What Is Form 2210

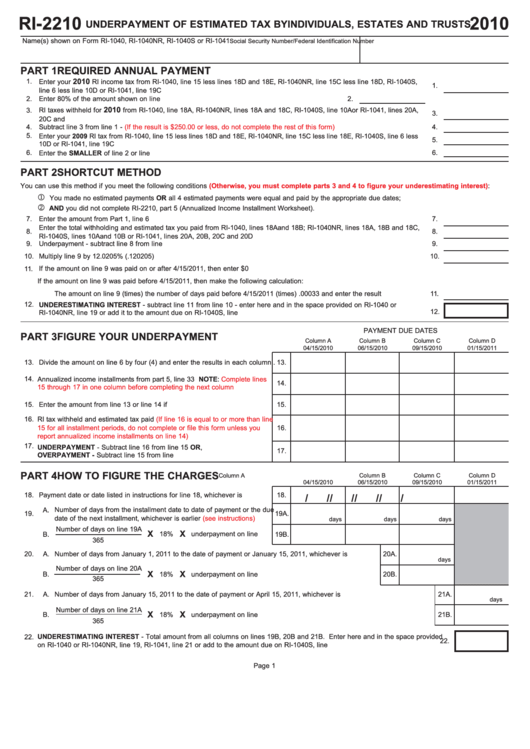

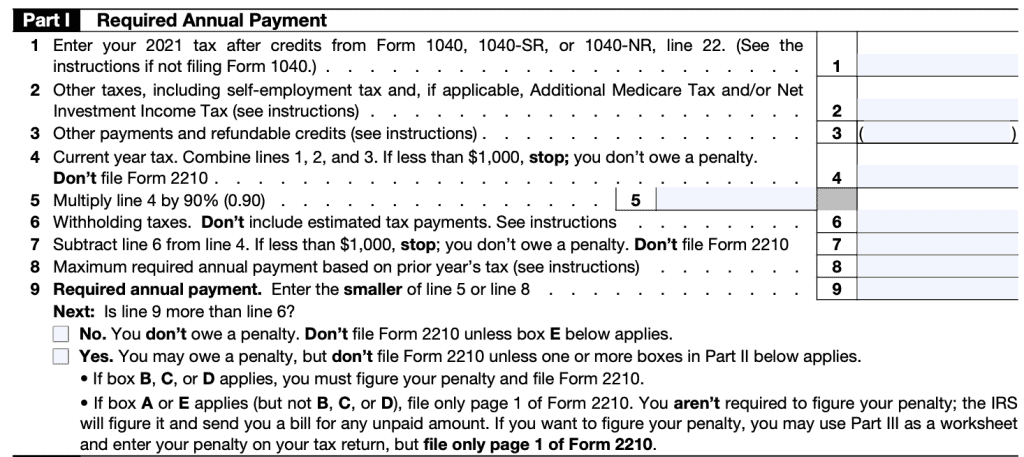

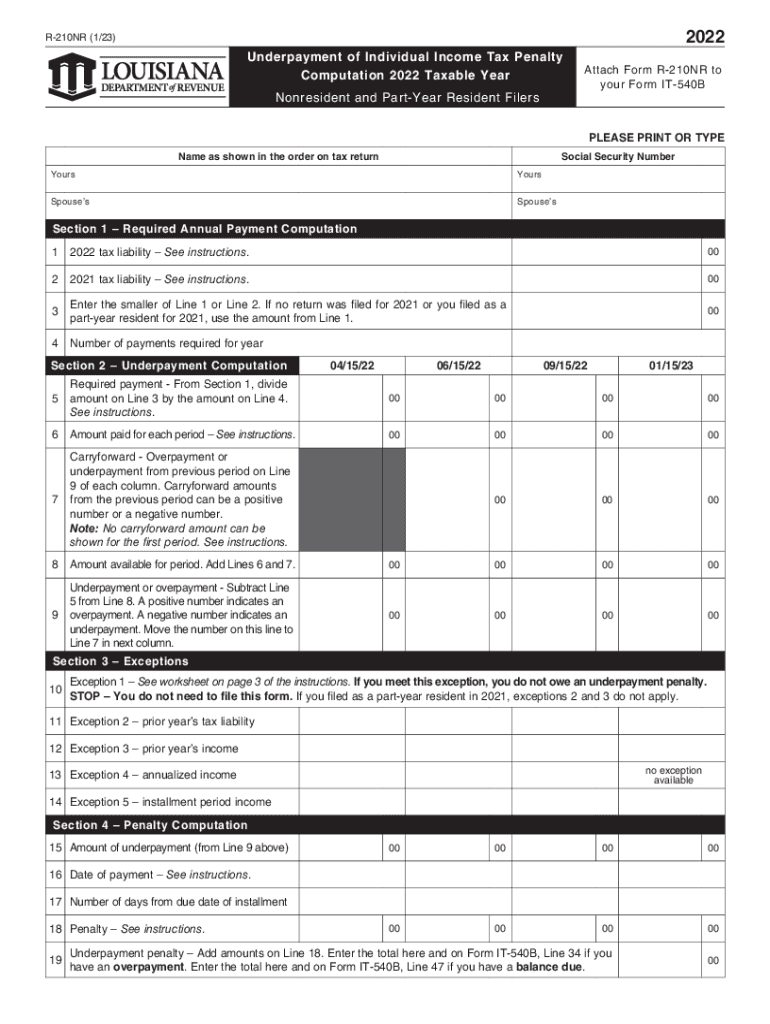

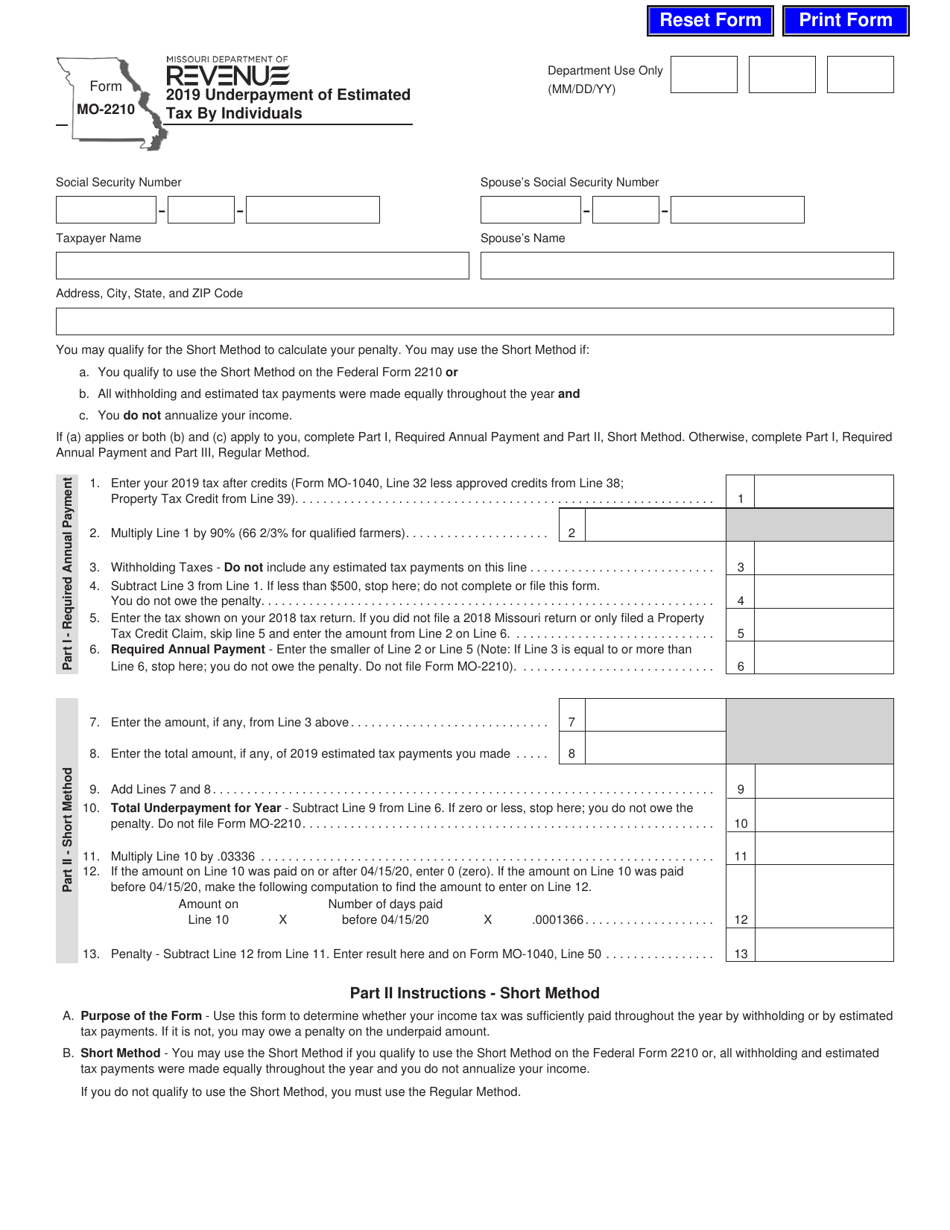

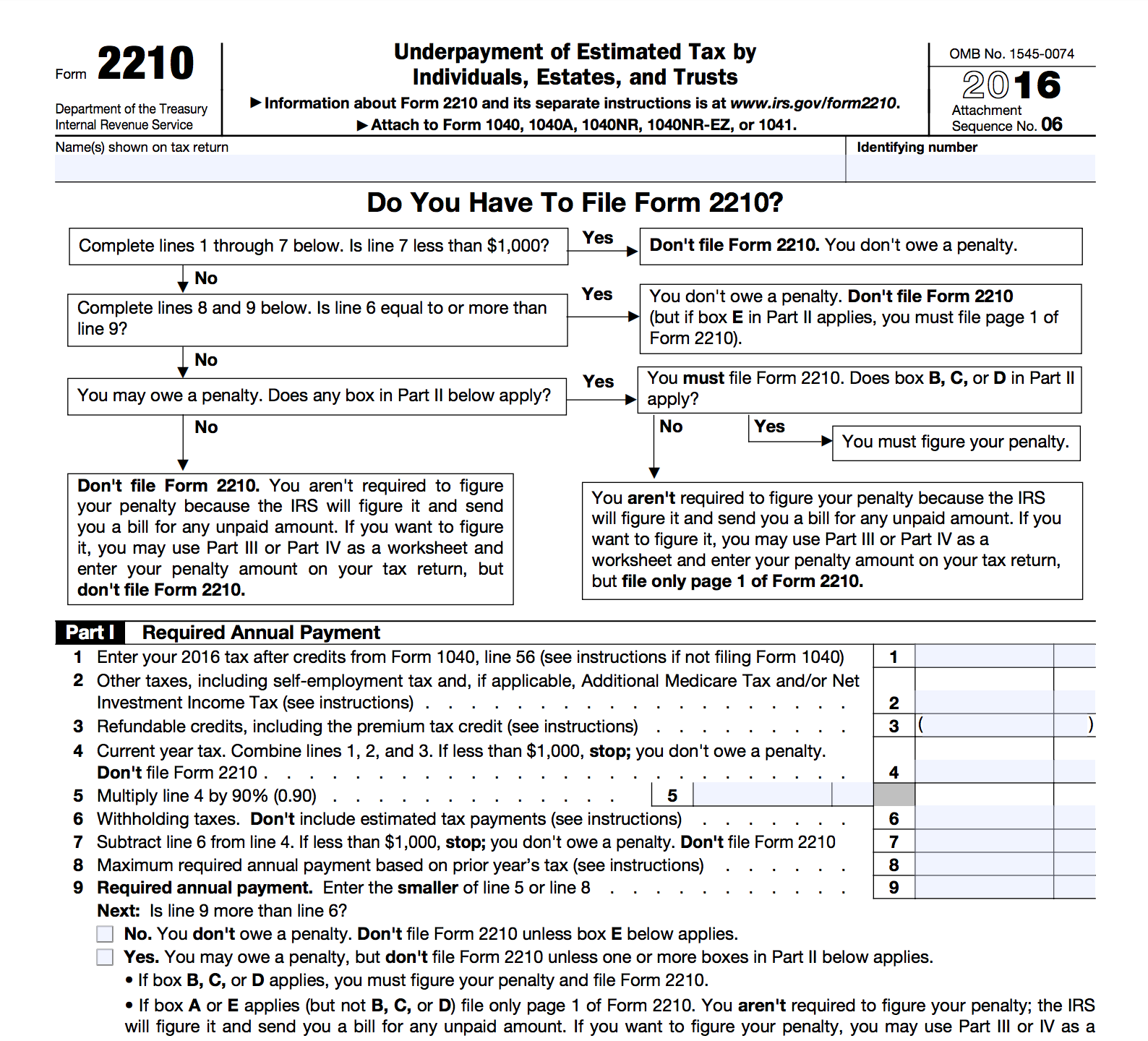

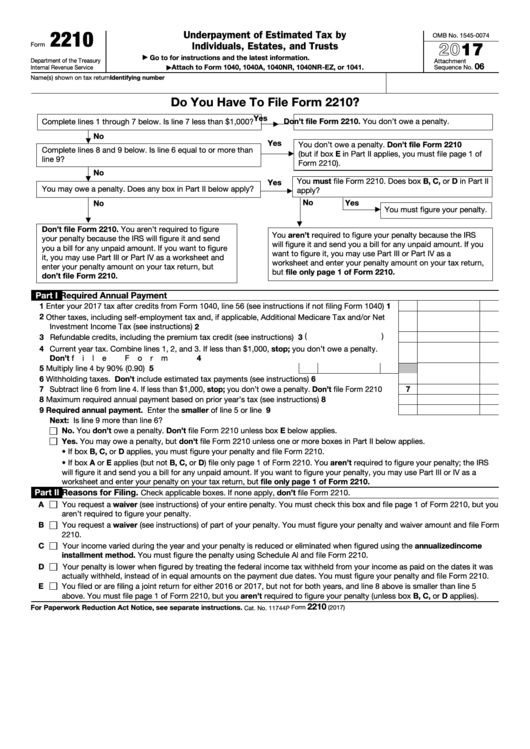

What Is Form 2210 - Web Oct 27 2022 nbsp 0183 32 You can use Form 2210 Underpayment of Estimated Tax by Individuals Estates and Trusts as well as a worksheet from the Form 2210 Instructions to calculate your penalty Web Apr 11 2024 nbsp 0183 32 Contents While the IRS will send you a notice about the penalty themselves you can use IRS Form 2210 to determine whether you owe a penalty calculate how much that penalty will be and pay your penalty using your tax return In most cases you won t have to file Form 2210 since the IRS will figure your penalty for you

What Is Form 2210

What Is Form 2210

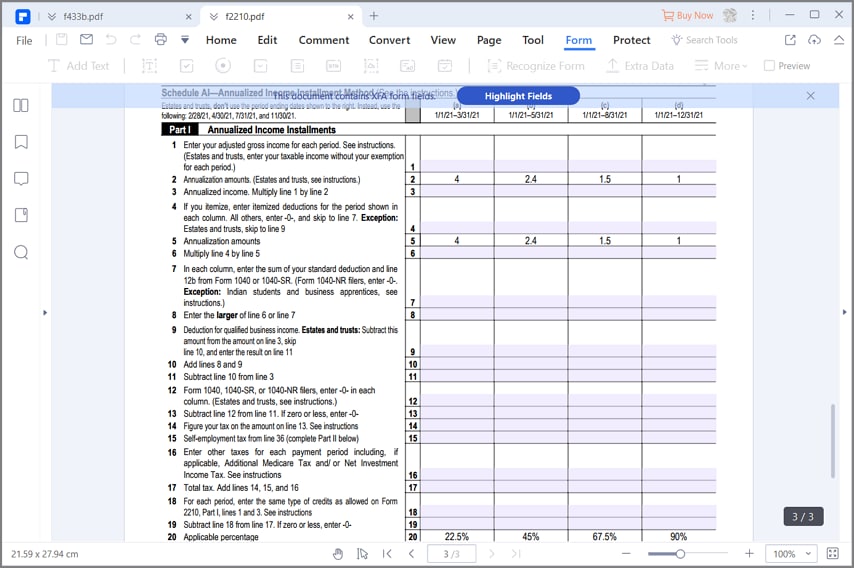

Underpayment of Estimated Tax by Individuals, Estates, and Trusts. Attach to Form 1040, 1040-SR, 1040-NR, or 1041. Go to www.irs.gov/Form2210 for instructions and the latest information. ;Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, helps taxpayers determine if they owe a penalty for underpayment of estimated taxes. An underpayment penalty may arise when your tax payments, including withholding and estimated tax payments, fall short of what you owe in federal income taxes.

What Is Form 2210 Calculating Underpayment Of Estimated Tax

Form 2210 Underpayment Of Estimated Tax By Individuals Estates And

What Is Form 2210;Form 2210, titled "Underpayment of Estimated Tax by Individuals, Estates, and Trusts," is a tool the IRS uses to determine whether taxpayers have paid enough tax throughout the year via withholding or estimated tax payments. Web Apr 10 2024 nbsp 0183 32 Use Form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties You may need this form if You re self employed or have other income that isn t subject to withholding such as investment income

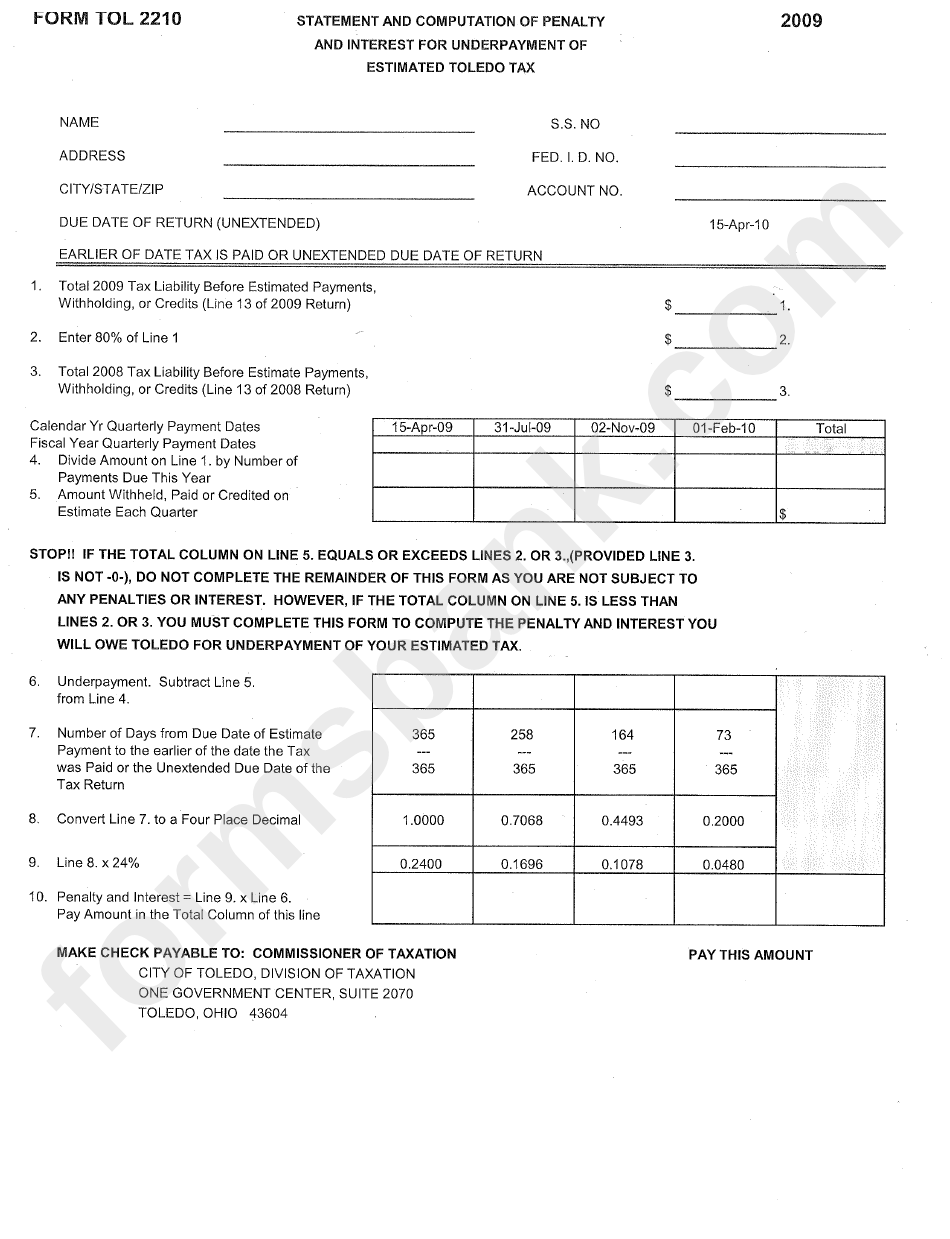

;What is Form 2210? IRS Form 2210 serves to calculate a penalty for underpaying estimated taxes. Most business owners, freelancers, and independent investors pay estimated taxes four times a year, due April 15, June 15, September 15, and January 15 (or by July 15 during extraordinary circumstances such as 2020). Form M 2210 Edit Fill Sign Online Handypdf Form DCF 2210 Fill Out Sign Online And Download Fillable PDF

What Is Form 2210 The Underpayment Penalty And Who Must

Form 2210 Underpayment Of Estimated Tax By Individuals Estates And

;Instructions. Comments. fillable forms. If you’re filing an income tax return and haven’t paid enough tax throughout the tax year, you may be filling out IRS Form 2210. In this article, we will cover what you need to know about IRS Form 2210, including: How to complete IRS Form 2210. How to determine whether your may have an underpayment … What Is How To File It Out IRS Form 2210 Accounts Confidant

;Instructions. Comments. fillable forms. If you’re filing an income tax return and haven’t paid enough tax throughout the tax year, you may be filling out IRS Form 2210. In this article, we will cover what you need to know about IRS Form 2210, including: How to complete IRS Form 2210. How to determine whether your may have an underpayment … IRS Form 2210 Fill It With The Best Form Filler Instructions For Form 2210 Underpayment Of Estimated Tax By

IRS Form 2210 A Guide To Underpayment Of Tax

Tax Form 2210 Instructions A Complete Guide

2210 2022 2024 Form Fill Out And Sign Printable PDF Template

Irs Form 2210 For 2023 Printable Forms Free Online

Form MO 2210 Download Fillable PDF Or Fill Online Underpayment Of

IRS Form 2210 Fill It With The Best Form Filler

Form Tol 2210 Statement And Computation Of Penalty And Interest

What Is How To File It Out IRS Form 2210 Accounts Confidant

Estimated Vs Withholding Tax Penalty Rules Saverocity Finance

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals