Instructions For Form 8962 2024

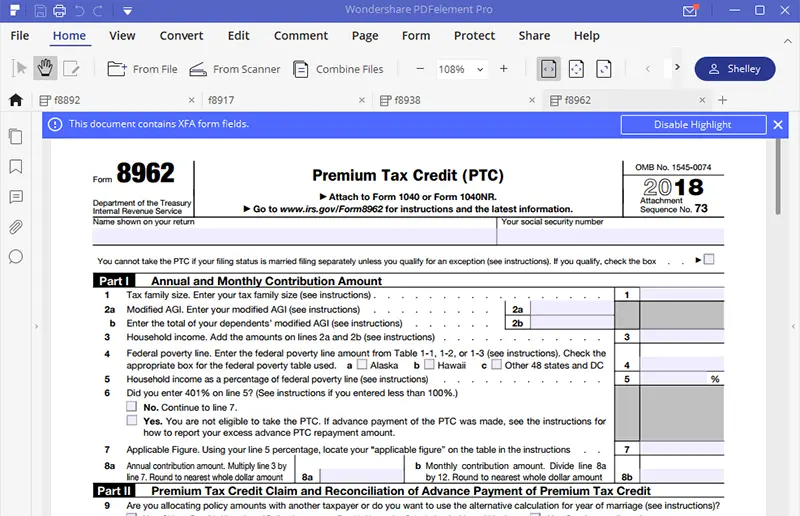

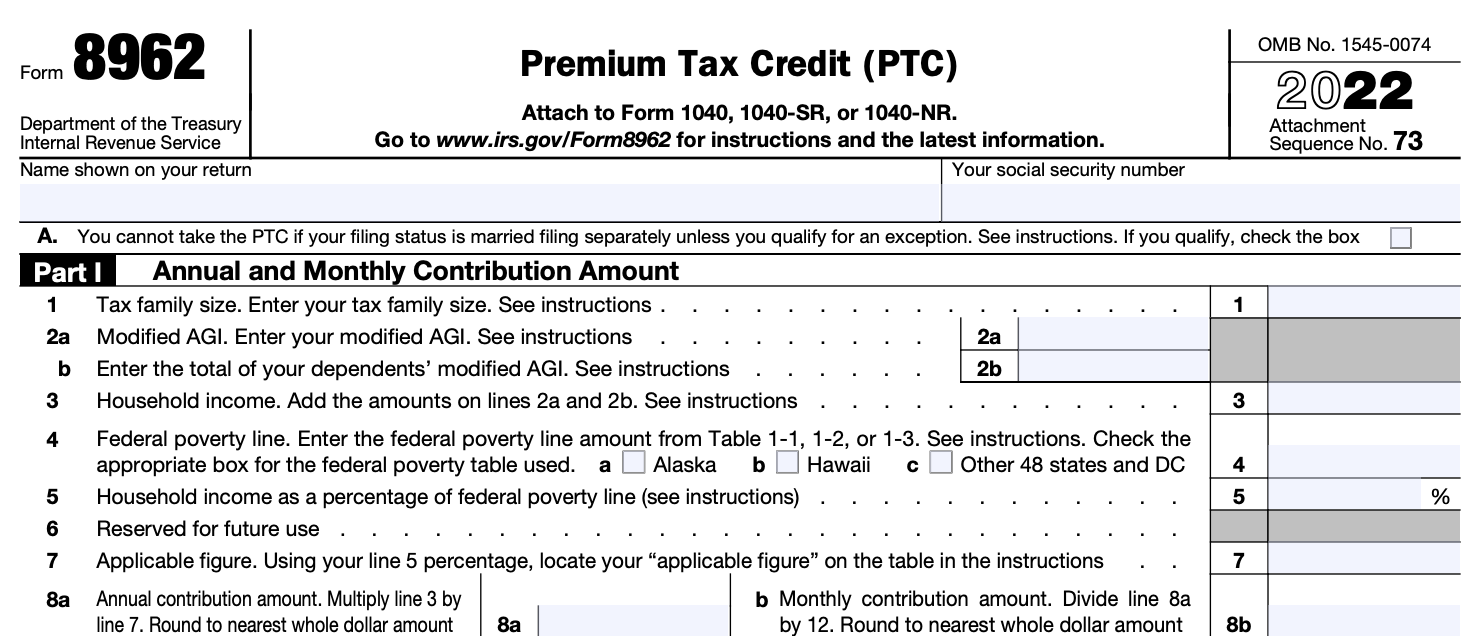

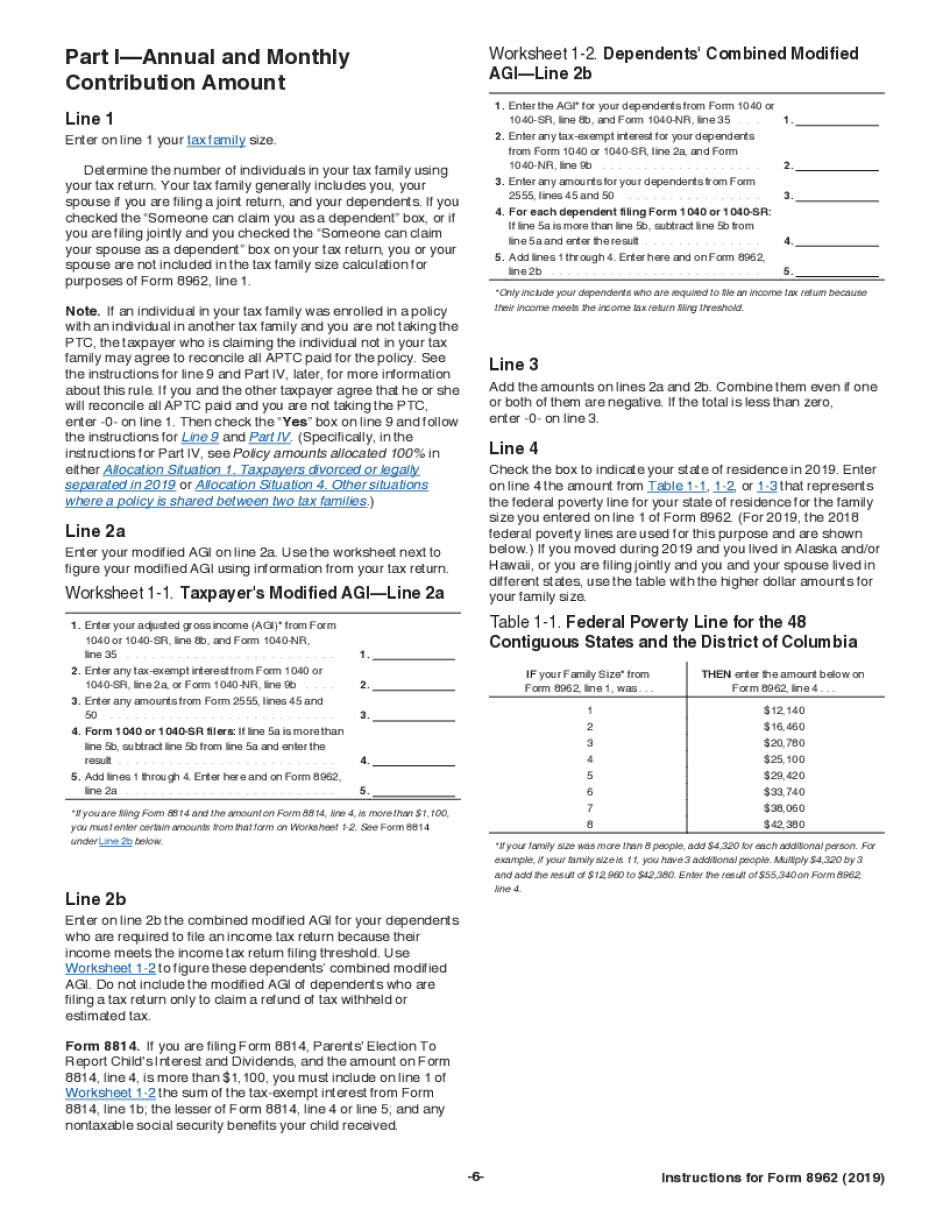

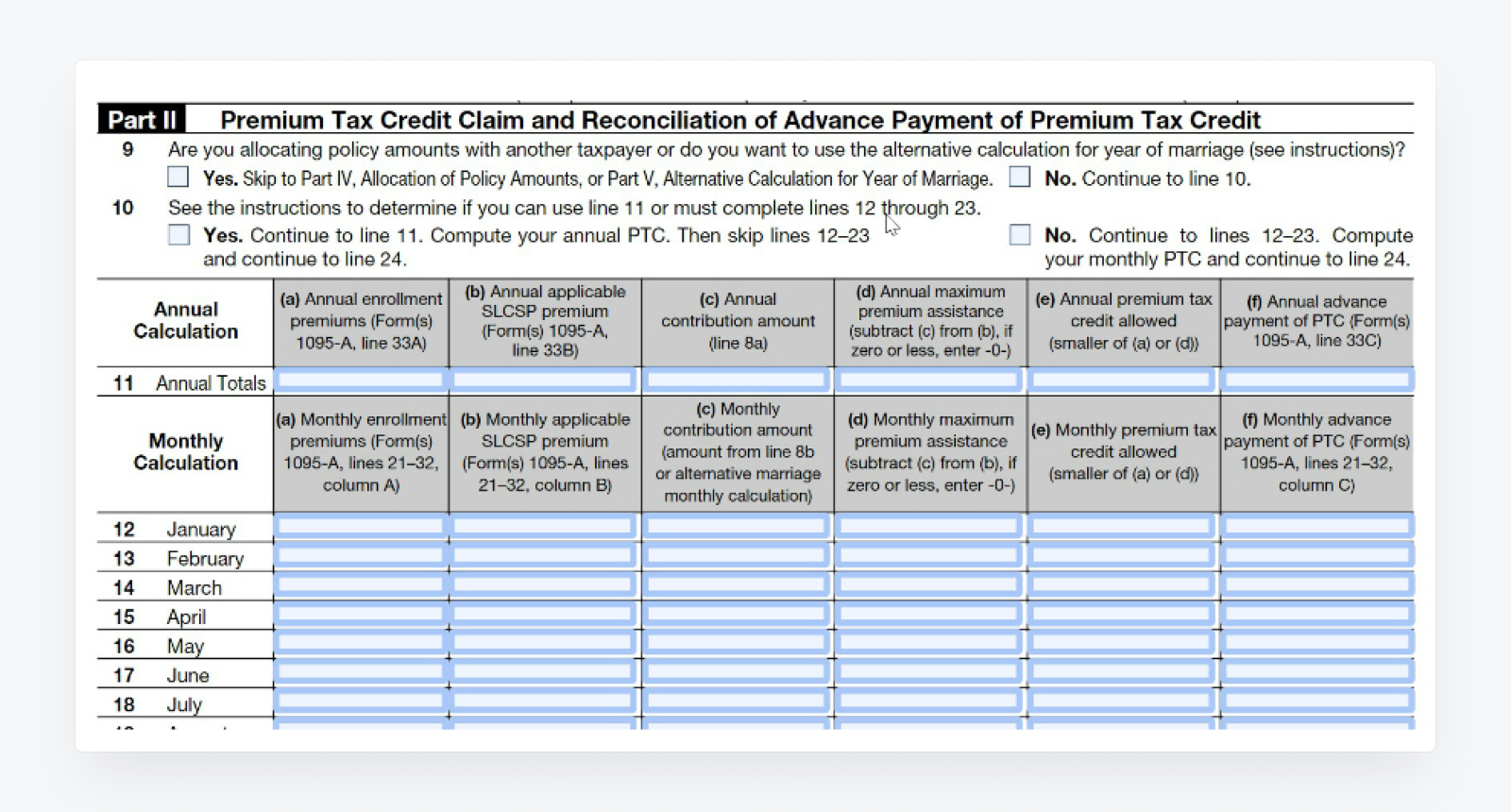

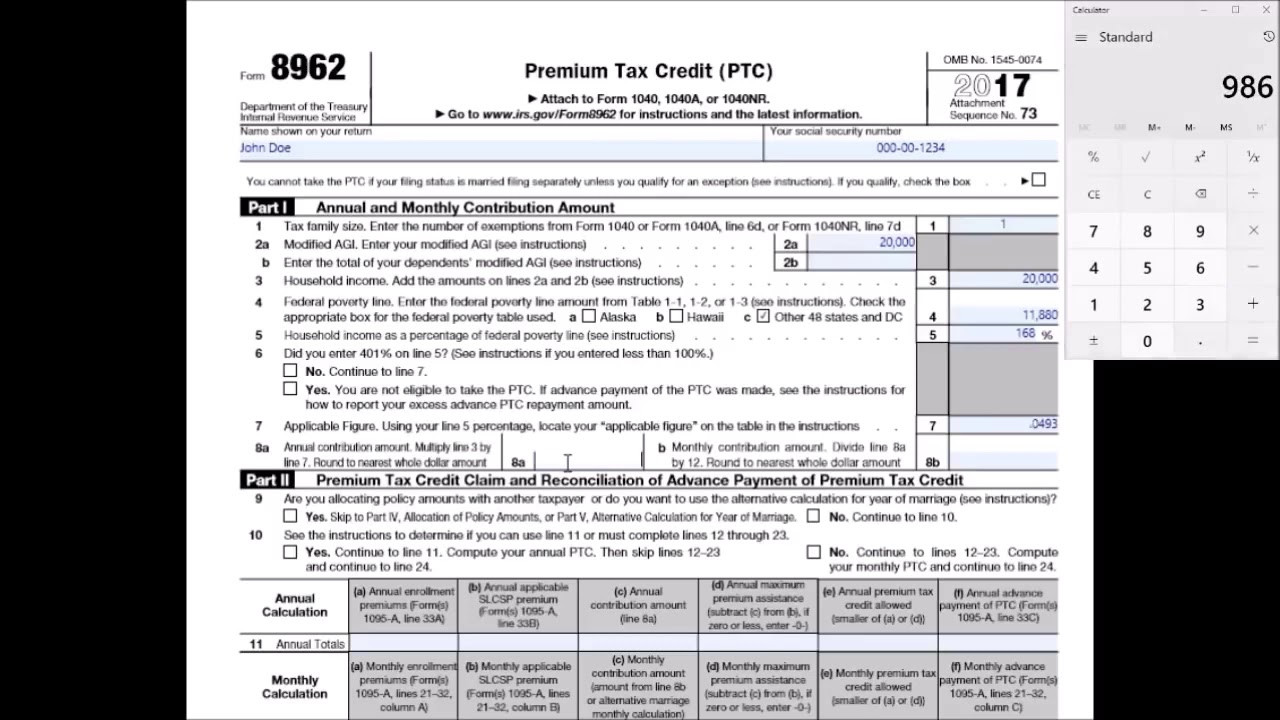

Instructions For Form 8962 2024 - Apply enroll in 2024 coverage today Beat the December 15 deadline to enroll in health coverage that starts January 1 Apply now Get Answers Search Health care tax forms instructions tools Form 8962 Premium Tax Credit You ll need it to complete Form 8962 Premium Tax Credit At the top of Form 8962 enter your name and Social Security number Step 3 Calculate the Annual and Monthly Contribution Amounts in Part I of Form 8962 Line 1 Use your tax return to enter the size of your tax family on line 1 This number generally includes you your spouse if filing jointly and your dependents

Instructions For Form 8962 2024

Instructions For Form 8962 2024

This is an early release draft of an IRS tax form, instructions, or publication, ... For the latest information about developments related to Form 8962 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8962. ... 2024. If you are expecting to receive Form 1095-A for a qualified health plan and you do ... Apply & enroll in 2024 coverage today. ... You'll use IRS Form 8962 to do this. If you used more premium tax credit than you qualify for, you'll pay the difference with your federal taxes. If you used less, you'll get the difference as a credit. ... Print Form 8962 (PDF, 110 KB) and instructions (PDF, 348 KB).

How to File Form 8962 Step by Step Instructions

Tax Form 8962 Printable

Instructions For Form 8962 2024Form 8962 is used to figure the amount of Premium Tax Credit and reconcile it with any advanced premium tax credit paid. This form is only used by taxpayers who ... See the Form 8962 instructions for more information. For tax year 2020 returns only. The American Rescue Plan Act was signed into law on March 11, 2021, and eliminates the 2020 ... Page Last Reviewed or Updated 02 Feb 2023 Information about Form 8962 Premium Tax Credit including recent updates related forms and instructions on how to file Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit

Read our detailed guide to learn what Form 8962 is and how to file it. ... "Guidance on Annual Redetermination and Re-enrollment for Marketplace Coverage for 2024 and Later Years," Page 3. 2014 Federal Form 8962 Instructions NEW EXAMPLE HOW TO FILL OUT FORM 8962 Form

How to reconcile your premium tax credit HealthCare gov

Irs Form 8962 Instructions 2023 Printable Forms Free Online

The purpose of Form 8962 is to allow filers to calculate their Premium Tax Credit (PTC) amount with their federal income tax return. With that amount, they're then able to reconcile that amount with any advance payments of the Advance Premium Tax Credit (APTC) that have been made for the filer throughout the year. How To Fill Out Form 8962 Step By Step Premium Tax Credit PTC Sample Example Completed YouTube

The purpose of Form 8962 is to allow filers to calculate their Premium Tax Credit (PTC) amount with their federal income tax return. With that amount, they're then able to reconcile that amount with any advance payments of the Advance Premium Tax Credit (APTC) that have been made for the filer throughout the year. Irs Form 8962 Fillable Brilliant Form 8962 Instructions 2018 At Models Form Ideas W2 Forms 2014 Federal Form 8962 Instructions

Irs Form 8962 Instructions Fill Online Printable Fillable Blank

Printable Irs Forms 8962 Printable Forms Free Online

IRS Form 8962 2020

Create Fillable Instructions For Form 8962 And Keep Things Organized

How To Fill Out Form 8962 Monthly Premium Taxes Instructions PDFliner

IRS Instructions 8962 2015 Fill Out Tax Template Online US Legal Forms

Download Instructions For IRS Form 8962 Premium Tax Credit Ptc PDF 2019 Templateroller

How To Fill Out Form 8962 Step By Step Premium Tax Credit PTC Sample Example Completed YouTube

Form 8962 2014 Diy Menu Cards Menu Card Template Wedding Menu Template Wedding Menu Cards

Form 8962 Printable Printable World Holiday