Cheap Long Term Care Insurance

Cheap Long Term Care Insurance - We reviewed and compared waiting periods and discounts from the best long term care insurance providers This list will help you select the one right for your needs Affordable long term care insurance can be difficult to secure Consumer Reports money expert offers what factors you need to consider as well as suggest cheaper alternatives

Cheap Long Term Care Insurance

Cheap Long Term Care Insurance

1. Buy sooner rather than later. Long-term care insurance is less expensive if you apply early. You can buy a policy up to age 75 from most companies, but you'll pay more at older ages and... Best Long Term Care Insurance. Based on In-Depth Reviews. A comprehensive guide to long-term care insurance: why you need it, when to buy it, how much it costs, and how to compare the best long-term care insurance providers. Last Updated: February 22, 2024. 200+. Hours of research. 20+. Sources used. 12. Companies vetted. 3. Features reviewed. 6.

Affordable Long term Care Insurance Advice Consumer Reports

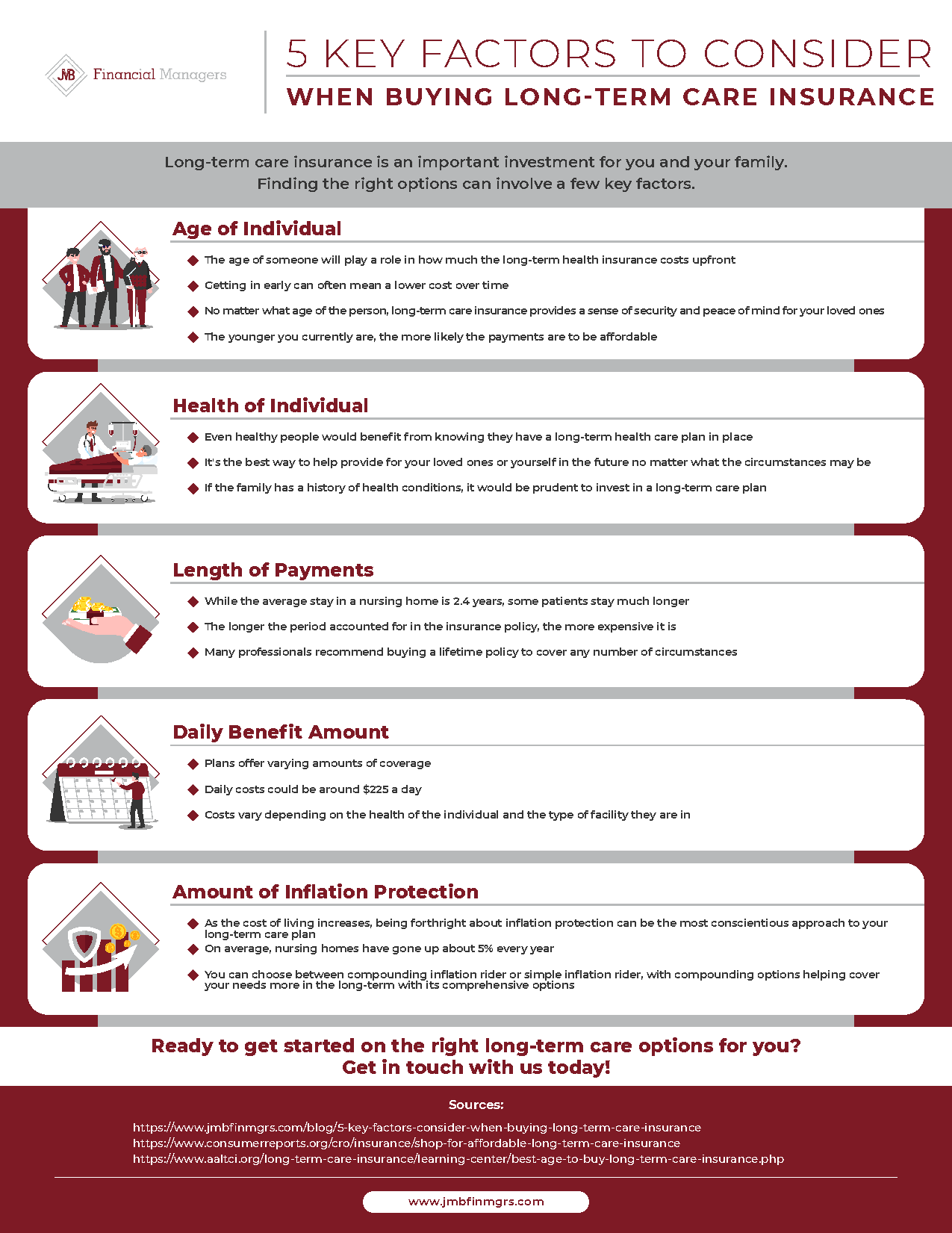

Infographic What To Consider When Buying Long Term Care Insurance

Cheap Long Term Care InsuranceThe average annual cost of long-term care insurance ranges from $950 to over $6,000, according to the American Association for Long-Term Care Insurance (AALTCI) What is long-term care... Long term care insurance can protect your assets from the high costs of extended care The two main long term care insurance options are traditional and hybrid policies Only about nine insurers offer traditional long term care insurance plans More companies now offer hybrid policies yet those tend to be more expensive

Below you can learn about prominent insurance companies offering long-term care policies that can offset increasingly high care costs. You'll also find information to help you understand the basic terminology of the industry and the do's and don't of choosing a policy. The Lisa Vogel Agency The Benefits Of Long Term Care Insurance Top 10 Best Long Term Care Insurance Companies

Top Long Term Care Insurance Companies 2024 ConsumersAdvocate

Buying Long Term Care Insurance SeniorAdvisor Blog

With the cost of care at an all-time high, a long-term care insurance policy can help you pay for assisted living, nursing homes, or other care — in either your home or a facility. The best long-term care insurance providers offer late issue ages, additional riders, discounts for couples, and flexible premium payment options. Accessing A Long Term Care Insurance Policy 1 Great Way To Pay For In

With the cost of care at an all-time high, a long-term care insurance policy can help you pay for assisted living, nursing homes, or other care — in either your home or a facility. The best long-term care insurance providers offer late issue ages, additional riders, discounts for couples, and flexible premium payment options. Infographic Do You Need Long term Care Insurance Long Term Care Who Needs Long Term Care Insurance Ramsey

What Are The Best Long Term Care Insurance Options

How Much Does Long Term Care Insurance Cost Mint

Is Long Term Care Insurance Worth The Cost Oklahoma Estate Planning

How Much Does Long Term Care Insurance Cost In 2020

How Much Does Long Term Care Insurance Cost Mint

Long Term Care Insurance Carroll Steele Insurance Agency Inc

Don t Wait Too Long To Purchase Long Term Care Insurance

Accessing A Long Term Care Insurance Policy 1 Great Way To Pay For In

7 Facts You Need To Know About Long Term Care Insurance Blog

5 Best Long Term Care Insurance Companies Of 2022