2024 Federal Income Tax Forms

2024 Federal Income Tax Forms - The tax year 2024 maximum Earned Income Tax Credit amount is 7 830 for qualifying taxpayers who have three or more qualifying children an increase of from 7 430 for tax year 2023 The revenue procedure contains a table providing maximum EITC amount for other categories income thresholds and phase outs Tax Calculator IRS Federal Tax Forms Schedules For 2024 The Forms and Schedules on this page are for Tax Year 2024 January 1 until December 31 2024 Prepare and e File 2024 Tax Returns starting in January 2025

2024 Federal Income Tax Forms

2024 Federal Income Tax Forms

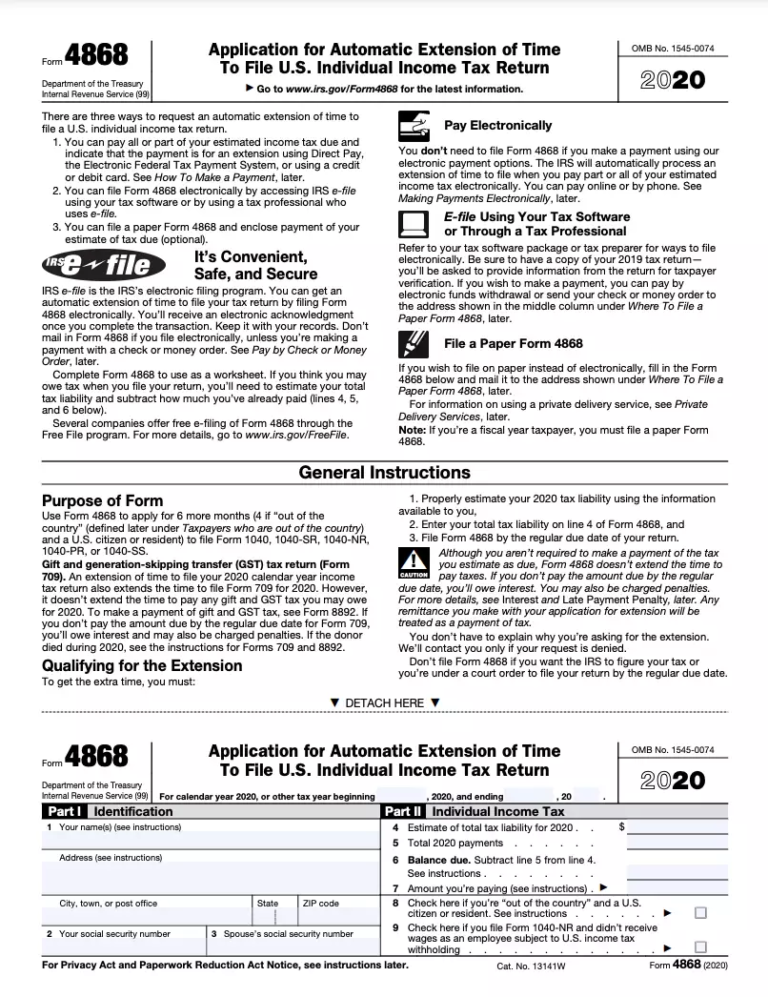

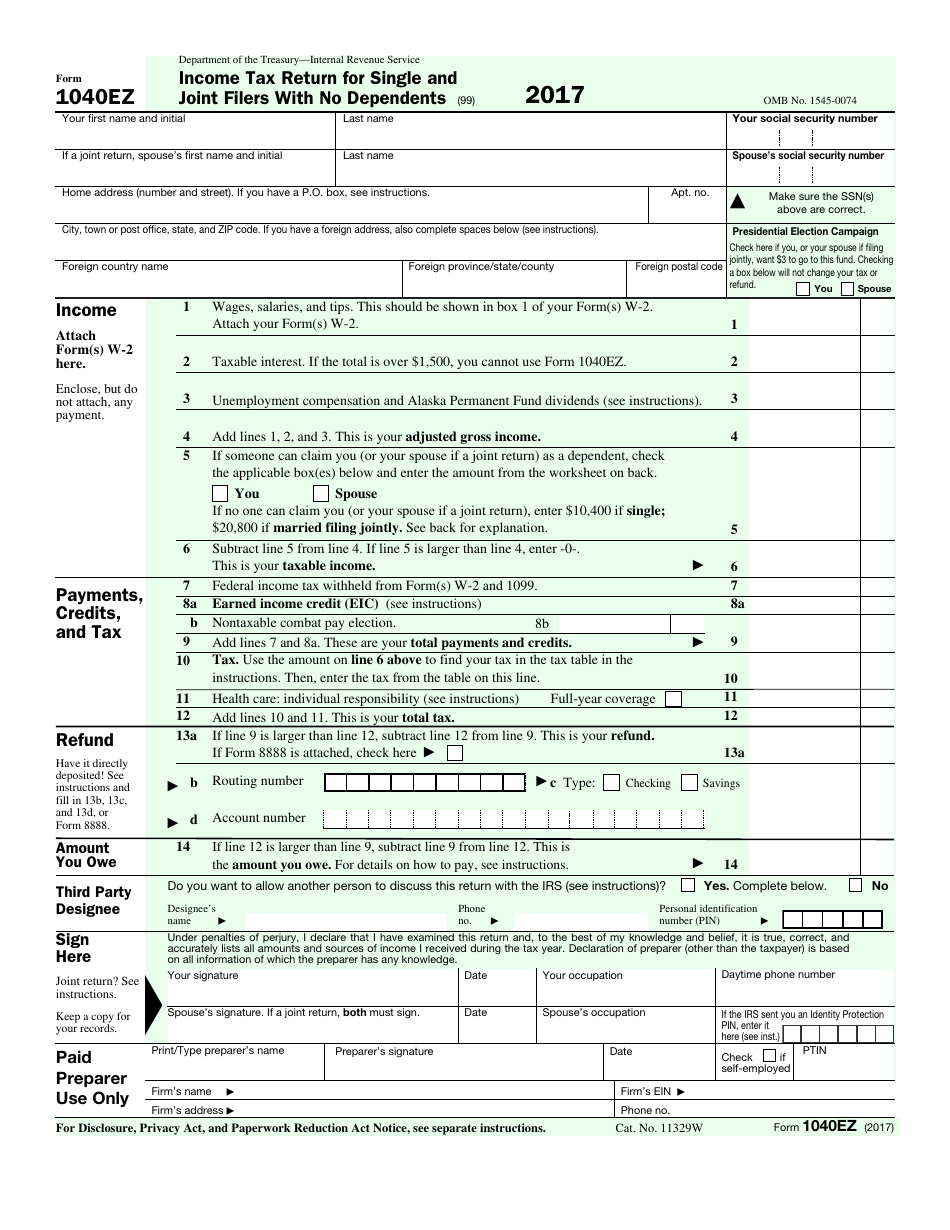

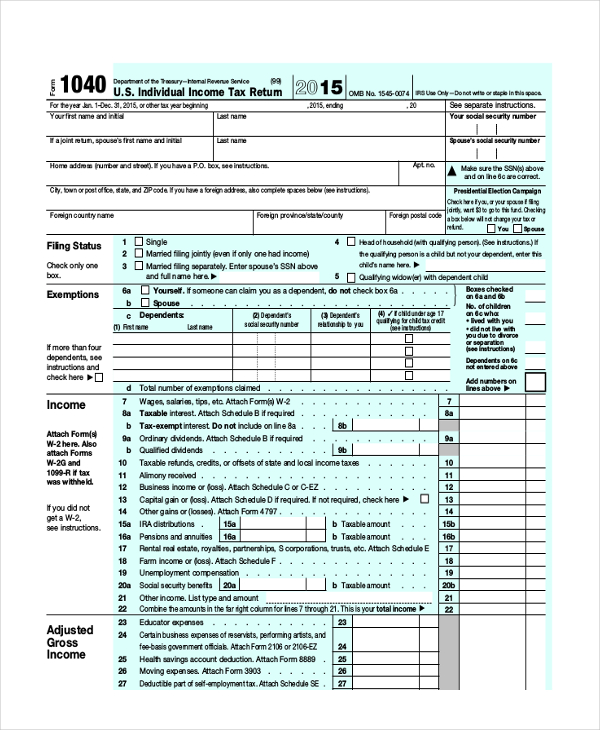

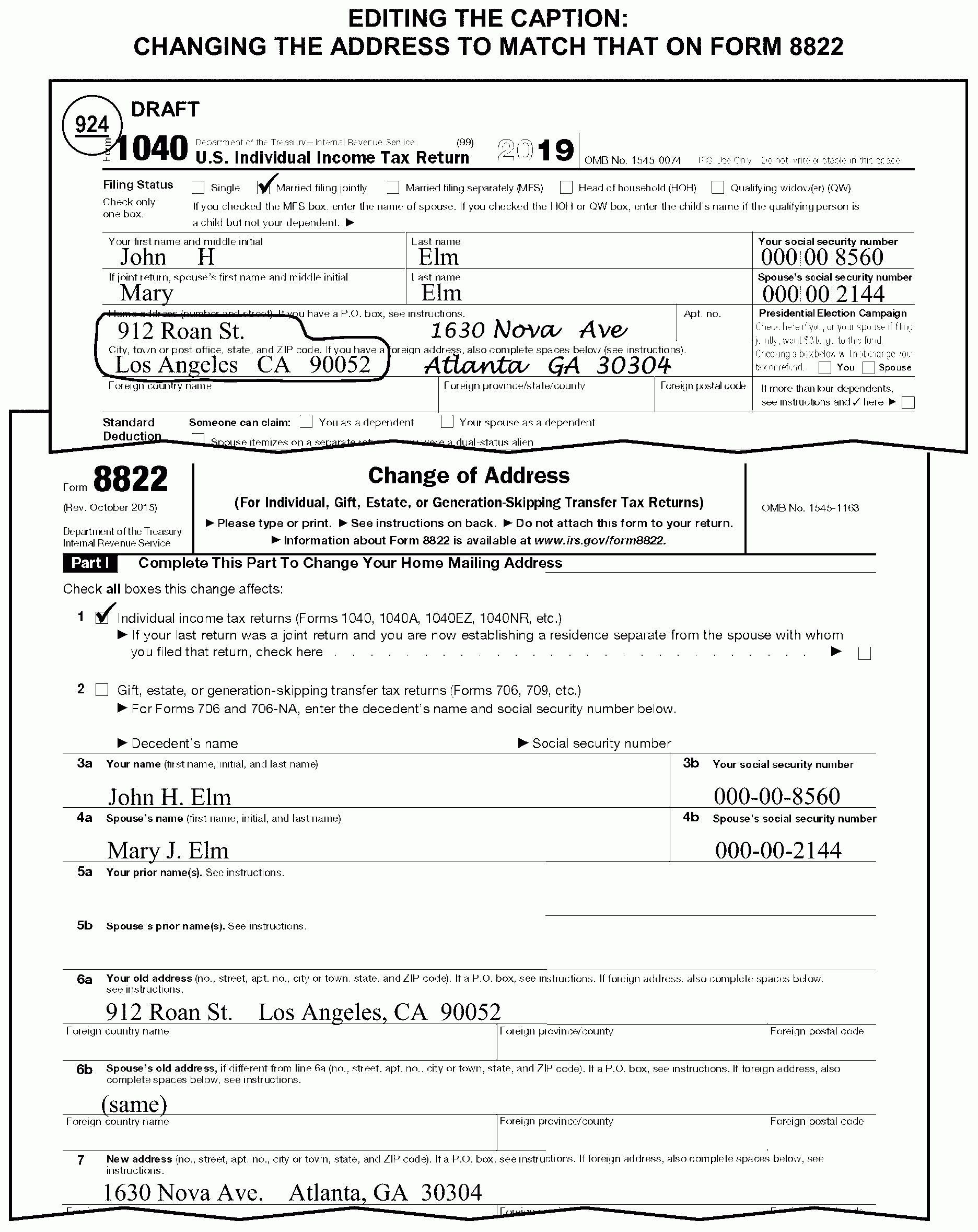

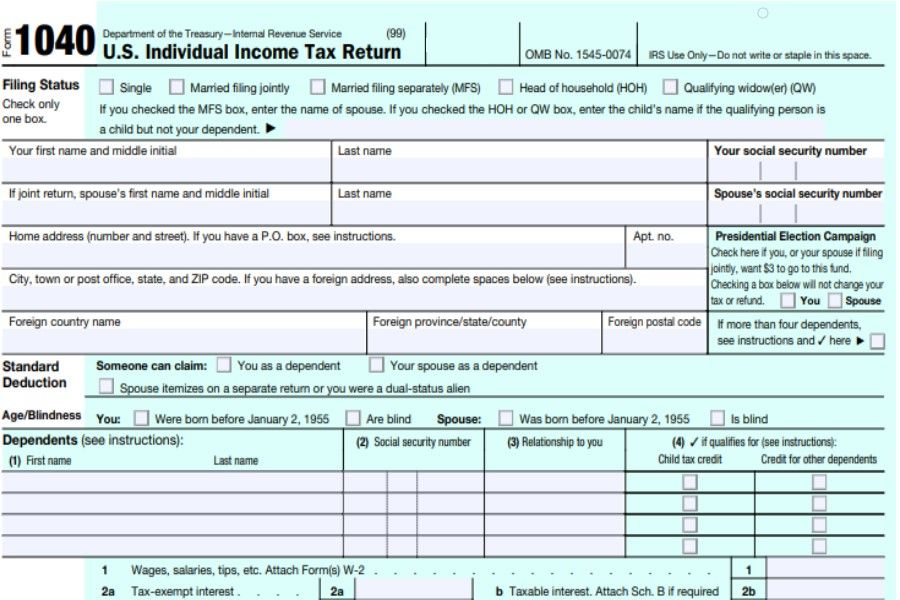

TRAVERSE CITY, MI, US, November 27, 2023 / EINPresswire.com / -- The Internal Revenue Service (IRS) will soon usher in the tax season by releasing the eagerly awaited 2024 version of Form... The IRS Form 1040 is the standard federal tax income form used to report your income and tax deductions, calculate your taxes, and your refund or balance due for the year. There are two different types: Form 1040 and Form 1040-SR. Form 1040-SR is specifically designed for people 65 and over.

Tax Forms For 2024 Tax Returns Due in 2025 Tax Calculator e File

Federal Withholding Tax Tables Review Home Decor

2024 Federal Income Tax FormsStarting in 2023, this form, alongside Form W-4R for Nonperiodic Payments and Eligible Rollover Distributions, is mandatory. Parallel to the adjustments in Form W-4, the 2024 draft Form W-4P incorporates the IRS's Tax Withholding Estimator into Step 2. This enhancement guarantees precise income tax withholding for pension and annuity payments. With an Online Account individuals can also View their tax owed and payment history and schedule payments Request tax transcripts View or apply for payment plans See digital copies of some IRS notices View key data from their most recently filed tax return including adjusted gross income

Nov 9, 2023,02:22pm EST Listen to article Share to Facebook Share to Twitter Share to Linkedin 2024 numbers getty The IRS has announced the annual inflation adjustments for the year 2024,... RECORD INCOME TAXES FOR 2022 AND AN ENTRY FOR 2023 Alsup Consulting Sometimes Performs Services Free Federal Tax Forms Printable

Filing your 1040 tax return in 2024 Jackson Hewitt

Top 20 US Tax Forms In 2022 Explained PDF co

Get a list of important tax and compliance deadlines for January 2024, and be sure to share this list with your clients. ... Qualifying small employers file annual Form 944, Employer's Annual Federal Tax Return, for 2023 (in lieu of quarterly Form ... Social Security, Medicare, and withheld income tax. File Form 941 for the fourth quarter of ... 6 2 The U S Federal Income Tax Process Business LibreTexts

Get a list of important tax and compliance deadlines for January 2024, and be sure to share this list with your clients. ... Qualifying small employers file annual Form 944, Employer's Annual Federal Tax Return, for 2023 (in lieu of quarterly Form ... Social Security, Medicare, and withheld income tax. File Form 941 for the fourth quarter of ... Form 40 Download Fillable PDF Or Fill Online Individual Income Tax Return 2019 Idaho Michigan Income Tax Withholding 2021 2022 W4 Form

Irs Tax Forms Printable

Tax Return Wait Time 2021 Canada QATAX

Printable Federal Income Tax Forms Printable Forms Free Online

Free Federal Tax Forms Printable

Free Printable Irs Tax Forms

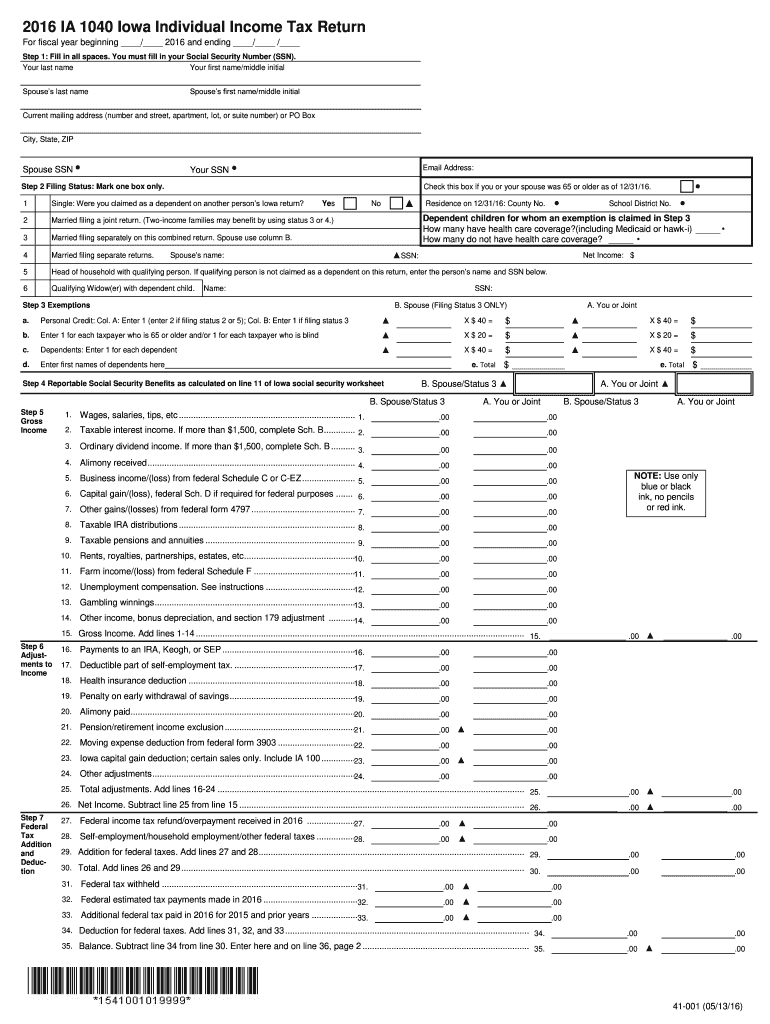

Iowa Income Tax Forms Fillable Fill Out And Sign Printable PDF Template SignNow

The Inconvenient Truth About The Convenience Rule LendAmi

6 2 The U S Federal Income Tax Process Business LibreTexts

Canada TD1 E 2019 Fill And Sign Printable Template Online US Legal Forms

2021 Federal Tax Forms Printable 2022 W4 Form