Present Value Of An Annuity

Present Value Of An Annuity - Calculate the present value of an annuity due ordinary annuity growing annuities and annuities in perpetuity with optional compounding and payment frequency Annuity formulas and derivations for present value based on PV PMT i 1 1 1 i n 1 iT including continuous compounding The interval can be monthly quarterly semi annually or annually Present Value Of An Annuity Based on your inputs this is the present value of the annuity you entered information for The present value of any future value

Present Value Of An Annuity

Present Value Of An Annuity

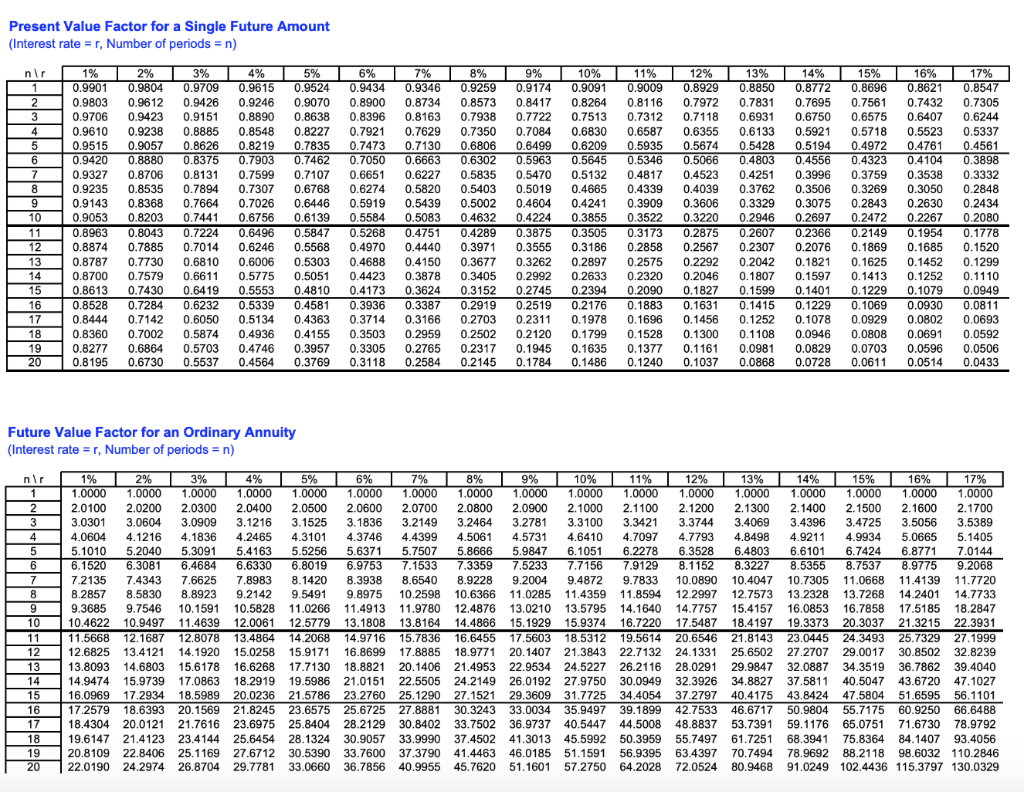

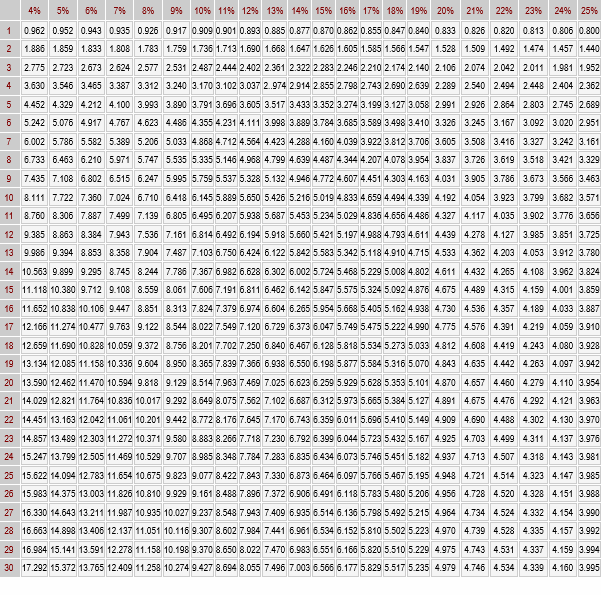

The future value of an annuity is the total value of payments at a specific point in time. The present value is how much money would be required now to produce those future payments. Two. There is a formula to determine the present value of an annuity: P = PMT x ( (1 – (1 / (1 + r) ^ -n)) / r) The variables in the equation represent the following: P = the present value of the annuity. PMT = the amount in each annuity payment (in dollars) R= the interest or. n= the number of payments left to receive.

Present Value Of Annuity Calculator Financial Mentor

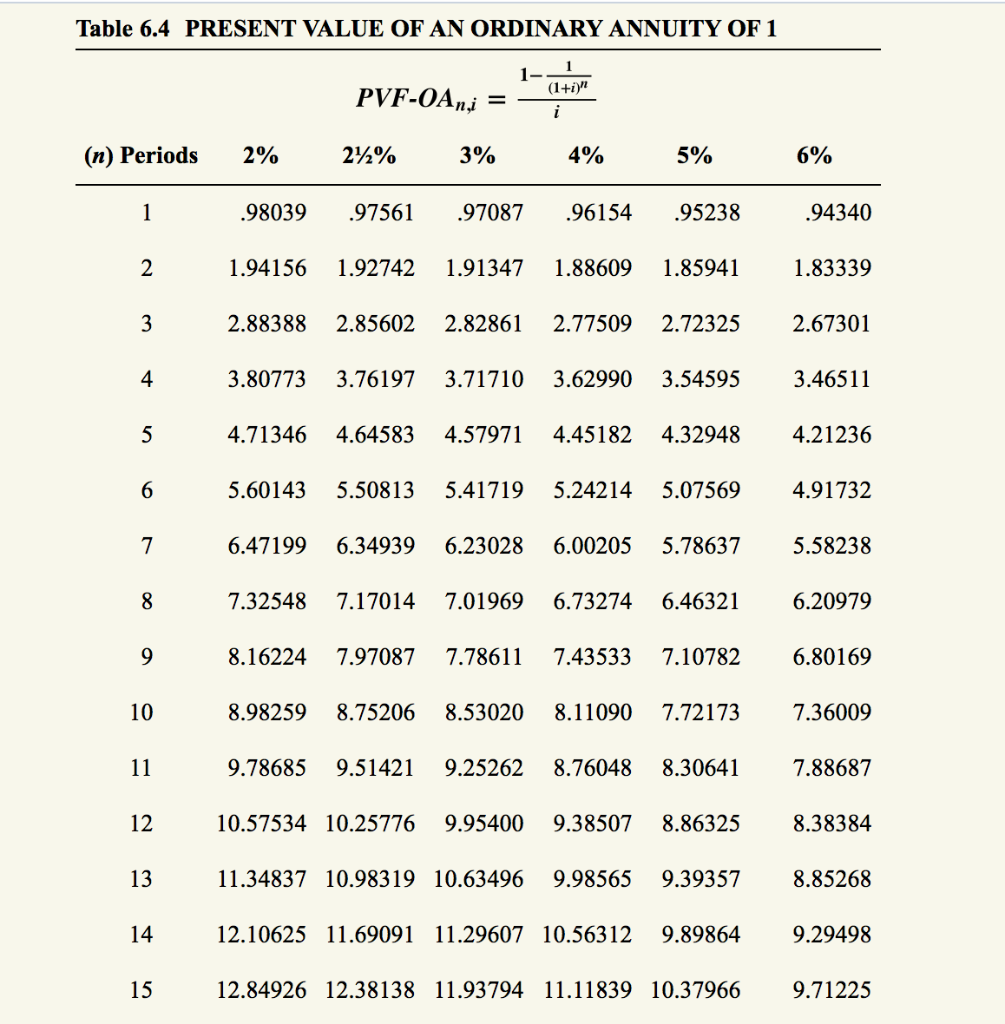

Present Value Annuity Due Tables Double Entry Bookkeeping

Present Value Of An AnnuityFurther, the present value or capital value of an annuity is the sum of the present values of all payments. Also, the present value of Rs. A paid at the beginning of the second period = A (1+ r 100)1 = A 1+i. Further, the present value of Rs. A paid at the beginning of the n th period = A (1+ r 100)n−1. Present Value of Annuity The present value of an annuity ordinary can be calculated using the formula PVOA PMT 1 1 1 r n r PVOA is the present value of the annuity stream PMT is the dollar amount of each payment r is the discount or interest rate n is the number of periods in which payments will be made

The present value of an annuity is the current value of future payments from that annuity, given a specified rate of return or discount rate. more Future Value of an Annuity: What Is It, Formula . Present Value Of Single Amount PetterDayne 8 Pics Present Value Of Annuity Due Table 13 And View Alqu Blog

What Is The Present Value Of Annuity SmartAsset

Present Value

Present value of annuity = $100 * [1 - ( (1 + .05) ^ (-3)) / .05] = $272.32. When calculating the PV of an annuity, keep in mind that you are discounting the annuity's value. Discounting cash flows, such as the $100-per-year annuity, factors in risk over time, inflation, and the inability to earn interest on money that you don't yet have. Present Value Of Annuity Table Of 1 DavidinaSandy

Present value of annuity = $100 * [1 - ( (1 + .05) ^ (-3)) / .05] = $272.32. When calculating the PV of an annuity, keep in mind that you are discounting the annuity's value. Discounting cash flows, such as the $100-per-year annuity, factors in risk over time, inflation, and the inability to earn interest on money that you don't yet have. Compound Interest And Present Value Principlesofaccounting Present Value Of Annuity Due Table 7 Cabinets Matttroy

Solved 5 PRESENT VALUE OF AN ANNUITY DUE OF 1 TABLE Chegg

Present Value Of Deferred Annuity Calculator

Present Value Factor Of Ordinary Annuity Table Bruin Blog

Solved Determine The Combined Present Value 2 Exercise 5 4 Algo

Solved Present Value Of An Annuity On January 1 2016 Chegg

Present Value Of An Annuity Chart

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

Present Value Of Annuity Table Of 1 DavidinaSandy

Present Value Of Annuity Formula Change Comin

:max_bytes(150000):strip_icc()/present-value-annuity.asp-Final-7d2ae860c2b044069d77d5e626c5a6f3.png)

Present Value Of An Annuity Meaning Formula And Example