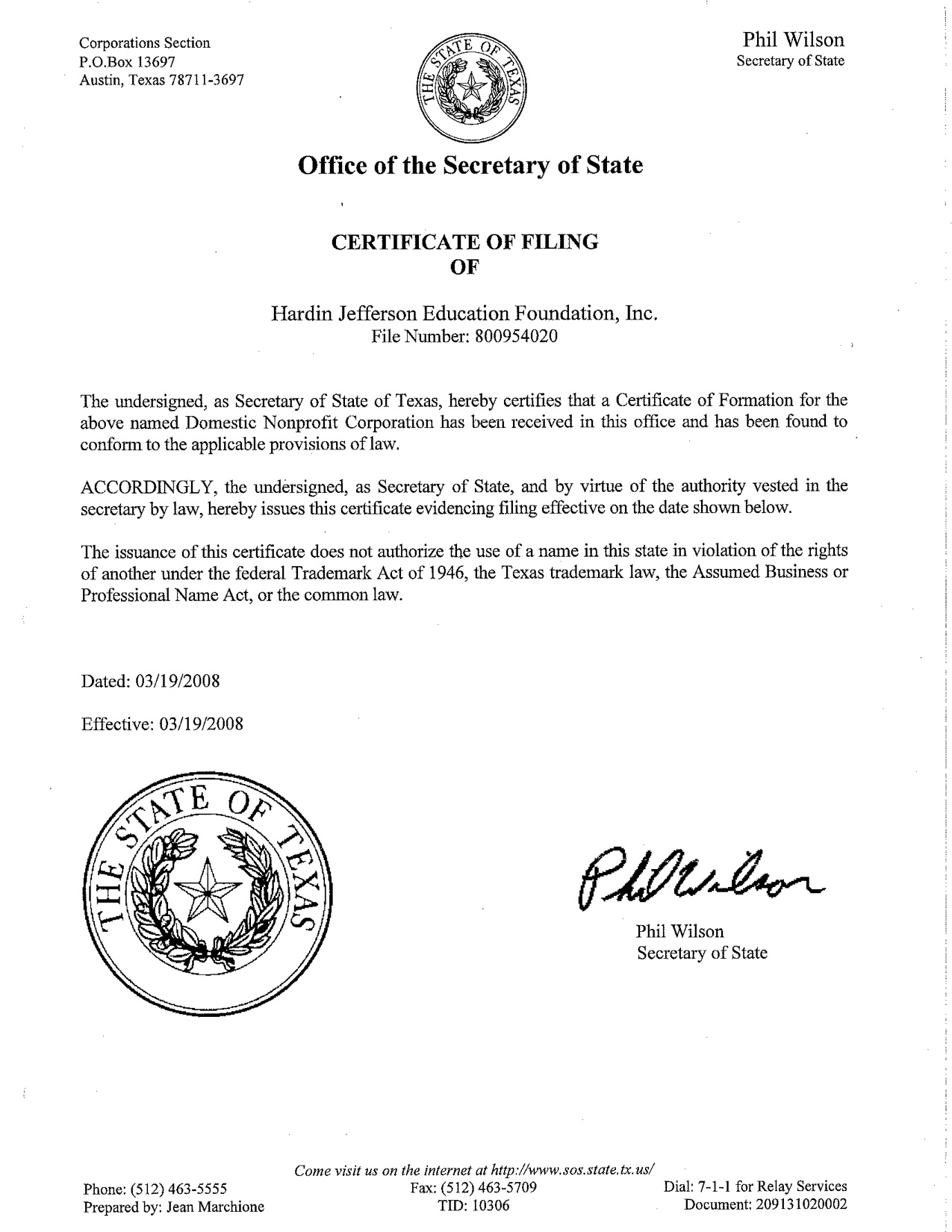

A 501 (c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code (26 U.S.C. § 501 (c)) and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. 501c3 Certificate Certificates Templates Free

A 501 (c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code (26 U.S.C. § 501 (c)) and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. 501 c 3 Nonprofit How To Start A 501c3 Nonprofit Unugtp

501 c 3 Church Basics benefits Disadvantages More

Organic torah 501c3 determination letter Organic Torah

501c3 Tax Exemption BryteBridge

IRS Non Profit Determination Letter Five Mile House

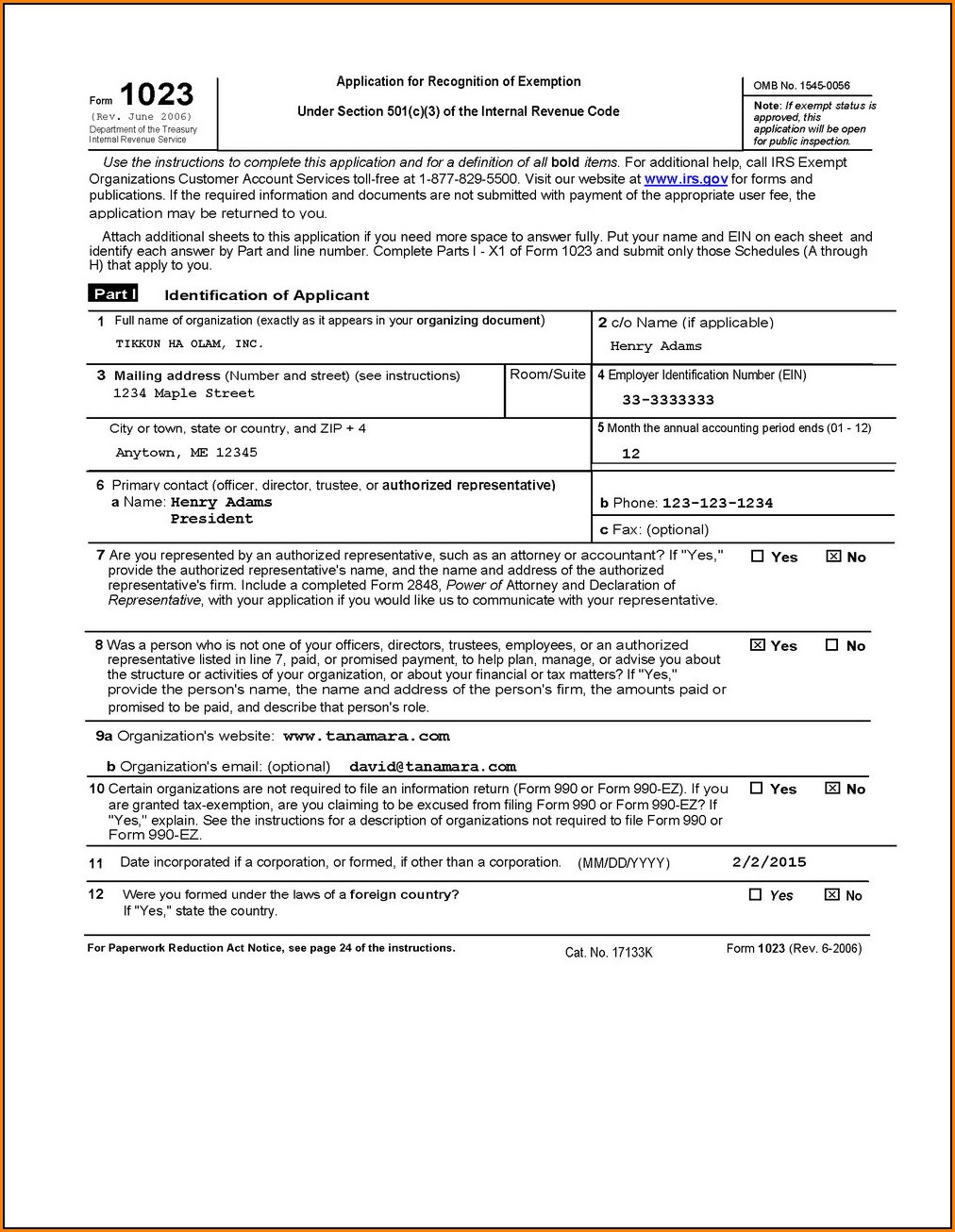

501 3c Form Form Resume Examples nO9bPxGV4D

IRS 501 c Subsection Codes For Tax Exempt Organizations Harbor

501c3 Form Sample Form Resume Examples wRYPBlP24a

501c3 Certificate Certificates Templates Free

Printable 5013c Forms Printable Forms Free Online

501C3 Articles Of Incorporation Template