What Is Working Capital In Accounting

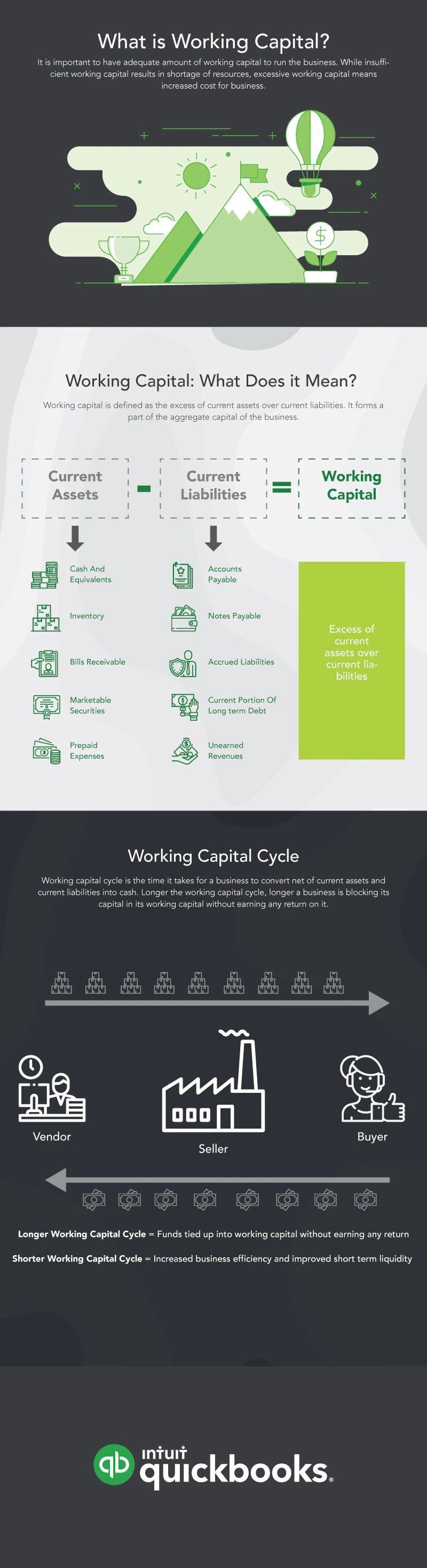

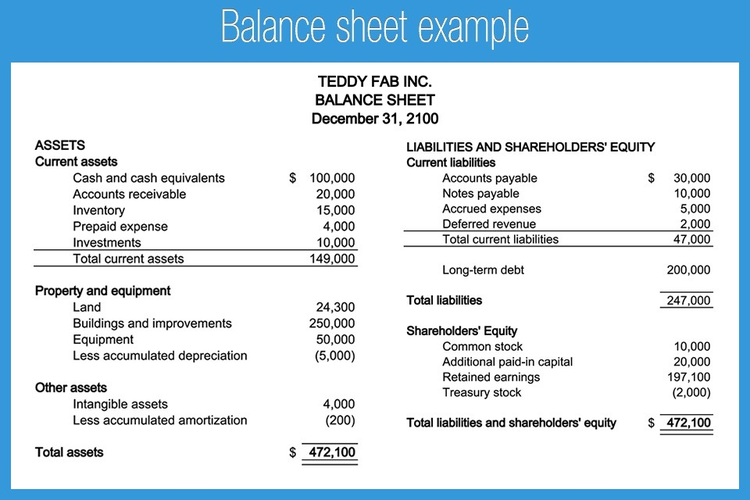

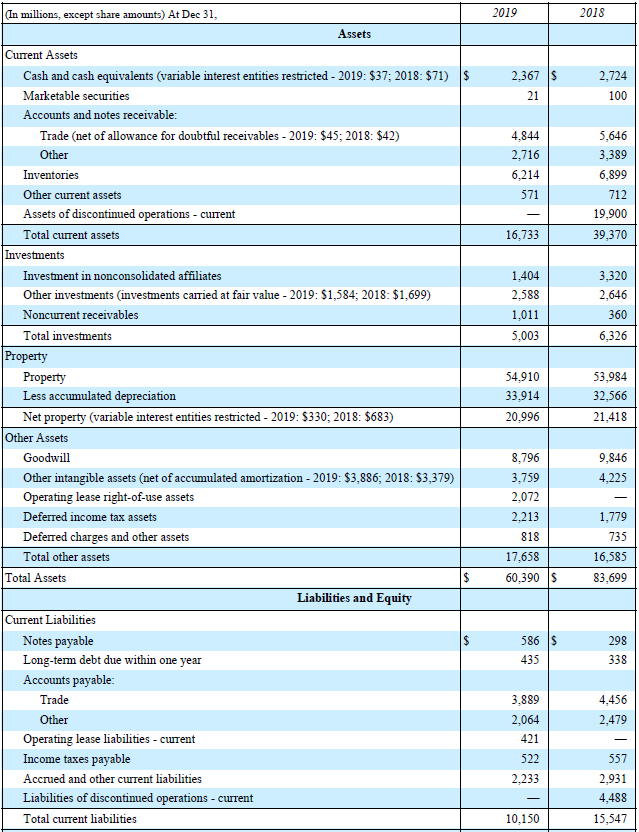

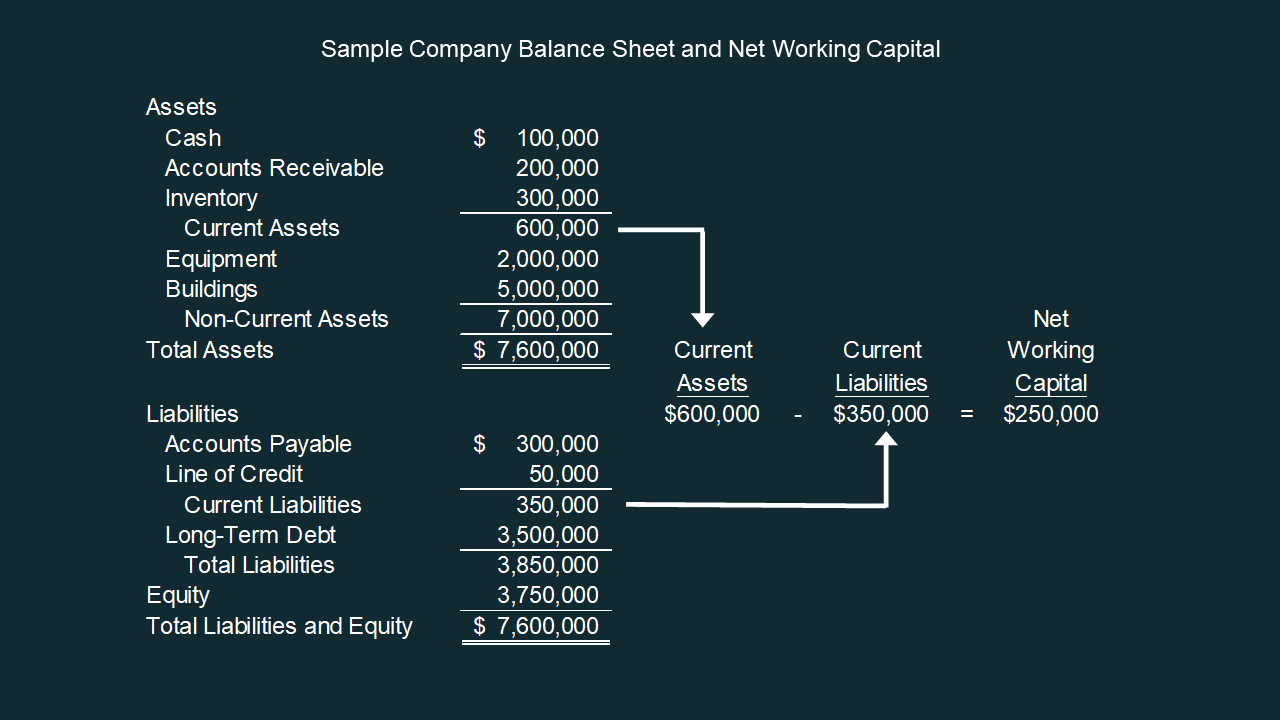

What Is Working Capital In Accounting - In financial accounting working capital is a specific subset of balance sheet items and calculated by subtracting current liabilities from current assets Working capital is a fundamental part of financial management which is directly tied to a company s operational efficiency and long term viability Working capital is the day to day cash that a company needs to run business operations It is the difference between a company s current assets and its current liabilities A company s working

What Is Working Capital In Accounting

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

What Is Working Capital In Accounting

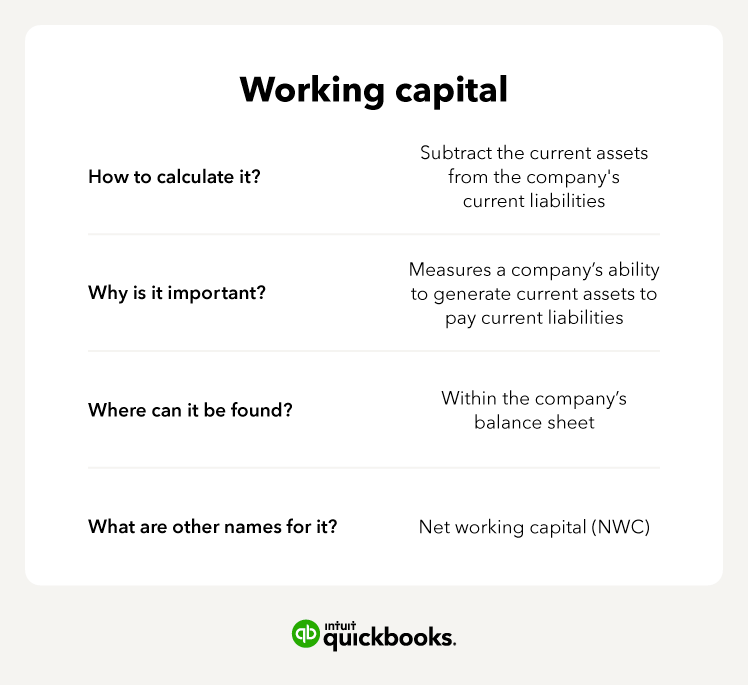

To calculate working capital, subtract a company's current liabilities from its current assets. A positive amount of working capital means a company can meet its short-term liabilities and . Working Capital = Current Assets – Current Liabilities. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. It is a measure of a company’s short-term liquidity and is important for performing financial analysis, financial modeling, and managing cash flow.

How Working Capital Works Investopedia

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

Working Capital Definition Formula And Examples

What Is Working Capital In AccountingExample. For instance, a manufacturer that has current liabilities of $100,000 and current assets of $200,000 has working capital of $100,000. This means that after all the current liabilities are paid off the company still has $100,000 of current assets remaining. This manufacturer is highly liquid. When analyzing a company’s working capital . Working capital also known as net working capital is a measurement of a business s short term financial health Simply put it indicates your liquidity or ability to pay your bills You can find it by taking your current assets and subtracting your current liabilities both of which can be found on your balance sheet

Working capital is the amount of an entity's current assets minus its current liabilities. The result is considered a prime measure of the short-term liquidity of an organization. A strongly positive working capital balance indicates robust financial strength, while negative working capital is considered an indicator of impending bankruptcy. Strategies For Optimizing Working Capital Balancing Liquidity And Sources Of Working Capital Finance Loan

Working Capital Formula How To Calculate Working Capital

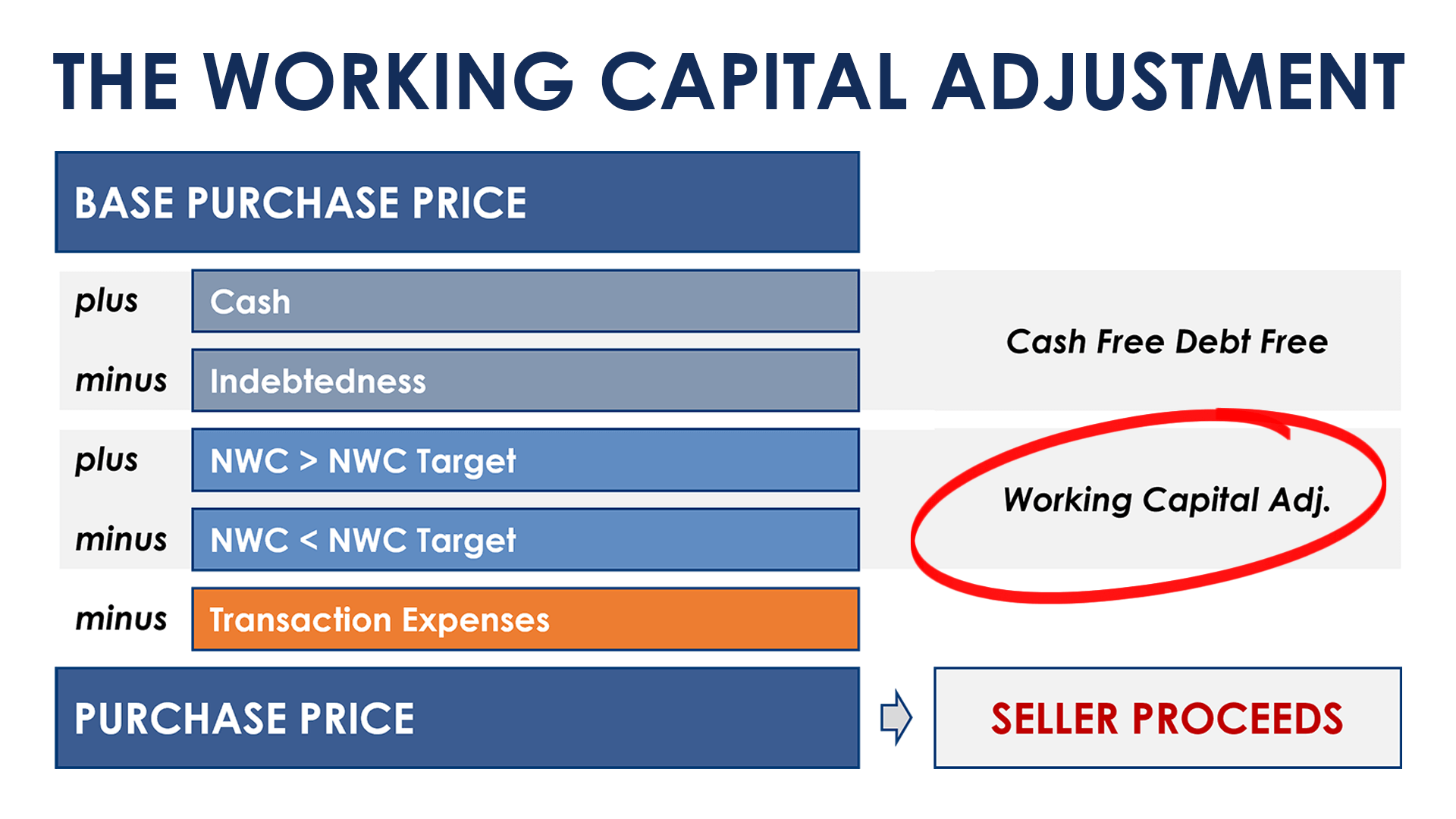

The Working Capital Adjustment A Simple Model

Working capital, also called net working capital (NWC), is an accounting formula that is calculated by subtracting a business’s current liabilities from its current assets. These assets include cash, customers’ unpaid bills, finished goods, and raw materials. Liabilities are any current debts and accounts payable. Types Of Working Capital Gross And Net Temporary And Permanent

Working capital, also called net working capital (NWC), is an accounting formula that is calculated by subtracting a business’s current liabilities from its current assets. These assets include cash, customers’ unpaid bills, finished goods, and raw materials. Liabilities are any current debts and accounts payable. Is Bonds Payable Considered Working Capital In Finance What Is Working Capital Formula Ratio And Examples BDC ca

Midnight Maid Tricky Net Working Capital Balance Sheet Achievement

Types Of Working Capital Check Factors Meaning QuickBooks

![]()

Working Capital Why Your Business Needs A Strategy Company

:max_bytes(150000):strip_icc()/WORKING-CAPITAL-FINAL-a6e7622f373e4210bd6d9eace32bdc82.png)

Working Capital Formula Components And Limitations Working Capital

A Small Business Guide To Calculating Net Working Capital

Working Capital Definition Formula Excel Example

:max_bytes(150000):strip_icc()/workingcapitalmanagement_definition_0914-38bc0aea642a4a589c26fbc69ea16564.jpg)

Is Bonds Payable Considered Working Capital In Finance

Types Of Working Capital Gross And Net Temporary And Permanent

Net Working Capital Formulas Examples And How To Improve It

Pin On Smesauda