What Is 1099 Oid Used For

What Is 1099 Oid Used For - Web Also use Form 1099 OID to report other interest accrued to a REMIC or FASIT regular interest holder during the year or paid to a holder of a CDO You may use Form 1099 INT rather than Form 1099 OID to report interest for an instrument issued with OID if no OID is includible in the regular interest holder s or CDO holder s income for the year Web Dec 18 2020 nbsp 0183 32 The 1099 OID is basically an expense report that needs to be submitted to the company via the payroll clerk to be reimbursed for purchases you made that the company should have paid for in the first place

What Is 1099 Oid Used For

What Is 1099 Oid Used For

;Form 1099-OID is used to report a special type of interest from certain bonds that were issued at a price less than the value you can redeem them for once the bond matures. Here's what you need to know about this type of interest and tax form. What is Form 1099-OID? OID stands for "original issue discount". OID arises when a bond is issued for a price less than its face value or principal amount. Generally, you should receive a Form 1099-OID for this. OID is the difference between the principal amount (the amount you would receive when the bond matures) and the issue price.

What Is This 1099 OID The Real Truth

E File IRS Form 1099 OID For 2022 File Form 1099 OID Online

What Is 1099 Oid Used ForInstructions for Recipient. Original issue discount (OID) is the excess of an obligation’s stated redemption price at maturity over its issue price (acquisition price for a stripped bond or coupon). OID on a taxable obligation is taxable as interest over the life of the obligation. Web Feb 14 2023 nbsp 0183 32 File Form 1099 OID If the original issue discount OID includible in gross income is at least 10 For any person for whom you withheld and paid any foreign tax on OID From whom you withheld and did not refund any federal income tax under the backup withholding rules even if the amount of the OID is less than 10

;The Form 1099-OID is used to report the OID (Original Issued Discount) included in your taxable income of at least $10. However, the rule of including OID in your gross income is generally not applicable to tax-exempt obligations, U.S. Savings bonds, and loans of $10,000 or less (between individuals who do not belong to financial business). 3. 1099 A Software To Create Print And E File IRS Form 1099 A For 2020 In 2020 Irs Forms Efile Irs 1099 S Software To Create Print E File IRS Form 1099 S

What Is Form 1099 OID Support

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

November 19, 2021. LinkedIn. Form 1099-OID is used to report original issue discount (OID) and certain other items related to debt instruments sold at a discount to investor/taxpayers. Original Issue Discount (OID) is the diff... 1099 INT 1099 OID Differences Form1099online

November 19, 2021. LinkedIn. Form 1099-OID is used to report original issue discount (OID) and certain other items related to debt instruments sold at a discount to investor/taxpayers. Original Issue Discount (OID) is the diff... What Is Form 1099 C Used For What Is Form 1099 NEC For Nonemployee Compensation

What s Form 1099 MISC Used For Tax Attorney 1099 Tax Form Tax Forms

IRS Form 1099 OID Instructions 2022 How To Fill Out 1099 OID

1099 OID For HR 1424 Returnthe1099oidtotheprincipal

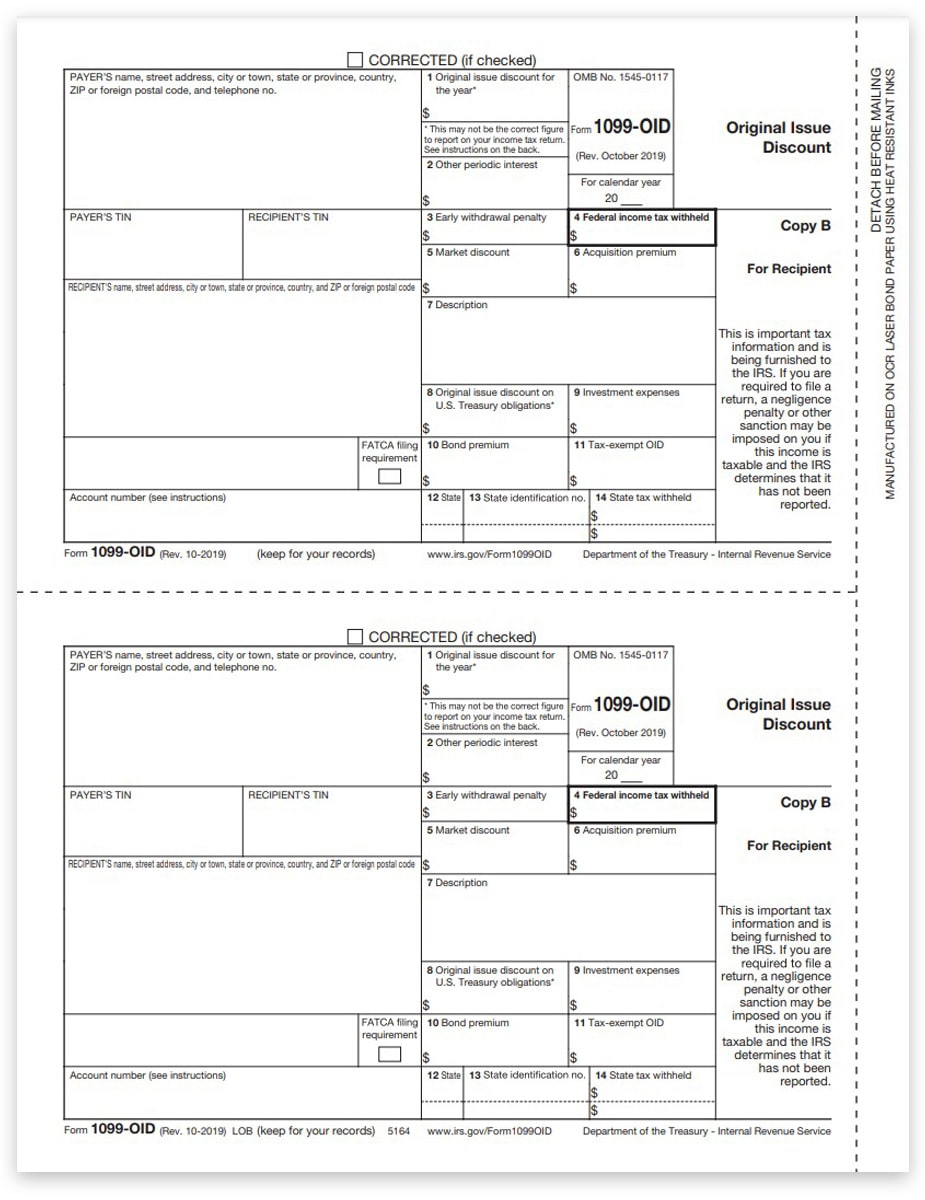

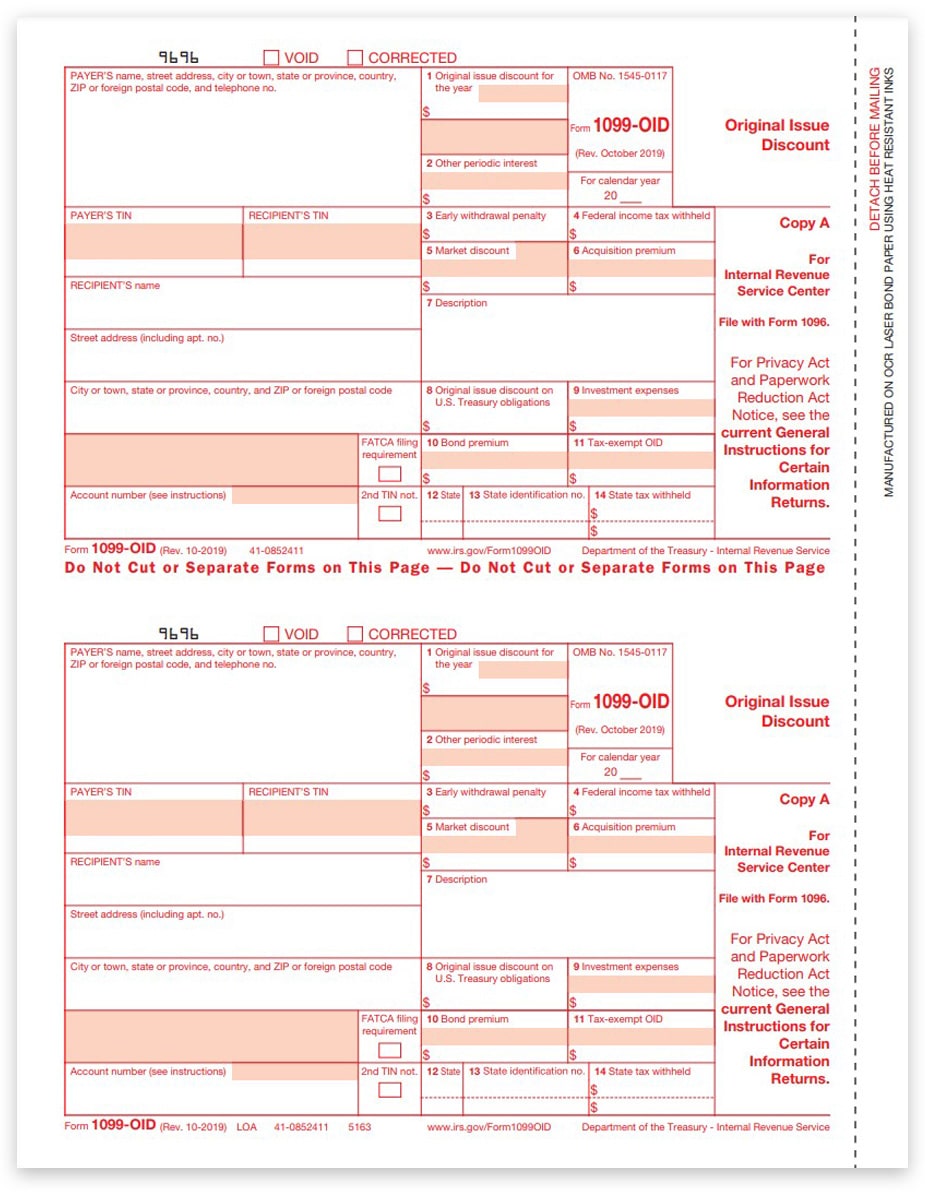

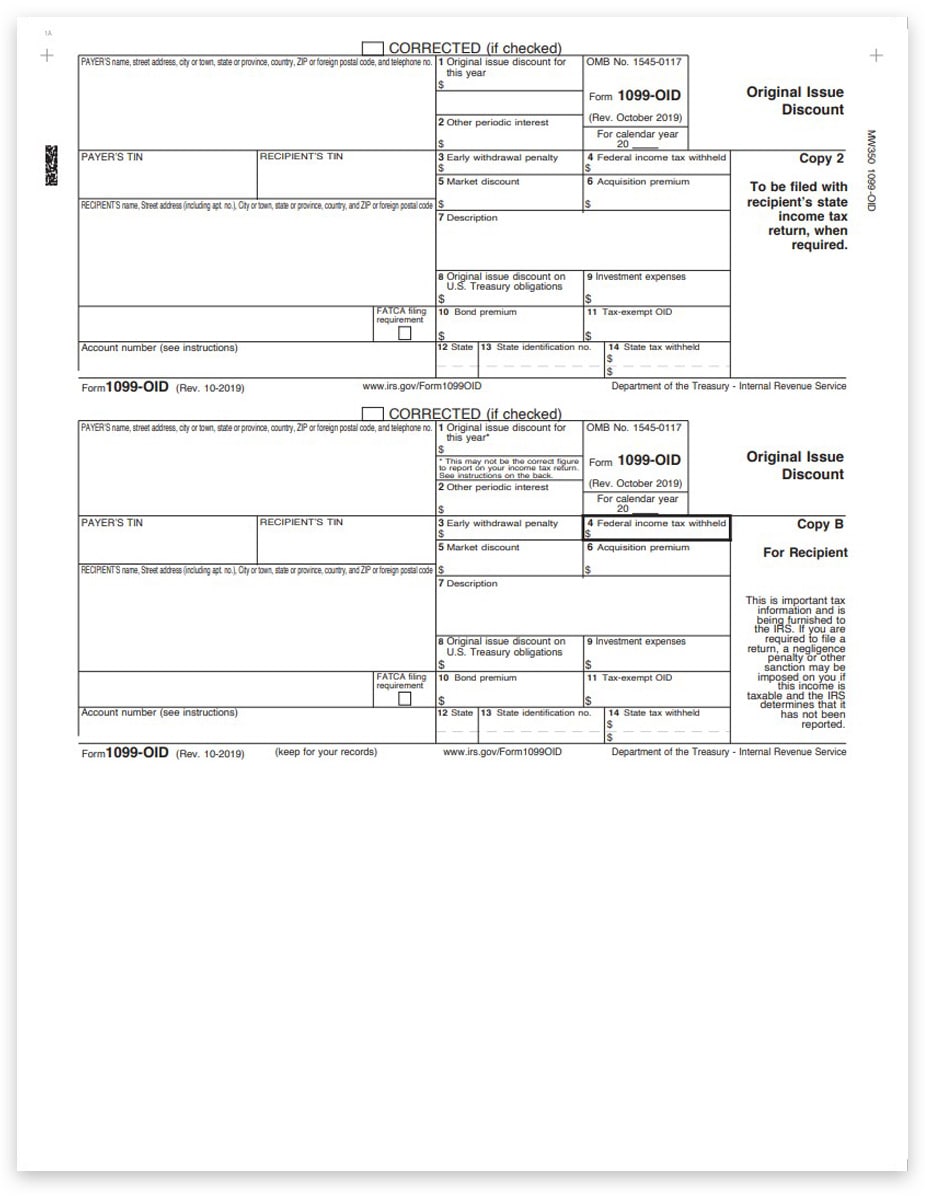

1099OID Form For Original Issue Discount Recipient DiscountTaxForms

1099OID IRS Forms For Original Issue Discount DiscountTaxForms

1099 OID Pressure Seal Forms 11 Z Fold Discount Tax Forms

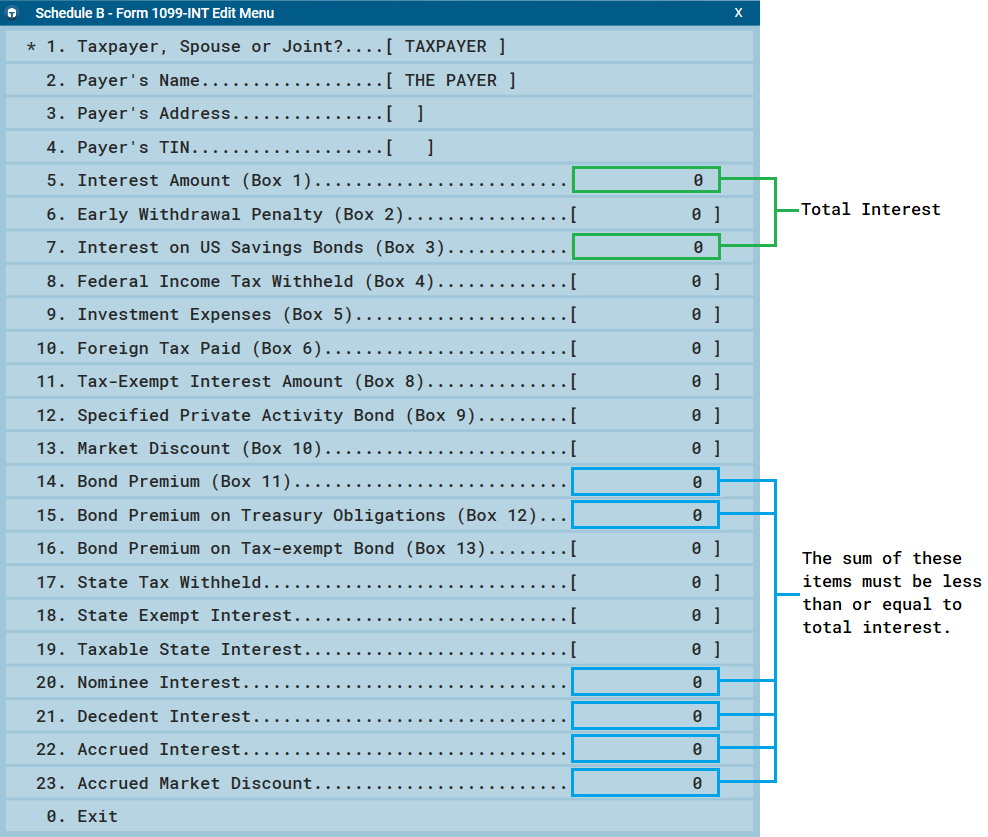

Desktop Form 1099 INT And 1099 OID Error Message For Bond Premium Support

1099 INT 1099 OID Differences Form1099online

W 9 Vs 1099 IRS Forms Differences And When To Use Them

Form 1099 NEC Requirements Deadlines And Penalties EFile360